Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Donald Trump’s copper tariffs risk reinforcing China’s dominance in smelting rather than encouraging metals processing in the US, top mining executives have warned.

The 50 per cent levy on certain copper imports, announced last week, is part of the US president’s push to develop a domestic industry and end America’s dependence on China for several critical minerals.

But mining executives and analysts said copper tariffs would not be enough to provide an incentive for new US copper smelters — energy-intensive facilities in which China has invested huge sums. The US has just two operational smelters, while China has dozens.

Talking to the Financial Times after the details of the tariffs were announced, Duncan Wanblad, chief executive of mining major Anglo American, said the cost of building copper smelters in the US would be “extraordinarily high compared to the average”.

“When this all washes out, all we’ve done is embed a much more inflationary environment at a global level.”

Andrew Forrest, the billionaire chair of Australian miner Fortescue Metals Group, said tariffs would “stop manufacturing growing in North America” and result in the “exporting” of jobs and industry. “Tariffs are self-harm,” he said.

While the US produces some copper ore, the raw material from which the metal is extracted, it does not have enough smelting capacity to refine all the copper that it consumes.

The White House announced on July 30 that a 50 per cent tariff would apply to semi-finished copper products such as pipes, wires and cables — but excluded refined copper metal from the levy, a move that shocked markets.

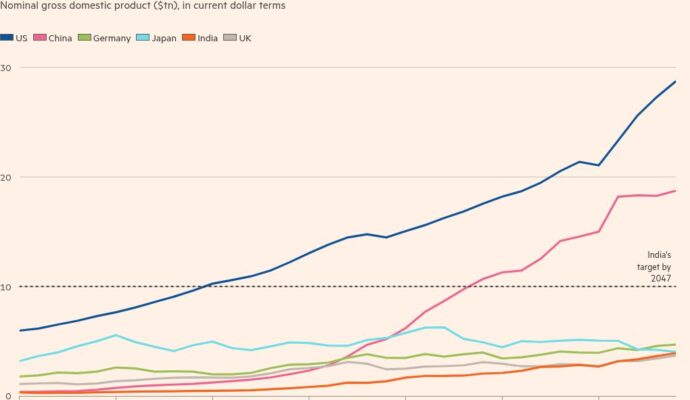

According to the International Copper Study Group, as of 2023 China accounted for more than 50 per cent of world copper smelter production, followed by Japan with 7 per cent, Chile at 5 per cent and Russia with 4 per cent.

Last week’s executive order from Trump said tariffs were necessary because of the “persistent threat of further closures of domestic copper production facilities” along with “unfair trade practices abroad” that have “hollowed out US copper refining and smelting”.

But Kathleen Quirk, president and chief executive of US copper producer Freeport McMoran, said in an earnings call in July that it was “not a given that you can bring on refined copper [capacity] very quickly”. Building a new smelter in the US would be “very challenging”, she said, noting that they were long-term investments.

European aluminium producer Norsk Hydro echoed the concerns, noting that investments in new smelters “cannot be made on the grounds of tariffs alone, which may disappear as quickly as they come”.

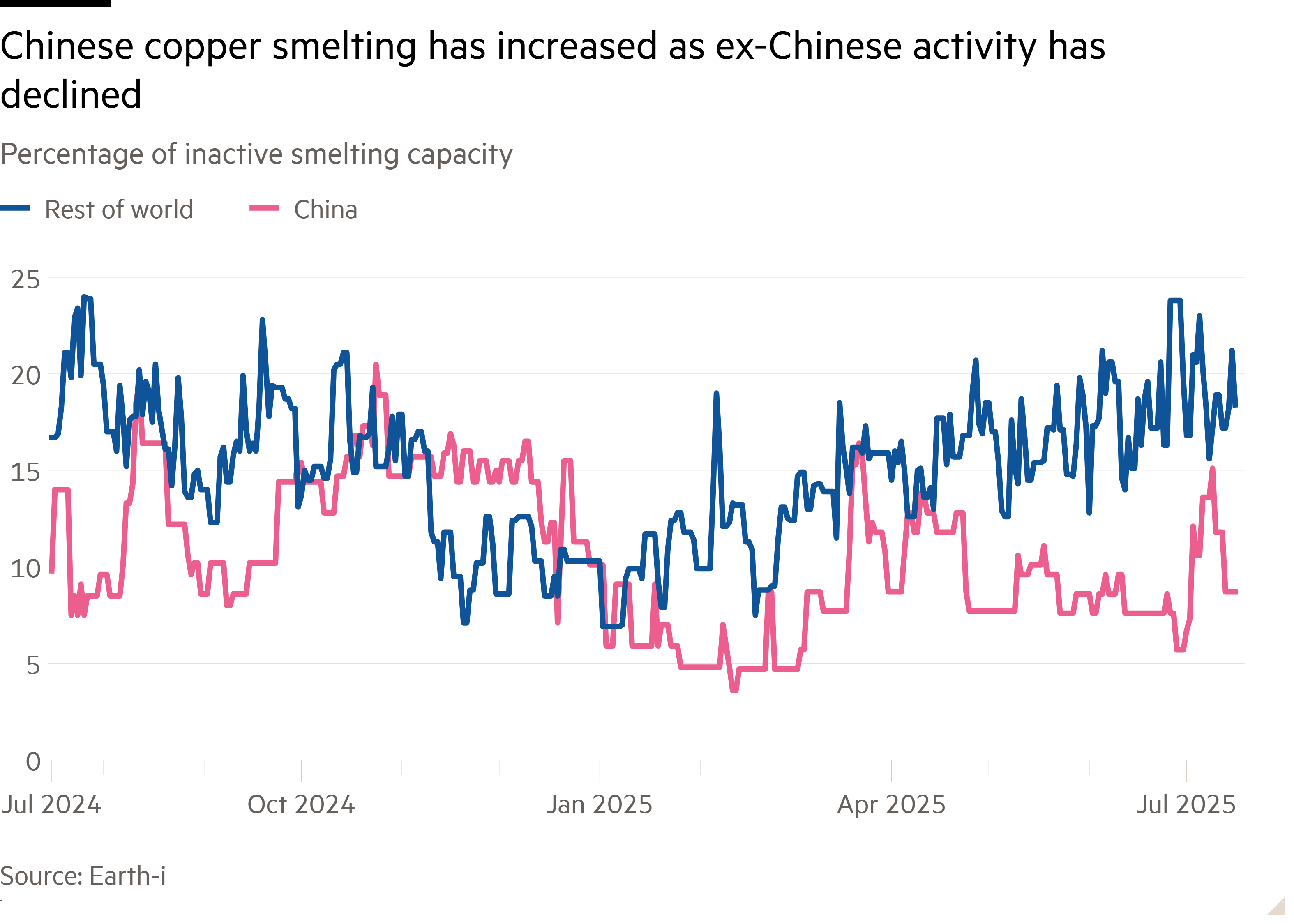

The rise in Chinese copper smelting capacity has resulted in shortages of the ore that feeds the facilities.

Some smelters have even been paying to process ore in order to keep running — the facilities are expensive and problematic to stop and tend not to be restarted after that happens.

Others have been forced to close because of the competition from China, including Glencore’s Pasar smelter in the Philippines. If smelters have to pay for ore, more of those outside China “aren’t going to be able to survive”, said one executive.

Erik Heimlich, head of base metals supply at market analysis group CRU, said Chinese capacity would continue to grow while capacity elsewhere could shrink. “The [Chinese] state-owned players, the big players, can withstand harsh market conditions for a very long period of time,” he said.

In June, copper smelting activity in China rose 1 percentage point and fell more than 2 percentage points elsewhere, according to data company Earth-i.

One copper trader said in order for the US to create a self-sustaining domestic copper sector, the Trump administration would need to accelerate the permitting of new facilities, encourage the construction of smelters with long-term support such as tax credits, and ban the export of copper scrap, a large volume of which goes to China. “Tariffs alone won’t help,” the trader said.

As part of the tariff announcement this week, the US administration said it would require a quarter of the high-quality copper scrap produced in the US to be sold domestically.

Daniel Hynes, senior commodities strategist at ANZ, said: “The obstacles that Trump’s putting in place for the US market are going to make things easier in the longer term for China to in effect increase its dominance in a lot of these markets.”

The US would need “two or three decent-sized smelters” to come online in the near term for the country to become more self-sufficient in copper, but “there’s really nothing in the pipeline”, he added.

Additional reporting by Wenjie Ding