Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

Taiwan’s failure to secure a trade deal with Donald Trump before his August 1 deadline has deepened fears that Washington could water down security support for Taipei to smooth relations with Beijing.

Taiwan — the world’s most important chip manufacturer and the seventh-largest US trading partner — was one of the first countries to start talks with Washington after Trump unveiled his “liberation day” tariffs in April.

Despite those efforts, Trump on Thursday imposed a 20 per cent tariff on imports from Taiwan. The levies are due to take effect next week.

The new rate comes at a sensitive time for Taiwan. President Lai Ching-te is embroiled in a bitter battle with Taiwan’s opposition parties, which have paralysed his minority government.

The Trump administration’s actions, meanwhile, have raised concerns about its commitment to supporting Taipei in the face of pressure from China, which claims sovereignty over Taiwan and has threatened to take it over by force.

Washington blocked Lai’s request to visit New York next week during a planned overseas trip to Taipei’s Latin American allies.

The Trump administration is also considering a downgrade to bilateral defence talks, which it postponed in June.

Observers in Taiwan and the US are concerned that those steps might reflect a broader shift in Washington’s Taiwan policy, as Trump seeks a trade deal with Beijing and a summit with Chinese President Xi Jinping.

People familiar with US-Taiwan tariff negotiations said they feared that shift could affect the bilateral trade relationship. According to two Taiwanese and one US official briefed on the talks, negotiators had reached basic agreement by July 8 on the market access issues that traditionally form the core of a tariff agreement, and were hoping that a deal could be announced within days.

“There are several possibilities for why [Trump] sat on the deal but I’m going with the China trade negotiations,” said one person.

Lai hurried to contain the damage on Friday. He said: “Twenty per cent was not Taiwan’s goal, and we will continue to negotiate to pursue a more beneficial and more reasonable tariff rate.” He added that the government “remained steadfast” in safeguarding Taiwan’s national interests and protecting its industries and public health.

A US official familiar with the talks echoed Lai’s expectation that the 20 per cent rate would not last, as two sides would “revisit a few more issues”.

“The fact that Taiwan’s temporary tariff is much lower than other partners still negotiating, such as Canada and India, should be seen as a reassuring sign that there are not insurmountable gaps,” they said

While the latest tariff rate is lower than the 32 per cent in Trump’s “liberation day” order, Taipei fell short of its goal of securing a level playing field with Japan and South Korea, its closest export competitors. Both countries secured a 15 per cent rate in agreements announced last month.

Taiwan’s opposition Kuomintang immediately focused on this gap in its criticism of the government’s handling of the trade talks. “This disparity may weaken the competitiveness of Taiwanese products in the US market, particularly impacting export-oriented industries,” it said.

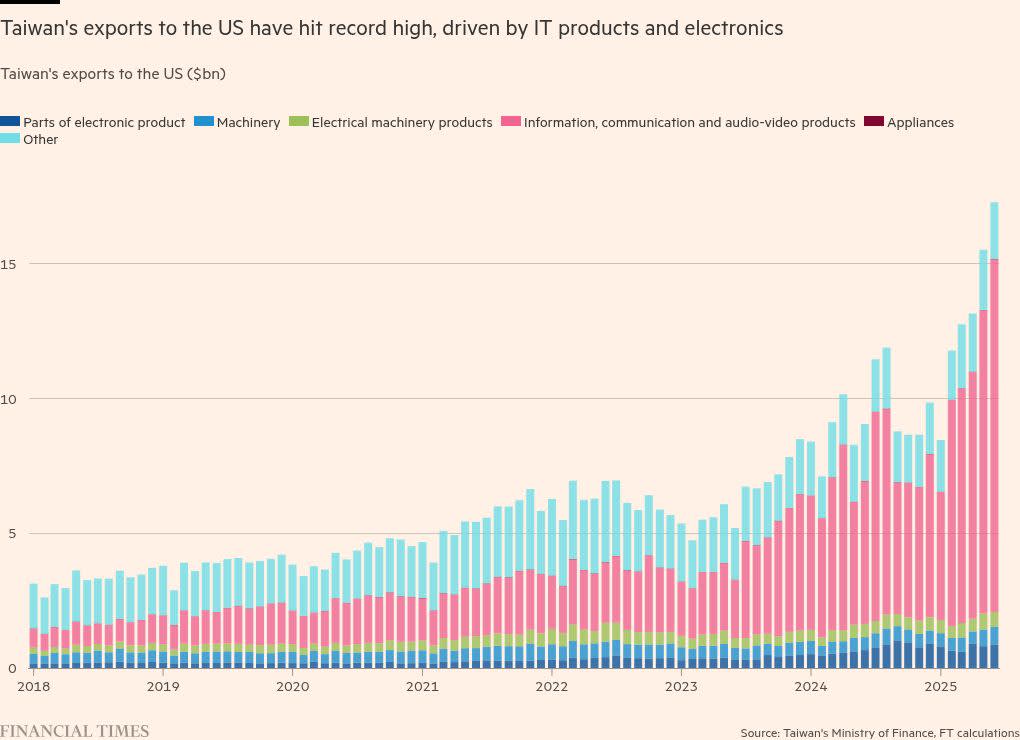

But government officials downplayed the risks of the tariff rate for Taiwan’s economy. Electronics — which make up the lion’s share of Taiwan’s exports to the US — are exempt from the “reciprocal” rate, and will be covered by separate sectoral tariffs Washington is preparing.

Under national security reviews of various sectors known as section 232 investigations, the US government aims to tax imports of semiconductors, tools and components for their production as well as a wide range of downstream electronics products that contain chips. Lai said Taipei wanted to tie this issue into its next rounds of negotiations.

Another outstanding question is how much additional investment the US government will extract from Taiwan.

Three people familiar with the matter said a deal was delayed by repeated interventions from US commerce secretary Howard Lutnick, who demanded in conversations with government representatives and big technology companies that Taiwan promise huge additional investments in the US along the lines of commitments made by Japan and South Korea.

Taiwan Semiconductor Manufacturing Co, the world’s largest chipmaker, announced plans earlier this year to step up investment in the US from $65bn to a $165bn, which Taipei had hoped would fend off some of the pressure.

But the KMT suggested that TSMC’s pledge amounted to giving away one of Taiwan’s key bargaining chips. “Future negotiations involving strategic industries should be approached with greater caution and rigour,” it said.

Industry insiders also said “buying down” Taiwan’s tariff rate by promising hundreds of billions of dollars more in investment did not serve the country’s economic interests.

“If the future chip tariffs have teeth, they will force us to onshore more capacity in the US anyway,” said one Taiwanese technology company executive. “So committing to some huge additional investment fund is not a good deal.”

Data visualisation by Haohsiang Ko in Hong Kong