Hello. This is Kenji from Tokyo, your host for this week’s #techAsia newsletter.

Much of Japan has been hit by blistering heatwaves for days and weeks, and the debate over US President Donald Trump’s tariff, trade and investment policy remains just as hot.

Under the scorching Tokyo sun on Tuesday, Chinese government officials extended an olive branch to Japanese businesses, promoting the country’s biggest trade exhibition, the Canton Fair.

Luo Xiaomei, minister in charge of economic and commercial affairs at the Chinese Embassy in Tokyo, and Ma Fengmin, deputy director-general of the China Foreign Trade Centre, the organiser of the fair, were helped in this effort by the Association for the Promotion of International Trade, Japan (JAPIT), a traditionally pro-Beijing Japanese business group. JAPIT is one of the seven major bilateral “friendship organisations” and traces its history back to 1954, 18 years before the opening of diplomatic relations between the two countries.

Masahito Yasuda, senior executive director at JAPIT, said the Trump administration’s trade policy is bringing uncertainty to the economic outlook, leading to “the need to enhance economic co-operation between Japan and China more than ever.” There was no mention of heightened personal security risks following the sentencing in Beijing of a Japanese employee of Astellas Pharma over espionage charges or mounting tensions over the East China Sea during the gathering.

Japan, the European Union and South Korea have all agreed with the Trump administration to set their “reciprocal” tariffs at 15 per cent, with a similar rate on cars, in exchange for making substantial investments and purchasing American goods. India, an increasingly important hub for iPhone production, has been hit with a 25 per cent rate.

China, meanwhile, faces an August 12 deadline to reach a tariff agreement. The most recent negotiations between the two countries in Stockholm failed to produce a major breakthrough, with US tech export controls seen as one of the sticking points.

South Korea’s chip drive

Amid the massive uncertainty of Trump’s tariff policy, South Korea’s big tech players continued to chart a path forward, both commercially and technologically, in chips.

Samsung Electronics has clinched a $16.5bn deal to supply semiconductors for Tesla by the end of 2033, marking a major win in its contract chipmaking business. Nikkei Asia’s Kim Jaewon reported that while Samsung kept its customer name confidential by only referring to it as a “big global company,” Tesla CEO Elon Musk spilled the beans on his X account. Musk further revealed that Samsung’s new site in Texas “will be dedicated to making Tesla’s next-generation AI6 chip”.

The deal is a major relief for Samsung, which is set to invest over $37bn in Texas in the coming years, as the South Korean chipmaker looks to catch up with Taiwan Semiconductor Manufacturing Co, the global leader in the chip foundry business.

Separately, LG Electronics is working to develop a hybrid bonder, a device that attaches multiple chips together in the same package, according to Nikkei’s Nami Matsuura. This marks LG’s full-fledged entry into chipmaking devices, a segment stimulated by the growing demand for high bandwidth memory (HBM) used for generative artificial intelligence applications.

Hanmi Semiconductor, which holds a 90 per cent global share in a device called thermocompression (TC) bonders used to manufacture HBM, is investing Won100bn ($72.3mn) to build a new hybrid bonder plant in the city of Incheon, with plans to begin operations next year. The company’s ambition is to break into the top 10 global chipmaking device producers by the end of the decade.

Secret shipments

At least $1bn worth of Nvidia’s advanced artificial intelligence processors were shipped to China in the three months after Donald Trump tightened chip export controls, exposing the limits of Washington’s efforts to restrain Beijing’s high-tech ambitions, write the Financial Times’ Zijing Wu and Eleanor Olcott.

A Financial Times analysis of dozens of sales contracts and company filings and interviews with multiple people with direct knowledge of the deals reveal that Nvidia’s B200 has become the most sought-after chip in a rampant Chinese black market for American semiconductors.

The processor is widely used by US powerhouses such as OpenAI, Google and Meta to train their latest AI systems, but is banned for sale to China.

In May, multiple Chinese distributors started selling B200s to suppliers of data centres that serve Chinese AI groups, according to documents reviewed by the FT.

It is legal to receive and sell restricted Nvidia chips in China, as long as relevant border tariffs are paid, according to lawyers familiar with the rules. Entities selling and sending them to China would be violating US regulations, however.

Nvidia has long insisted there is “no evidence of any AI chip diversion”. There is no evidence that the company is involved in, or has knowledge of, its restricted products being sold to China.

“Trying to cobble together data centres from smuggled products is a losing proposition, both technically and economically,” Nvidia told the FT. “Data centres require service and support, which we provide only to authorised Nvidia products.”

Battery-powered growth

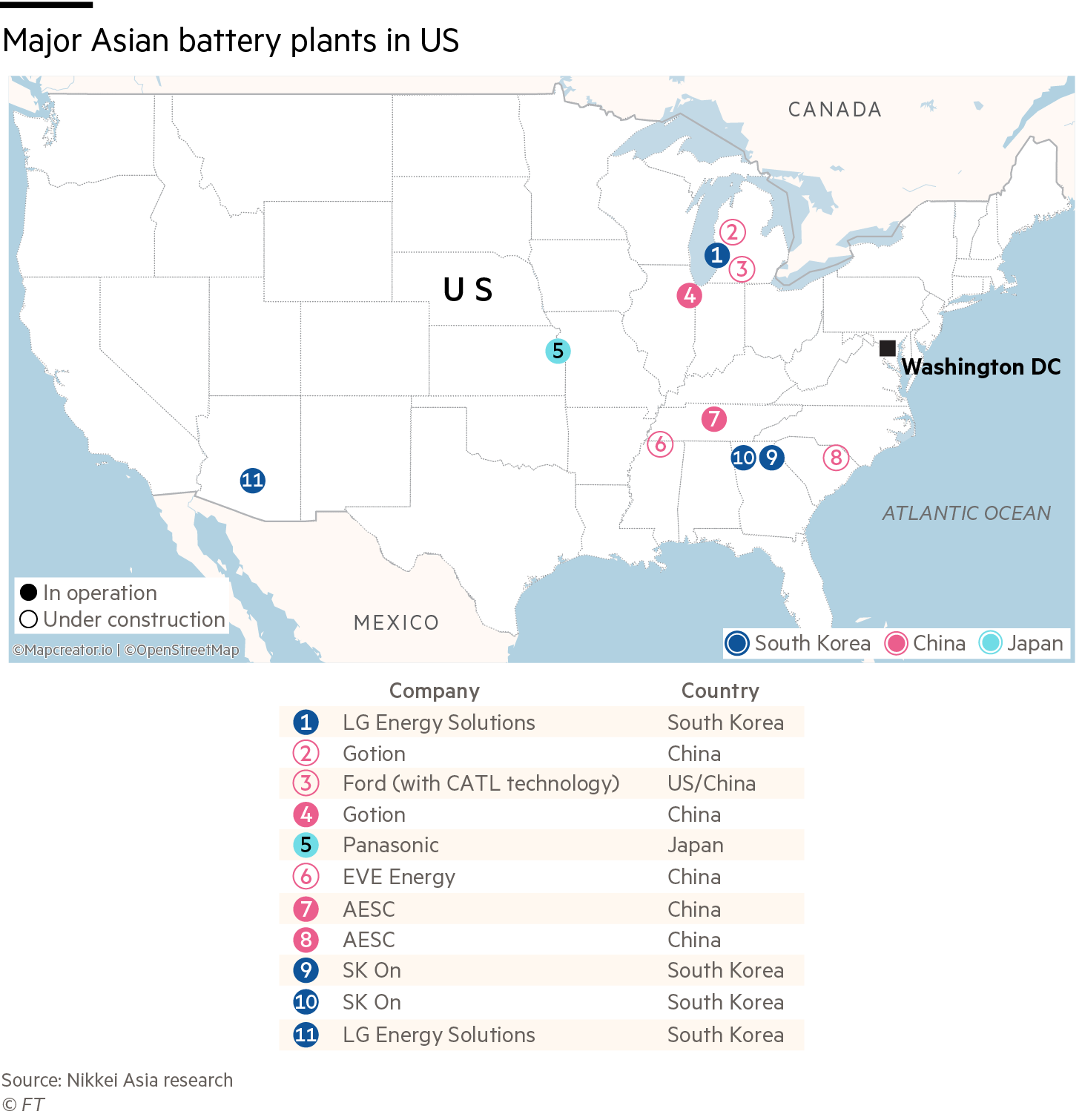

South Korean companies are expanding their footholds in the US battery market, as Washington places Chinese players under increasingly strict regulations, Nikkei Asia’s Pak Yiu reports.

South Korea’s LG Energy Solution, Samsung SDI and SK On are all scaling up their local production and strengthening partnerships. Japan’s Panasonic is also part of the trend, as it has started producing lithium-ion batteries at a second US plant.

In contrast, Chinese companies are being squeezed out of the American market. Automotive Energy Supply Corp put construction of its EV battery plant in South Carolina on hold last month, citing policy and market uncertainty, while Gotion indefinitely suspended its Michigan facility last year.

Dismal display

Japan Display, or JDI, an ailing panel manufacturer, will sell the LCD and OLED panel production equipment at its Mobara plant, according to Nikkei’s Fumie Yaku.

The original plan was to relocate it to another factory and continue production, since the Mobara site, in a Tokyo suburb, was shutting down as part of the company’s downsizing. The sale of the equipment means that the Japanese flagship display panel maker will no longer supply panels for the Apple Watch.

JDI — a combination by of panel businesses from Sony, Toshiba and Hitachi — was a poster child for INCJ, a public-private investment fund established in 2009 to help strategic industries acquire competitiveness.

However, the company has been racking up losses for the last 11 years, as it fell behind rivals from South Korea, Taiwan and mainland China. INCJ sold all remaining shares in JDI in March, marking a total loss of over $1bn in present value.

Suggested reads

China lays out its AI vision in foil to Donald Trump’s ‘America First’ plan (FT)

China’s automakers bring tech edge to Australia’s small but brutal market (Nikkei Asia)

Changan Auto business carved out from key PLA supplier (Nikkei Asia)

Tesla’s $16.5bn contract won’t be enough to drive a revival at Samsung (FT)

Brussels accuses China’s Temu of breaking EU digital rules (FT)

Indonesia’s GoTo and Indosat launch homegrown AI chat tool (Nikkei Asia)

Panasonic digital unit CEO Yasuyuki Higuchi to step down (Nikkei Asia)

TCS and other Indian tech giants struggle to reel in large clients (Nikkei Asia)

Narendra Modi’s kingmaker aims to build Indian ‘Quantum Valley’ (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp