This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

US trading partners including China, India and Taiwan are bracing for Donald Trump’s higher tariff deadline to kick in today. But the list of countries hit by the August 1 deadline have fluctuated as they race to cut trade deals with the US president. Here’s the latest:

Where things stand: On Thursday, the US delayed its rate of reciprocal tariffs with its largest trading partner, Mexico, by 90 days. White House press secretary Karoline Leavitt said that two-thirds of the country’s 18 major trading partners reached a deal. The US president has hardened his rhetoric on nations that have not struck a deal yet, like India, which Trump described on Thursday as a “dead economy”.

What happens next: Countries that do not reach a trade deal with the US will hear from the Trump administration by midnight eastern time on Friday. Leavitt said that trade talks with China are “moving in the right direction” and that Washington remains in “direct communication” with Beijing. Negotiations with other nations are expected to continue right up to the deadline, as well.

For more on what Trump’s tariffs will mean for the world:

Bank of Japan: The US-Japan trade deal was a “big step forward,” the central bank’s governor Kazuo Ueda said.

Wine and spirits: US levies on EU wine and spirits are set at 15 per cent from August 1. But bloc members including France and Italy are pushing for an exemption.

The Big Read: Ireland is one of the most exposed in Europe to Trump’s tariffs, intensifying fears that a golden era of growth will slow down.

Here’s what else we’re keeping tabs on today and through the weekend:

Results: Nippon Steel and Nintendo will publish Q1 results on Friday. Berkshire Hathaway will report second-quarter results and publish its quarterly report on Saturday. See our Week Ahead newsletter for the full list.

Economic data: The US reports July employment data on Friday.

Five more top stories

How well did you keep up with the news this week? Take our quiz.

1. Beijing has summoned Nvidia over alleged security issues with its chips. China’s cyber regulator said US AI experts had “revealed that Nvidia’s computing chips have location tracking and can remotely shut down the technology”. The meeting comes as the US semiconductor giant seeks to revive sales in the country after Washington this month lifted a ban on H20 sales to China.

2. Apple’s revenues have jumped behind increasing iPhone sales, and are up about 10 per cent year on year to $94bn. While the company’s sales in China have suffered from competition from local handset makers such as Huawei and Xiaomi, revenue from China increased 4 per cent in the quarter from a year ago. Here’s more on the tech giant’s earnings report.

3. Foreign spies are “aggressively” targeting Australia in sectors spanning from rare earths to Antarctic research, the head of the country’s intelligence service said. Australian Security Intelligence Organisation estimates that espionage cost the country’s economy A$12.5bn (US$8bn) in 2024. ASIO named China, Russia and Iran as “very active” in espionage in the region.

4. Exclusive: A top Republican lawmaker will lead a congressional delegation to Taiwan in August, a development that will be welcomed in Taipei amid concerns about Trump’s commitment to the country in the face of Chinese pressure. The visit by Roger Wicker, the Republican senator from Mississippi, comes at a delicate point in US-Taiwan relations.

5. Figma shares have shot up more than 200 per cent in its Wall Street debut. The design software maker’s IPO has been closely watched by private technology groups for signs of the reception they could receive from public investors.

Visual story

AI data centres have become symbols of a new frontier in computing. They are driving a spending blitz by big tech companies and countries that are pouring billions of dollars into their construction. But critics are questioning the complex, costly and energy-guzzling endeavour — and whether it is all needed.

We’re also reading . . .

Narrow negotiations: Iran’s foreign minister tells the FT that the US must agree to compensate Iran for losses incurred during last month’s war before resuming nuclear talks.

US drug prices: Trump threatens to “deploy every tool in our arsenal” as he demands for “binding commitments” from pharmaceutical companies to lower prices.

China’s mega cities: Instead of mixing and fusing the world, China’s cities are giant national and regional centres. Adam Tooze asks: Is this what the new global city looks like?

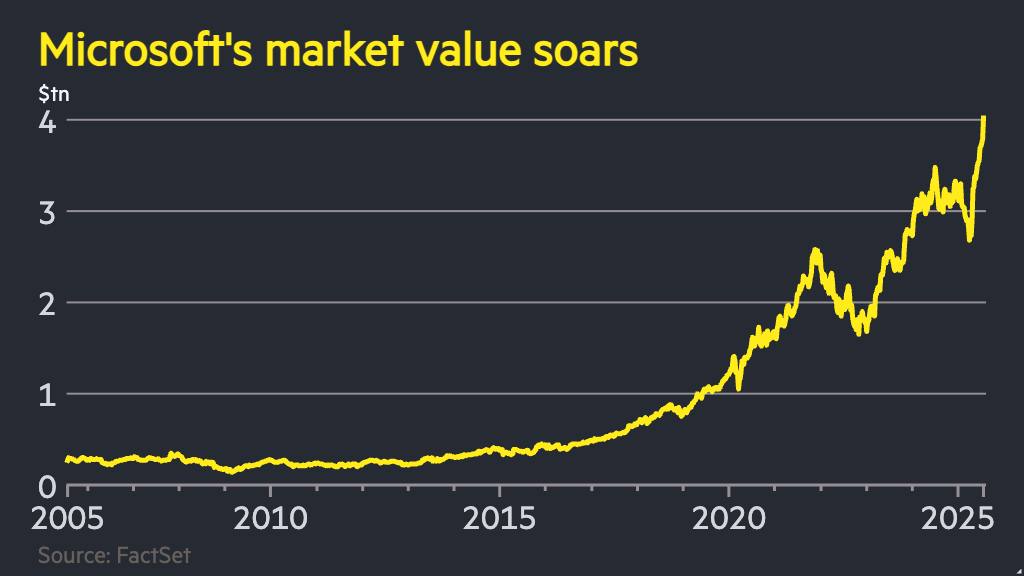

Chart of the day

Runaway earnings from Microsoft and Meta have allowed investors to shrug off worries about US growth and warnings of a stock market bubble. Meta’s shares jumped over 11 per cent, adding more than $150bn to its market value. The US tech share surge also powered Microsoft to a major milestone: hitting $4tn in market capitalisation on Thursday.

Take a break from the news . . .

With the beginning of August upon us, Simon Chilvers asked a group of designers and artists about a favourite holiday photo they love and why it’s nostalgic to them. Find out what Rick Owens, Isabel Marant, Erwin Wurm and many more shared with HTSI.