This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

Taiwan president’s New York stopover blocked

EU-US trade deal faces backlash

Thailand and Cambodia agree a ceasefire

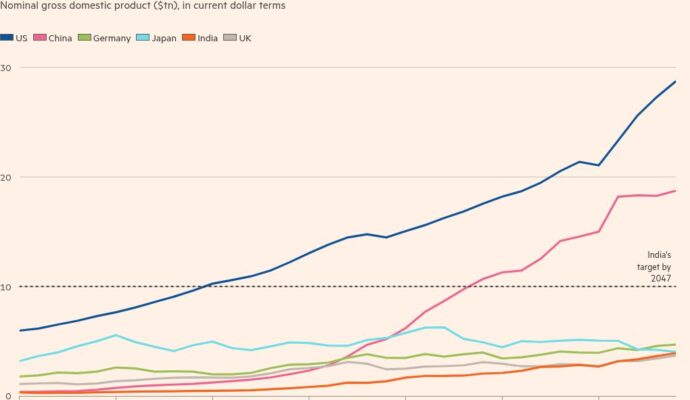

Lessons from India’s economy

Donald Trump’s administration has blocked Taiwan’s President Lai Ching-te from a stop in New York en route to Central America, after China raised objections with Washington about the visit. Here’s what we know about the US decision.

What happened: Lai planned to transit the US in August en route to Paraguay, Guatemala and Belize, which recognise Taiwan. But the US told Lai he could not visit New York on the way, according to three people familiar with the decision. Lai’s office issued a statement yesterday saying he had no plans to travel overseas in the near future because Taiwan was recovering from a recent typhoon and Taipei was in talks with the US about tariffs.

The people familiar with the matter said his decision not to travel came after he had been told he would not be allowed to visit New York.

Why it matters: The White House’s decision — which comes as the US and China hold trade talks — will deepen concerns among Taiwan’s supporters in Washington that Trump is taking a softer stance towards Beijing as he pushes to hold a summit with President Xi Jinping. China objects to Taiwanese leaders visiting the US, which does not have official diplomatic relations with Taipei.

What analysts said: “Trump should be standing up to People’s Republic of China pressure, not caving into it,” said Bonnie Glaser, a China and Taiwan expert at the German Marshall Fund. “By signalling that aspects of the US relationship with Taiwan are negotiable, Trump will weaken deterrence and embolden Xi to press for additional concessions regarding Taiwan.” Read the full story.

Here’s what else we’re keeping tabs on today:

Global economy: The IMF publishes its latest Economic Outlook Update.

Results: Nomura, Barclays, Boeing, Starbucks and Spotify report earnings.

Five more top stories

1. Thailand and Cambodia have agreed a ceasefire to end fighting along their shared border that has killed more than 30 people and displaced about 300,000 in recent days. Analysts said the ceasefire had been prompted in large part by Trump’s threat to terminate trade talks with both south-east Asian countries if they did not stop fighting.

2. Germany and France hit out at the long-awaited EU-US trade deal yesterday, as the euro slid against the dollar. German Chancellor Friedrich Merz said the agreement would cause “considerable damage” to his country, Europe and the US itself, while France’s Prime Minister François Bayrou said that the EU had “resigned itself into submission”.

Explainer: Which sectors will be most affected by tariffs? How have markets reacted? What happens next? FT reporters explain.

Tariff impact: Complex economies are rarely shaped by just one factor, not even a shock as big as Trump’s levies, writes Ruchir Sharma.

3. Trump has given Russia a shorter window of 10 to 12 days to agree a ceasefire in Ukraine or face tighter sanctions, as his frustration with his Russian counterpart escalates. The US president signalled yesterday that he does not believe Vladimir Putin will comply within the 50-day window he previously set.

4. Samsung Electronics has won a $16.5bn order to produce Tesla’s next generation of custom artificial intelligence chips, raising hopes of a turnaround in the tech giant’s struggling contract chipmaking business. The eight-year contract is the biggest deal its chips arm has landed from a single customer.

5. Hong Kong-based conglomerate CK Hutchison has said it plans to bring on a “major” Chinese investor for a consortium backed by US asset manager BlackRock as the company seeks Beijing’s approval for a $23bn ports sale that includes key assets in the Panama Canal. Four people close to the discussions said China’s state-owned shipping conglomerate Cosco was in talks to join the group.

The Big Read

An estimated one in 10 people now lives in a country with what the UN’s water agency classifies as “high and critical water stress”. As climate change makes rain more erratic and groundwater sources run low, governments across the world are seeking solutions to keep the taps running — a boon for the fast-growing desalination industry, which market researchers think will exceed $20bn in 2027.

We’re also reading . . .

Indian lessons: Britain should take a cue from India’s transformational UPI digital payments network, writes Patrick Jenkins.

Singapore Airlines: Singapore’s national carrier suffered plunging profits last quarter from its stake in Air India.

Market calm: In 2025, the louder the headlines, the quieter the market gauges of risk have become. Rick Rieder, chief investment officer of global fixed income at BlackRock, explains why.

Map of the day

Russia has depleted its once-vast stockpiles of Soviet-era weaponry during the full-scale invasion of Ukraine, and is become increasingly reliant on its allies in Asia. New data shows the Russian military now receives the majority of its ammunition from North Korea.

Take a break from the news

Trading a career in finance to go back to school may be tempting, but the adjustment to academic life can be jarring, writes Craig Coben.