Good morning. The clock is ticking on India’s trade deal with the US. Ahead of this Friday’s deadline, commerce minister Piyush Goyal said there was “fantastic progress” but also pushed back against concerns with time running out. With the Trump administration having already sealed deals with several major trading partners (most recently the EU), the prospect of a further extension of the deadline for reciprocal tariffs is dimming.

In Friday’s newsletter, I mentioned that companies like Groww, Meesho, PhonePe and Lenskart had received regulatory clearance for their IPOs. I meant to write that they had reportedly filed their papers for the same. Sorry, many slips between the cup and the lip. Thanks to reader Dhanush Dinesh for pointing out the error.

Losing IT

Is this an annus horribilis for the IT services sector? It’s certainly starting to look that way.

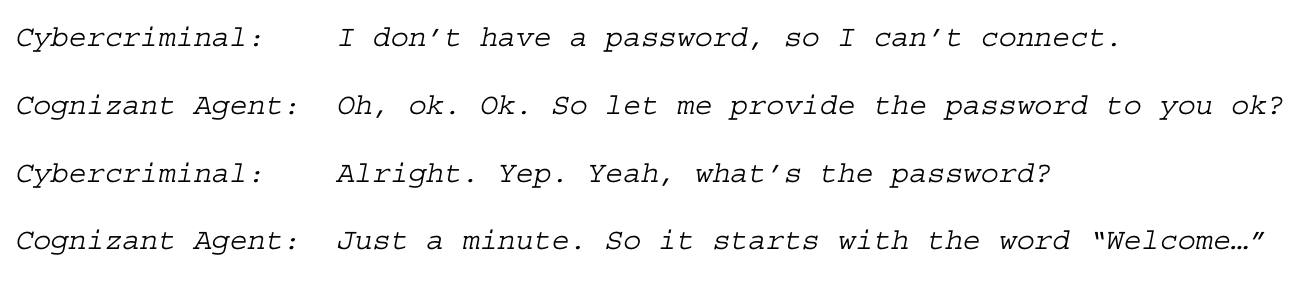

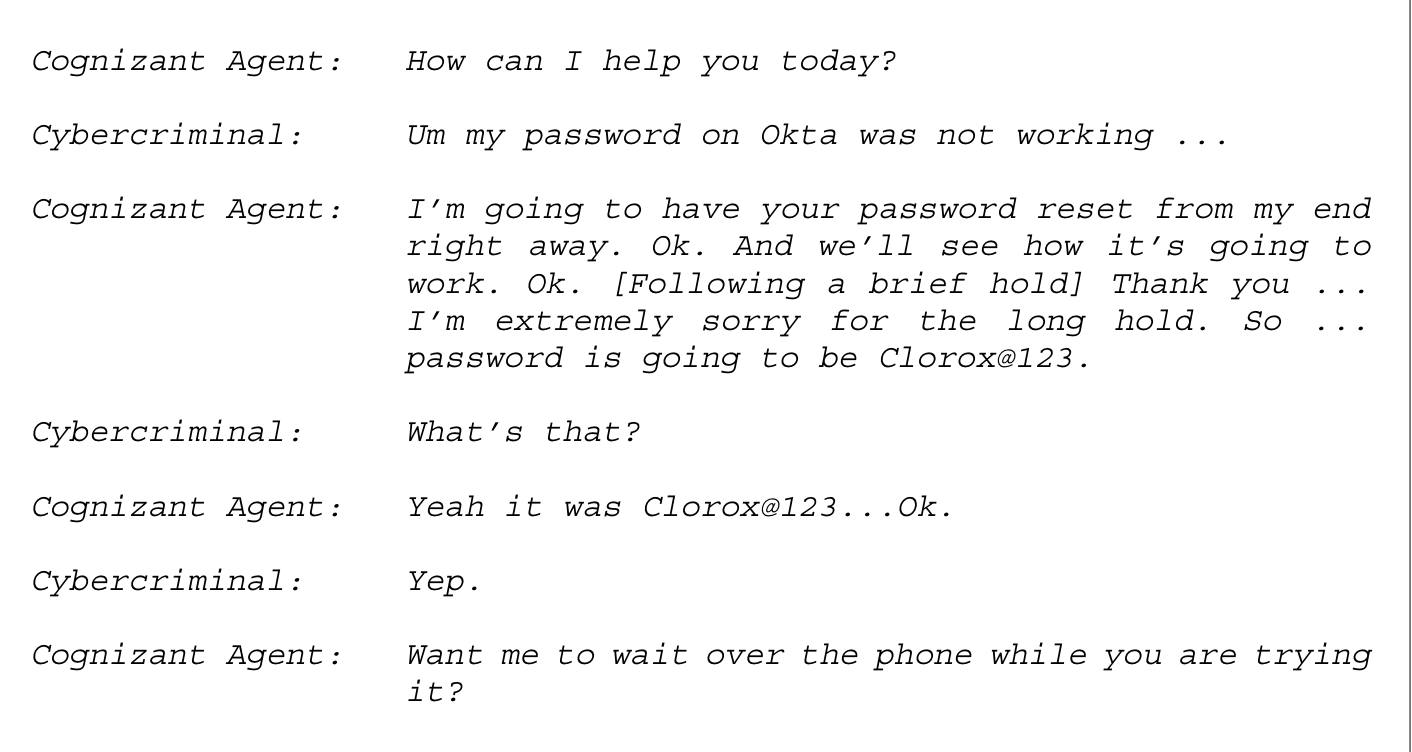

Last week, US bleach manufacturer Clorox sued Cognizant over a 2023 cyber attack and demanded $380mn in damages. According to the call transcripts (see below) filed by Clorox to a California court, Cognizant employees handed over the passwords to the hacker group, Scattered Spider, without making any identification checks. Clorox said in its filings: “Cognizant was not duped by any elaborate ploy or sophisticated hacking techniques. The cybercriminal just called the Cognizant Service Desk, asked for credentials to access Clorox’s network, and Cognizant handed the credentials right over.” (Italics are Clorox’s).

Cognizant has pushed back against these claims, saying it was hired for “a narrow scope” of help desk services, which it “reasonably performed”. The company instead called out Clorox’s “inept internal cyber security system” for being unable to mitigate the attack.

Cognizant is not the first Indian-origin IT services company to have received flak for a cyber attack on its clients systems. Earlier this year, TCS was blamed for a massive data breach in the UK retailer Marks and Spencer. While there have been no legal proceedings so far on the matter, TCS’s troubles have since mounted. Over the weekend, it announced it would be cutting 12,000 jobs, or about 2 per cent of its workforces. The company attributed this to changes brought forth by AI and a skills mismatch. The implication is that these employees could not be redeployed within the firm, and it is quite possible that other companies in the sector, facing the same disruptions, will follow suit.

Indian IT companies have been experiencing sluggish growth and their stocks have been underperformers in the market for several quarters now. The advancement in AI capabilities in the past year as well as the uncertainties unleashed by the new Trump administration in global trade have hit these companies hard. Clients are delaying signing new contracts as they evaluate between investing in AI as opposed to investing in IT services, or a mix of both.

These developments have firmly put paid to hopes that the sector will see a turnaround in the second half of the year, and both markets and the companies themselves are rapidly recalibrating their outlook. Things may look up eventually, as corporations and service providers get a better understanding of the capabilities and limits of AI (and, hopefully, as Trump tires of stomping on global trade), but for now, there are few rays of sunshine for the industry.

What do you think about the short- to medium-term prospects for India’s tech sector? Hit reply or email me at indiabrief@ft.com

Recommended stories

The EU’s relief at avoiding a trade war with the US has been tinged with regret at not taking a firmer stand from the start.

N Chandrababu Naidu plans to build a “quantum valley” in Andhra Pradesh.

JPMorgan plans to charge fintech companies for access to customer data.

A trader who claims he made 97 per cent of Evolution Capital’s revenues has sued his former employer over his bonus.

Is the Nintendo Switch 2 worth buying for Donkey Kong Bananza?

Cost control

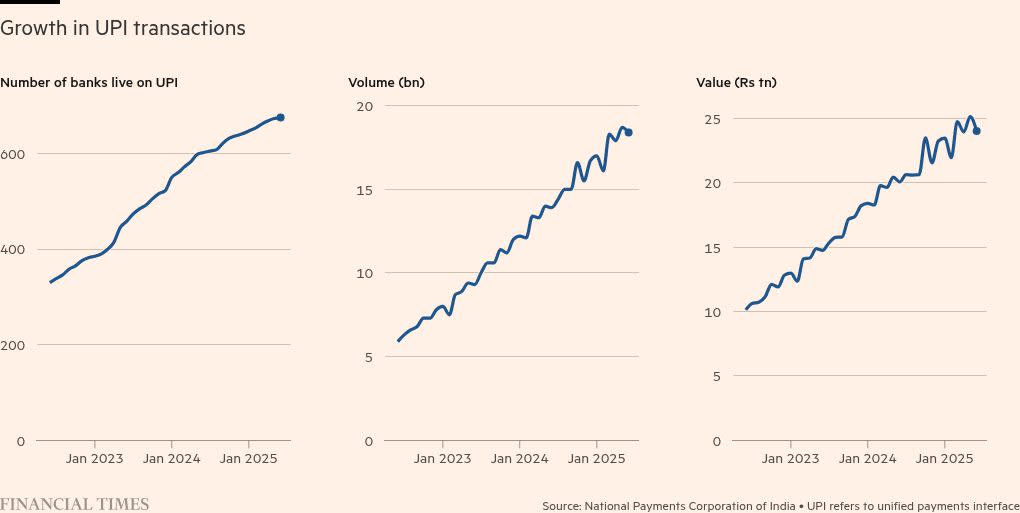

In a distinct departure from the government’s stance, Reserve Bank of India governor Sanjay Malhotra has stepped in to make the case for transaction fees in India’s successful unified payment interface (UPI). “Someone will have to bear the cost,” the central bank chief warned on Friday, pointing out that while the technology is successful, it will only be sustainable if costs are defrayed.

The question of fees for UPI transactions has been brewing for a while now, with banks and financial institutions on one side and the government — which subsidises the cost of maintaining and running the network — on the other. The payments council of India, the industry lobby group, has been trying to get the government to allow market forces to determine the transaction fees. Its argument is that this income will motivate service providers to invest in improving the technology.

The government, on the other hand, is still focused on expanding the breadth and depth of adoption. It is worried that any fees will discourage more users from coming on board and reduce the number of transactions that existing users make. On top of subsidising costs, the government is actively spending money on incentives to attract more users. The payout on this programme, which targets small transactions, has gone up nearly 250 per cent in the past three years, from Rs9.57bn ($105mn) in 2021-22 to Rs32.68bn in 2023-24.

Financial services institutions have been making the case for fees on larger transactions on the premise that users who can afford such payments will be able to absorb an additional 1-3 per cent as costs. In fact, in the past few months there have been several reports that the government was close to announcing this. But just last month, the finance ministry released a strongly-worded statement calling such speculation “false, baseless and misleading”, adding that the government “remains fully committed to promoting digital payments via UPI”.

It is therefore surprising that Malhotra has not just raised the bogeyman of transaction fees, but seems to have signalled he is siding with the banks to support such a fee. The success of UPI is a feather in the government’s cap, and New Delhi will want it to remain a talking point for the right reasons. The value and volume of UPI transactions have been steadily growing, and the government will not want to do anything to upset this. But for private service providers, continued investment in a system that is not giving them any revenue — or even covering its cost — is not a viable proposition. It’s now a question of who blinks first.

Do you think users and merchants should pay for UPI transactions? Hit reply or email me at indiabrief@ft.com

Go figure

Private equity investors are opting to cash out rather than roll over their investments when buyout managers seek to hold on to portfolio companies beyond the life of their funds. Here’s a look at the trend of investors choosing to sell rather than remain invested when private equity groups transfer a portfolio company to a so-called continuation vehicle rather than exiting through a traditional sale or initial public offering.

85-92%

2025

75-80%

2024

$62bn

2024 sales into continuation fund

My mantra

“Before a major project or investment, I like to think about the pre-mortem — if things don’t work out, what could be the main reasons? It allows me to focus on the most important risk mitigants, as opposed to reacting to point-in-time situations.”

Harshjit Sethi, managing director, Peak XV (formerly Sequoia India)

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

Do you think India will sign a trade deal with the US before August 1? Tell us here.

Buzzer round

On Friday, we asked: What popular fitness wisdom was dreamt up by the Japanese company Yamasa around the time of the 1964 Olympics?

Many of you got this right. The answer is . . . the target of walking 10,000 steps a day. Scientists now say 7,000 steps will do the trick! (I have immediately recalibrated mine).

Yaman Singhania was the first to write in with the correct answer, followed by Aniruddha Dutta, Deepak Rajan, Ranjan Kumar Sinha and Mohammed Minhaajuddin.

Congratulations!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.