This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning, happy Friday and welcome to FirstFT Asia. In today’s newsletter:

Inside China’s roaring black market for Nvidia chips

Thailand-Cambodia border clashes erupt

Singapore’s GIC signals caution on private credit

At least $1bn worth of Nvidia’s advanced artificial intelligence processors were shipped to China in the three months after US President Donald Trump tightened chip export controls, according to a Financial Times analysis. Here’s what you need to know.

Roaring black market: The FT’s analysis of dozens of sales contracts, company filings and multiple people with direct knowledge of the deals reveals that Nvidia’s B200 has become the most sought-after — and widely available — chip in a rampant Chinese black market for American semiconductors.

The processor is widely used by US powerhouses such as OpenAI, Google and Meta to train their latest AI systems, but banned for sale to China. In May, multiple Chinese distributors started selling B200s to suppliers of data centres that serve Chinese AI groups, according to documents reviewed by the FT.

What this means: The findings expose the limits of Washington’s efforts to restrain Beijing’s high-tech ambitions. It is legal to receive and sell restricted Nvidia chips in China, as long as relevant border tariffs are paid, according to lawyers familiar with the rules. Entities selling and sending them to China would be violating US regulations, however. There is no evidence that Nvidia is involved in, or has knowledge of, its restricted products being sold to China.

Here’s what FT reporters discovered about the booming black market for US semiconductors.

China-EU summit: European Commission president Ursula von der Leyen warned Chinese leader Xi Jinping that relations are at “an inflection point”.

More China news: China’s investment banks have slashed fees for bond issues to as low as $100 as price-sensitive state-owned issuers dominate a tepid credit market.

Here’s what else we’re keeping tabs on today and over the weekend:

Economic data: Japan releases June services PPI inflation rate data and consumer prices for Tokyo.

Taiwan: The main opposition Kuomintang party faces a reckoning on Saturday over its ties to China when a series of recall votes could result in the KMT losing up to 31 of its 52 seats.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. Thailand has used F-16 fighter jets to bomb military targets in Cambodia after accusing its neighbour of launching attacks that it said resulted in at least 11 civilian deaths. The clashes yesterday reignited a century-long territory dispute over several temple complexes along the 800km long border.

2. Trump clashed with Jay Powell over the costs of refurbishment to the Federal Reserve’s headquarters in a rare public confrontation between a US president and central bank chief. Here’s what happened.

Related news: Any attempt to curb the Federal Reserve’s independence would be “very bad for markets”, Pimco has warned.

More US news: The Trump administration is giving permission to Chevron to resume pumping and exporting oil from Venezuela, in a major policy reversal.

3. Volodymyr Zelenskyy appeared to soften his stance on bringing Ukraine’s anti-corruption bodies under executive control, approving a new draft bill that he said would guarantee the agencies’ independence. Zelenskyy’s apparent retreat comes after protests and scathing criticism of the Ukrainian leader, marking a shift in the country’s wartime discourse.

FT Magazine: Andriy Yermak, the burly right-hand man to Ukraine’s president, is fuelling concerns over creeping authoritarianism.

4. Trump’s special envoy Steve Witkoff has said US negotiators are cutting short talks over a possible ceasefire in Gaza, accusing Hamas of being “selfish” and “not acting in good faith”. The apparent setback comes amid mounting international horror at the catastrophic humanitarian conditions caused by Israel’s 21-month offensive in Gaza.

France to recognise Palestine: President Emmanuel Macron has pledged that France will recognise Palestine as a state at a UN conference in September, becoming the biggest and most influential EU country to do so.

5. British carmakers have been left underwhelmed by the UK-India trade deal signed yesterday, with industry figures saying “very difficult” last-minute talks between London and New Delhi had resulted in a watered-down accord.

News in-depth

Singapore’s GIC sovereign wealth fund has signalled growing caution about investing in the fast-growing private credit asset class. “We are now at a part of the cycle where we feel that spreads are a lot tighter [and] valuations are also higher,” said Bryan Yeo, GIC’s chief investment officer ahead of the release of the fund’s annual results today. Yeo highlighted the market’s lack of experience of a major downturn as a source of potential concern.

We’re also reading . . .

Trump vs Murdoch: Fox News, Maga world’s favourite TV network, is caught in middle of war between its owner and the US president.

Billionaire doomers: A niche investment book from the 1990s reveals why powerful tech leaders fixate on the apocalypse, writes Elaine Moore.

Australia’s ‘millionaires factory’: Macquarie is facing shareholder backlash against its pay policy that has rewarded executives with packages rivalling those of Wall Street CEOs.

Chart of the day

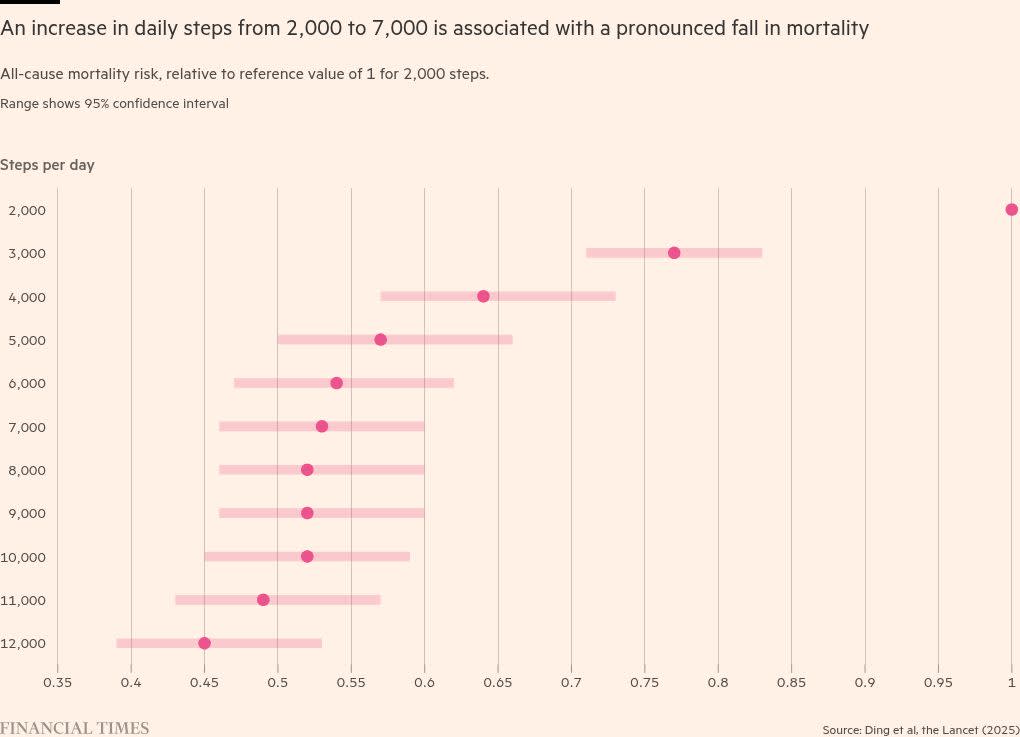

Scientists have busted the myth that 10,000 steps a day are required for good health. The widely used goal was dreamt up in the 1960s by Japanese company Yamasa to sell pedometers, but new research suggests a lower target of 7,000 steps a day could deliver big health benefits.

Take a break from the news

More than three decades ago, Tim Harford nearly dropped economics, had it not been for a handwritten letter of encouragement from his tutor. How do well-timed kind words change lives?