Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In Japan, cash accounts for about 40 per cent of all transaction value, around double that of regional peers. That reflects the country’s relative late start in financial digitisation. At the same time, its banking sector is structurally overbuilt, crowded with regional lenders in a growth constrained economy. Yet even in this saturated market, a new entrant should not be dismissed.

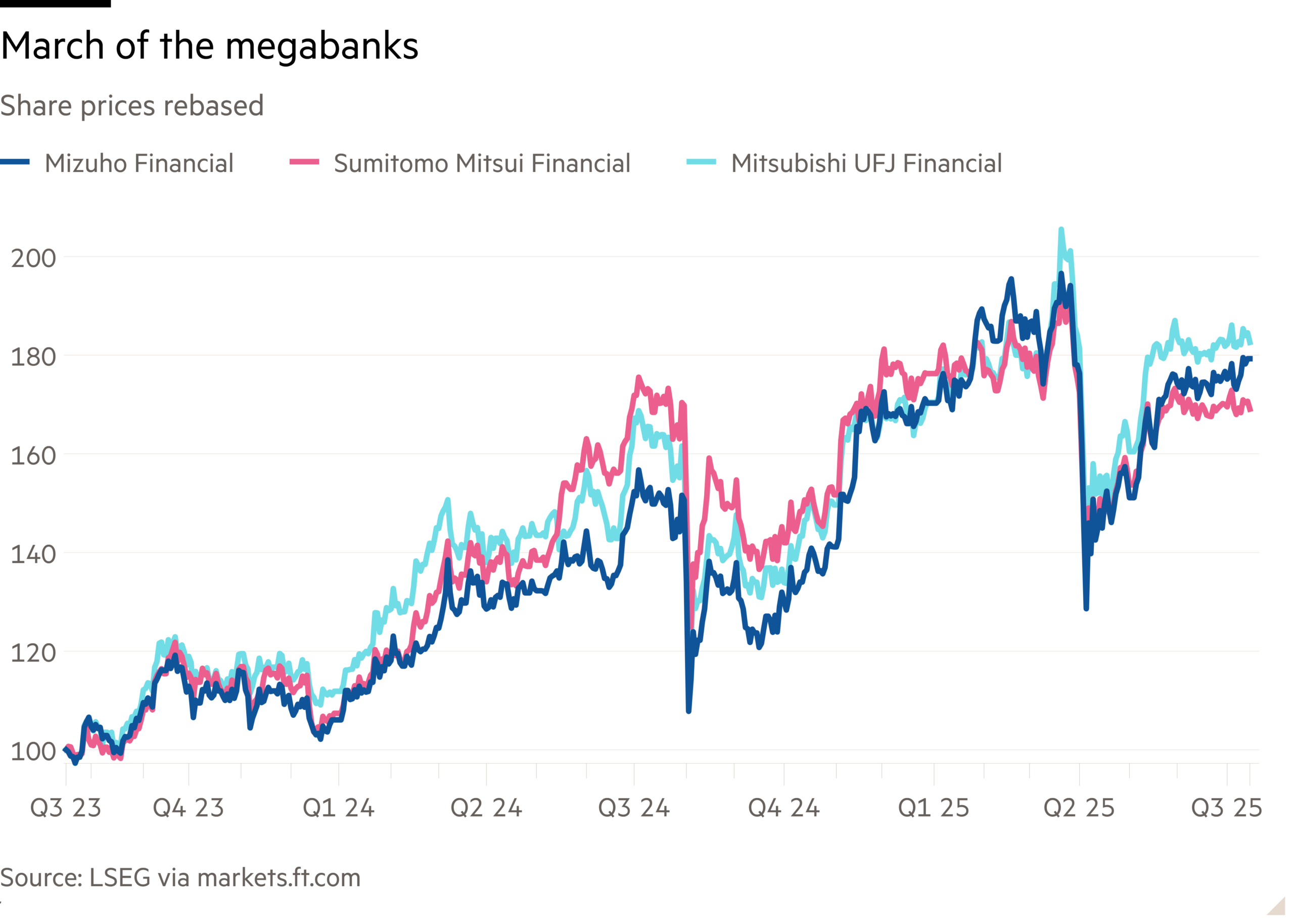

Japan’s big three megabanks, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group and Mizuho, already dominate the local sector. Now, SBI Shinsei Bank, which delisted in September 2023 following its takeover by SBI Holdings, is positioning itself as a potential fourth, with plans to relist in Tokyo.

The bank was rescued in the aftermath of Japan’s financial crisis and became one of the country’s most high-profile foreign investment stories, after US private equity firm JC Flowers backed its 2000 acquisition from the government. It is targeting a valuation of more than ¥1.5tn, which would make it one of Japan’s largest IPOs this year. Still, that would place it far below the megabanks, with total assets just a fraction of the country’s largest MUFG.

Local rivals have been moving to modernise. MUFG has invested in fintech platforms to improve personal finance while Sumitomo Mitsui has invested in blockchain-based settlement systems. Mizuho has been experimenting with artificial intelligence-driven customer service and Japan Post Bank, considered the most conservative, has also launched smartphone-based payment apps. But across the sector, these efforts remain fragmented and layered over ageing infrastructure.

While even the megabanks are struggling to generate growth at home, SBI Shinsei has an edge. Unlike traditional groups weighed down by sprawling branch networks, SBI Holdings has built a reputation as Japan’s most digitally focused financial group. Its portfolio includes the country’s largest online brokerage, a digital only banking platform as well as investments in crypto infrastructure and AI.

Its cloud-based, AI-integrated platform could help drive down costs and use customer data for tailored loans and wealth management services. Meanwhile, digital adoption in Japan is finally picking up, albeit cautiously. While cash remains dominant, mobile payments have more than doubled since 2019.

The timing is right for a bank listing. After years of being dismissed as over-regulated and underperforming, Japan’s banking sector is finally being reassessed. A decade of ultra-low interest rates has ended, giving lenders room to rebuild margins. Corporate governance reforms and improving shareholder returns are drawing renewed global interest.

As a result, Japanese financial stocks have staged a remarkable comeback this year. Shares of MUFG are up nearly 60 per cent from last year’s lows and trade at 1.4 times tangible book, a decade high. That momentum should help support SBI Shinsei’s return to the market.