Just ahead of the July 9 deadline to reach an agreement on tariffs, US President Donald Trump announced his decision on the

tariffs levels for 14 countries – including a rate of 25 per cent on Japan and South Korea – effective August 1.

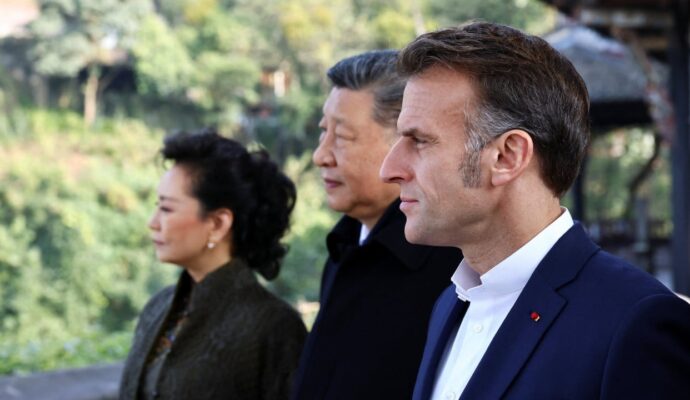

Trump accused Japan of not buying enough rice and cars from the US. It’s worth noting that the American car industry is simply not competitive in Japan. Germany, Japan and China are the top three auto exporters. Those countries, along with South Korea, have commanded high surpluses in the global auto trade while the US has incurred a steep deficit.

Japan’s rise was epitomised by global brands like Sony and Toyota. While Sony’s pre-eminence may have been long eclipsed by Samsung, Toyota is still one of the best carmakers in the world. As for electric vehicles (EVs), Chinese companies like

BYD are emerging as formidable challengers to Tesla.

The East Asian economic model has been powered by export-led growth.

East Asian economies went through similar pathways from basic labour-intensive products like apparel to hi-tech products such as cameras and smartphones.

Unlike Japan and South Korea, whose manufacturing is largely based on home-grown technologies, China has long played the role of an original equipment manufacturer. While laptops and smartphones represent a key proportion of China’s exports to the US, many of them are made for foreign brands. Geopolitics and cost factors notwithstanding, such a role is dispensable.

However, China has passed the stage where it competes on low costs. Labour-intensive production has shifted to Southeast Asia, South Asia and elsewhere. China remains a manufacturing powerhouse due to its robust supply chain and shift towards automation. Ranked third after South Korea and Singapore, China has surpassed Germany and Japan in adopting

industrial robotics.

South China Morning Post