Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Taiwan is just the sort of place you’d expect to have a sovereign wealth fund. The country runs a massive current account surplus, and manages enormous quantities of official assets.

But rather than being allocated to stocks, infrastructure, property or *checks notes* a Versailles palace or 440ft yacht for the country’s leader, these assets have been stuck mostly at the central bank.

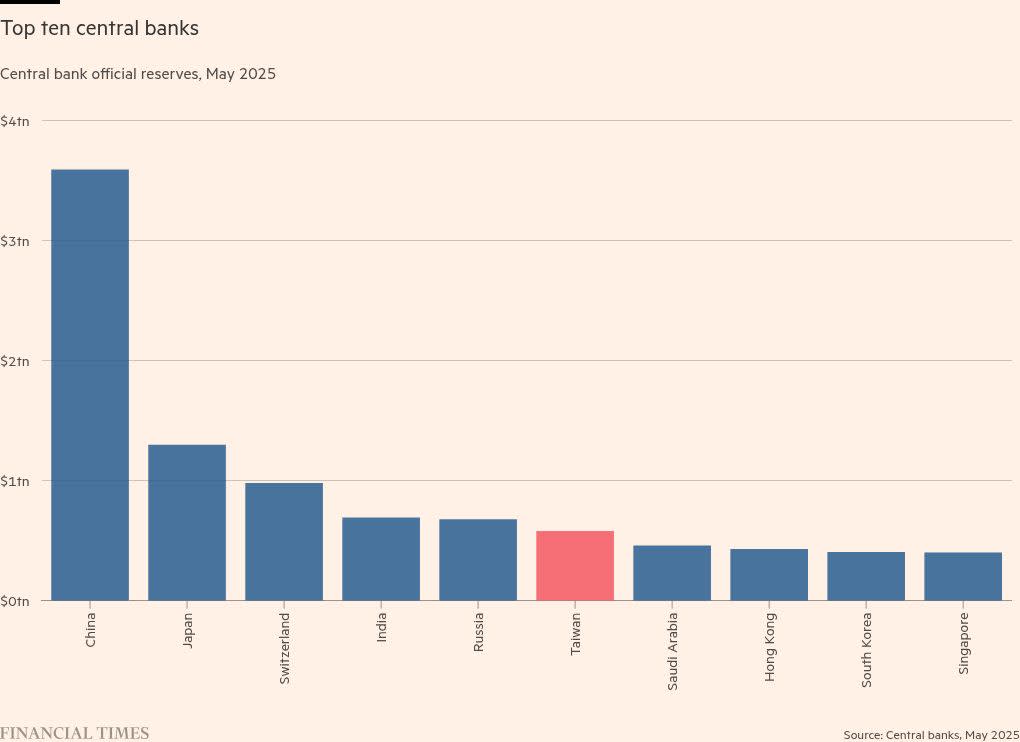

With $581bn of foreign exchange reserves, tiny Taiwan’s central bank ranks sixth in the world by official reserve assets. They don’t disclose their asset allocation, but our guess is that it’s stuck mostly, or perhaps entirely, in bonds.

But things look like they are about to change.

On May 20, President Lai Ching-te announced that his government would set up a brand new sovereign wealth fund for the country. In a new BofA report Xiaoqing Pi and team write:

Entrusting FX reserves and fiscal surpluses via the fiscal authorities, as in KIC’s case, could be a feasible option for Taiwan, in our view. In addition, various state funds could be aggregated into the proposed SWF as well, and Singapore’s mechanism of transferring excess FX reserves from the central bank to the government could also be a reference for Taiwan.

Where would it invest its assets? BofA think likely priorities would be in:

US markets and technology: investments in public and private equity to align with trade risk mitigation and technological leadership goals.

Strategic sectors: potentially targeting new energy and defense industries to address Taiwan’s energy challenges and security concerns, in our view.

In fairness, the country has done a pretty good job at maintaining technology leadership goals without a SWF.

But the idea of a Taiwanese SWF has been kicking around for years without getting anywhere. Back in 2022 there were moves in the legislature to siphon off ten per cent of central bank reserves for investment in “strategic industries”. Other plans looked at investing 25 per cent of reserves. The central bank was, apparently, unimpressed, staking out a position that they shouldn’t allocate reserves to any SWF “for free”.

Is the central bank’s consent for reserve appropriation no longer required, or has the central bank been persuaded to drop its objections? While BoA seems to think so, analysis from GlobalSWF ($) suggests that central bank agreement may not be a deal breaker, writing:

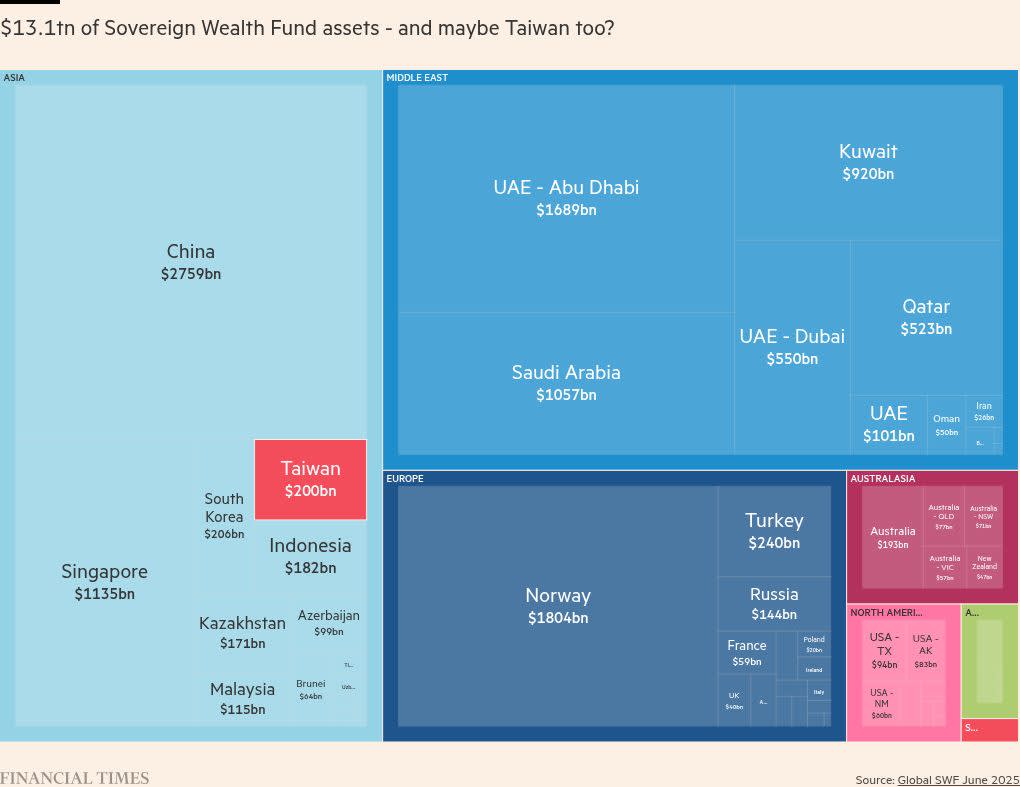

Instead of draining central bank reserves, Taiwan could start by consolidating its existing public funds under a single, professionally managed investment entity. Between the Bureau of Labor Funds, Public Service Pension Fund, and the NFSF, there’s nearly US$190 billion already under management.

And how big exactly does the BofA team think the new fund will be?

Taiwan’s proposed SWF could resemble Korea’s KIC in terms of scale and funding source.

The last time we looked, KIC had a touch over $200bn in assets. So if the country consolidates its existing public funds, it won’t need a huge top up from the central bank.

Having a new KIC-sized SWF drift on to the investment scene would be a big deal. Whether a SWF will transform Taiwan into a defence tech superpower — or indeed whether doing so would address its security concerns — remains to be seen.