Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

At the height of Macau’s gaming boom in 2013, the city’s casinos generated over $45bn in gross gaming revenue, seven times that of Las Vegas. That surge in demand overwhelmed the city’s casino infrastructure, paving the way for the rapid growth of over 20 satellite casinos tucked into downtown side streets and old hotels. These venues, operating as extensions of licensed casino operators, were a lucrative business that dramatically expanded the reach of gaming for local groups.

Macau’s major casino groups had lent their government-issued licenses, of which only six were granted, to more than a dozen third-party venues. This allowed them to keep up with growing demand without the upfront capital investment or regulatory burden of building new resorts. At their peak, satellite casinos accounted for up to a fifth of all gaming establishments in Macau. They became key sources of employment and fuelled the city’s rise as a global gaming hub. But those boom years are now drawing to a close.

By the end of this year, all remaining satellite casinos will either be shut down or absorbed into parent companies, following a 2022 legal reform prohibiting casino operations in properties not directly owned by license holders. SJM Holdings, once the largest licenser of these third-party venues, will close down most of its satellites, keeping just two through full acquisition. Peers including Galaxy and Melco will also integrate satellites into their core operations or exit entirely.

This transition will bring challenges. Consolidation entails property acquisitions, staff redeployments and the logistics of relocating equipment and retraining employees, all of which will be costly. Closures, meanwhile, would result in the loss of revenue from still-profitable satellites and disrupt customer traffic.

Yet moving to a fully-owned model also opens the door to upside for licensed operators. The likes of SJM now stand to benefit by consolidating operations, eliminating the need to share revenue or oversight with third party partners. With full ownership, they can relocate gaming tables and machines to more profitable, high traffic properties and improve operational efficiency, which should help improve margins.

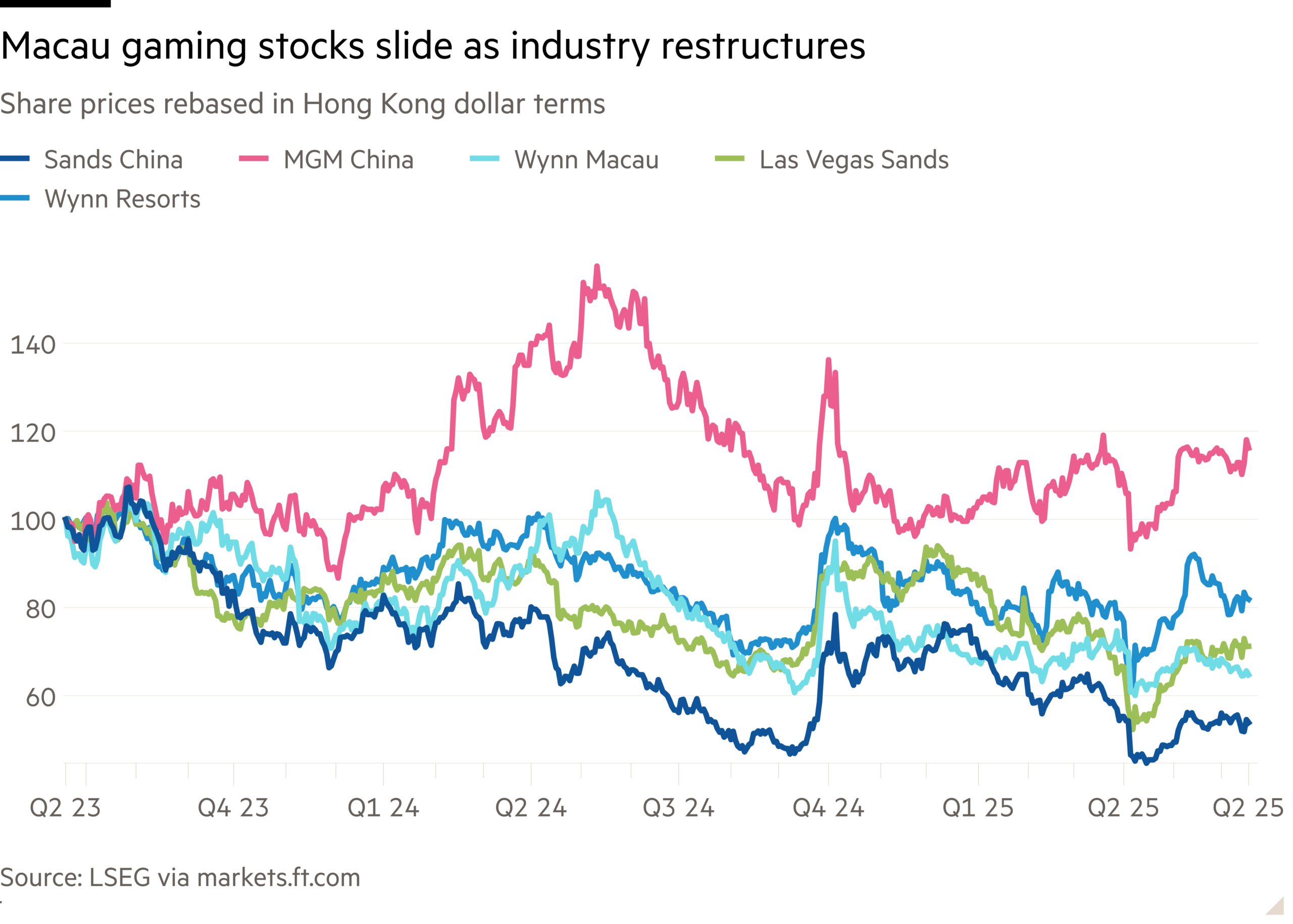

Shares of Macau’s casino groups have been falling across the board as the industry undergoes one of its biggest structural shifts in decades. The transformation comes at a time when persistently low consumer confidence in mainland China, Macau’s largest revenue source, continues to weigh on travel and discretionary spending. But if done right, the shift could position local operators for stronger profitability and a more resilient long-term outlook.