Only one person has survived yesterday’s tragic crash of a London-bound Air India flight in Ahmedabad. The flight, which was carrying 242 passengers and crew, went down minutes after taking off. Home minister Amit Shah said the process of retrieving bodies was nearly complete and an official number of deaths will be released after they have been identified and DNA samples from the crash site are matched with relatives.

The flight crashed into the dining area of the BJ Medical College, killing at least five students and injuring 60 others.

Yesterday’s crash has focused scrutiny on Boeing’s 787 Dreamliner, one of its best-selling aircraft. The company’s shares closed down 4.8 per cent on Thursday.

This is India’s worst aviation disaster since the 1996 Charkhi Dadri mid-air collision. In the coming weeks, we will bring you more about the cause of the crash and its impact on Indian aviation. For now, my thoughts are with the victims and their grieving families.

A tough chapter

Byju’s, once one of the brightest stars in India’s start-up ecosystem, has sold two of its most-prized acquisitions at throwaway prices. Coding platform Tynker was acquired by San Francisco-headquartered educational technology company CodeHS for $2.2mn, and the children’s digital library app Epic went to China-owned TAL Education for $95mn. Byju’s had acquired these companies in 2021 for $200mn and $500mn respectively.

These are just the latest developments in the company’s continued unravelling since 2021, when it made the big mis-step of taking a $1.2bn loan to create a US-based entity. The unit broke the loan’s covenants two years later, after which creditors took control and subsequently filed for bankruptcy. In India, the company is tangled in a mess of insolvency proceedings, primarily over its sponsorship contract for the Indian cricket team, and facing public backlash for its aggressive sales practices.

In the middle of all this, after lying low in Dubai for the past three years, founder Byju Raveendran has resurfaced. On a popular video podcast last month, he attempted to kick off the next phase for his eponymous company, calling it Byju’s 3.0, an AI-powered educational platform.

Raveendran blamed his troubles on what he called “vulture” lenders, but it was a rather poor explanation from someone who made a career out of explaining things. I emerged from the more than two-hour podcast unclear about how Raveendran will find funding for this new start, and what exactly he plans to do. I’ve contacted him but he has yet to reply.

The rise and fall of Byju’s is a telling illustration of the dangers of the venture capital model. In the beginning, as edtech presented an opportunity, VCs were falling over themselves to fund the company no matter how high the valuations. With high valuations came high demands for growth, and the company went berserk, riding the tiger both in customer and company acquisitions. Such stories usually have only one ending: everyone loses.

While the responsibility for the company’s key decisions rests with Raveendran (and his executive team, including his wife and brother), the investors who put billions of dollars into this company were also responsible for their lack of oversight and failure to intervene in a timely manner to steady the ship. The fire sale of Tynker and Epic is unlikely to be the last bit of bad news for the company. Byju’s version 2.0 is still playing out; 3.0 will have to wait.

Recommended stories

Israel has launched a strike against Iran.

Pakistan plans to raise military spending after clashes with India.

European banks have spent €1.1bn axing senior staff since 2018.

Here are the corporate winners and losers under Donald Trump.

The US dollar has fallen to a three-year low.

What’s booming? Sports tourism!

People power?

India rarely tops global lists, but in terms of population, we are now the undisputed number one. The UN’s most recent estimates have put the country’s population at 1.46bn, comfortably ahead of China’s 1.41bn. This is expected to continue to rise, reaching 1.7bn by 2065. For now, the population is still relatively young. Nearly 68 per cent of Indians fall within the working age band of 15-64 years and only 7 per cent are considered elderly.

Despite having a favourable population mix, India has been unable to cash in on its “demographic dividend”. With the manufacturing sector failing to fire up in the last decade and a half, the country’s working age population is unable to find work. The gig economy is one of the largest employers now, especially in urban India, but the earnings there are neither big nor stable enough to pull families into a higher income strata, resulting in economic stagnation. Overall, the vast majority of Indians still make a living off agriculture.

More significantly, the UN report noted a dip in the country’s fertility rate at 1.9, which is below the replacement mark of 2.1 — the average number of children a woman needs to have to maintain the country’s population. The fertility rate is not uniform across the country. Poorer states such as Uttar Pradesh and Bihar continue to have a large number of births, while in wealthier southern regions women are having fewer children.

This lopsided population growth is significant politically, since the freeze on delimitation will lapse next year, allowing the government to redraw the representation that each state will have in parliament based on population. This will mean that Uttar Pradesh and Bihar will get more seats, and the southern states will get fewer. Last week, the government announced that it will conduct the census exercise in 2027, widely seen as a precursor to delimitation. The southern states are not going to take this lightly, and there will probably be disruptive protests and strikes in the run-up to the 2029 election.

Go figure

The World Bank has maintained its GDP forecast for India for the current year, but it has significantly revised its growth expectations downwards for two-thirds of developing economies. Here are some projections.

6.3%

India FY26

6.5%

India FY27

2.3%

Global FY26

Buzzer round

What has photo-sharing company Snap spent $3bn to build, after a failed first launch in 2016?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

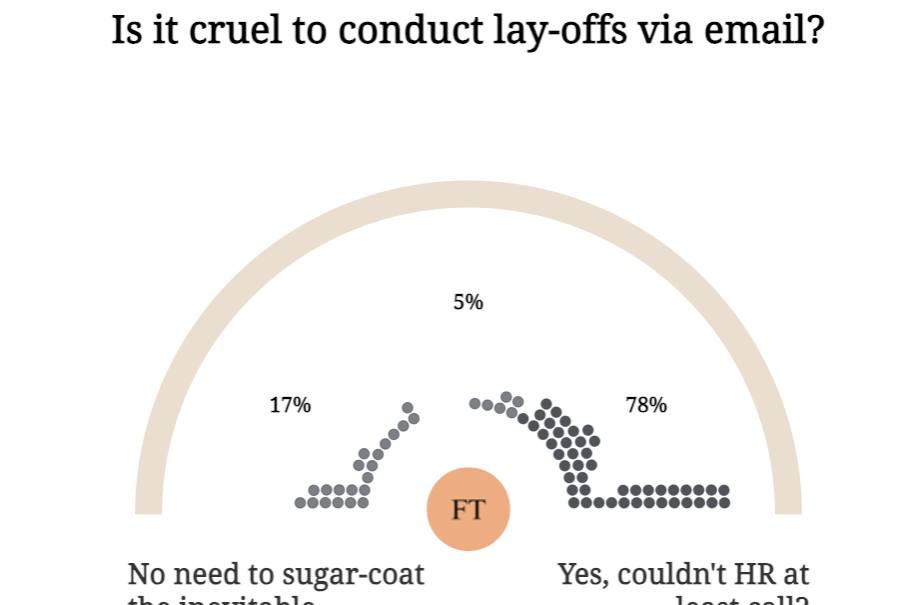

On Tuesday, we asked: Is it cruel to conduct lay-offs via email? Here are the results. Nearly 80 per cent of you would appreciate a call, at the very least.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.