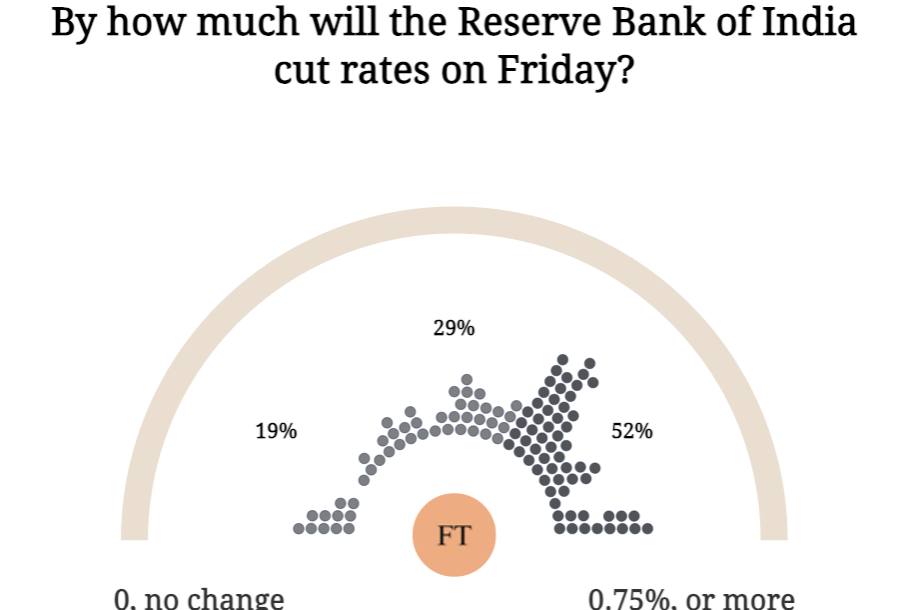

Good morning. The central bank will announce its rate decision later today. Going by our poll on Tuesday, most of you seem to be expecting a 0.5 percentage point cut. If I were being optimistic I’d agree, but realistically I expect it to be 0.25 — we’ll soon see which is right.

In other news: we’ve just passed the six-month mark since India Business Briefing was launched (yay!). I wanted to say thank you — for reading and writing in with your comments, opinions and quiz answers. We really appreciate it, and please keep them coming!

Do you have any suggestions to help improve this newsletter? Hit reply or email me at indiabrief@ft.com

Sudden brake

India’s carmakers have warned that a crunch in rare earth supplies could stall production in the country’s $240bn automobile industry after China curbed exports in April. Seventeen Indian manufacturers of related components are still awaiting the green light from Chinese authorities for supplies to resume. While all vehicles require these critical components to work, electric vehicles have a significantly higher dependence.

To be clear, we are not the only country facing a shortage. Earlier this week, US President Donald Trump expressed his frustration about dealing with his Chinese counterpart Xi Jinping in an all-caps, 2am post on his Truth Social platform. The EU is also pressing China to loosen restrictions on exports of rare earths because of the “alarming situation” for the bloc’s car industry.

India’s government, however, does not look like it plans to wade into the issue directly. Instead, HD Kumaraswamy, minister for heavy industries, is sending a delegation of senior manufacturing executives to Beijing to make the case for expediting import approvals. Maruti Suzuki has played down the urgency of the situation, with executive director Rahul Bharti saying there was “no immediate impact” because of the restricted supply. But scooter maker Bajaj Auto’s Rajiv Bajaj has cautioned that the industry could come to a grinding halt if the situation is not addressed.

In the past five years, India’s imports of rare earths from China have gone up 60 to 80 per cent, and the government is now trying to cut this reliance by increasing local production. In March it announced a liberalised scheme allowing private companies to explore minerals and rare earth elements and opened some 13 acreages up for auction. Under this policy, the government will also reimburse half the exploration costs in areas where no minerals are discovered.

Mining and mineral exploration by private companies is unlikely to be a smooth or easy process, and often has an adverse impact on the local community. Also, any success from these initiatives will be years in the making, and unlikely to come around to ease the ongoing crisis. The only solutions right now are diplomatic, however bitter a pill this might be for New Delhi to swallow in the current circumstances.

Recommended stories

Big investors are shifting away from US markets, thanks to Trump’s trade wars and the country’s escalating debt.

Muhammad Yunus has resisted calls for early polls in Bangladesh, despite political turmoil.

Putin is planning to retaliate over Ukraine’s drone attack, says Trump.

The definitive answer to what to wear for an interview.

The FT’s pick of business books to read this month.

Starlink’s (almost) here

Elon Musk’s Starlink looks all set to launch in India. The company received a letter of intent from the government last month and will probably receive the final licence to operate in the next few days, according to local media. Indeed, with the ink still wet on this deal, scams have already hit the market, offering “Starlink” internet connection to paying victims. The real network will still need a few months more as it sets up infrastructure.

Considering the speed at which these developments are taking place, it was surprising to see a recent complaint from the telecom industry body. The Cellular Operators Association of India wrote to regulators last week, saying that the process of spectrum allocation for satellite communication did not create a level playing field.

This is not exactly a new grievance. Reliance Jio Infocomm and Bharti Airtel, the association’s biggest members, had lobbied against the entry of Starlink for the past four years. But shortly after Prime Minister Narendra Modi met Musk in Washington earlier this year, the two Indian telecom groups took a U-turn, announcing tie-ups with Starlink. Now it looks like the companies have reverted to their earlier stance of resisting Starlink’s launch despite their partnerships with it. Perhaps Jio and Airtel see an opportunity as the public feud between Trump and his decidedly former “First Buddy” grows increasingly ugly. With the president threatening to cancel federal contracts with Musk’s companies, the billionaire and his business interests are now more vulnerable.

For now, the Indian government’s view is to throw the telecom space wide open. Communications minister Jyotiraditya Scindia said that his job was to ensure customers could choose between service providers. “All players across the world are welcome”, he emphasised. This is the new reality for Indian companies, especially in closely regulated industries. India’s string of trade deals largely involves opening up the country’s market to products and services from the US, UK and EU, among others. Now that the umbrella of protection has been yanked away, local corporations will have to be competitive in order to survive — they can no longer take the market for granted. But this is great news for consumers, and I am already rubbing my hands in gleeful anticipation.

Go figure

On Wednesday, the government announced it would undertake a population count in 2027. This will be the first digital census and will also include caste. The results could affect the number of seats accorded to each state in parliament, and the less populous southern states are worried that they will lose out, as it opens the door to a delimitation exercise. Here are some details.

16

Years since last census

11

Month exercise

Read, hear, watch

I’ll be settling in to watch the French Open this weekend, and hoping for an Alcaraz-Djokovic final. My favourite in the women’s line up is young Coco Gauff. This year’s tournament is also bittersweet because of Rafael Nadal’s retirement. If you want a deep dive into how he came to dominate at Roland-Garros, winning the trophy 14 times in 18 years, this book — The Warrior: Rafael Nadal and His Kingdom of Clay — is a great read.

Buzzer round

Which uniquely British phenomenon started as a way to get more people into pubs on quieter nights?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

On Tuesday, we asked: By how much do you think the Reserve Bank of India will cut rates on Friday? Here are the results.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.