Good morning. India is now the fourth-largest economy in the world, government think-tank Niti Aayog has claimed, as the IMF’s growth forecast for 2025 has placed the country a shade ahead of Japan. But these are just projections, and this Friday’s GDP figures will only provide a picture for the last quarter. It’s a fascinating race to watch and we’ll keep a close eye on it.

Taxing times

Donald Trump’s “big, beautiful” budget bill, which was cleared by the US House of Representatives on Thursday, poses a peculiar problem for India. The 1,000-page tax legislation imposes a 3.5 per cent levy on international remittances on non-citizens. This includes those on H-1B visas and green card holders, two categories that include many Indians who send home a considerable chunk of their earnings.

The bill had originally set out a 5 per cent tax but this was reduced to 3.5 per cent when it went for a vote last week. Although India has ongoing trade negotiations with the US, it is unlikely New Delhi can use the talks to influence the matter at this stage, people in the know told me. However, the bill still has to be cleared by the US Senate and it will be asking for some rewrites. This means further cuts or even the elimination of the tax is not entirely impossible (in Trump’s world, everything is a possibility).

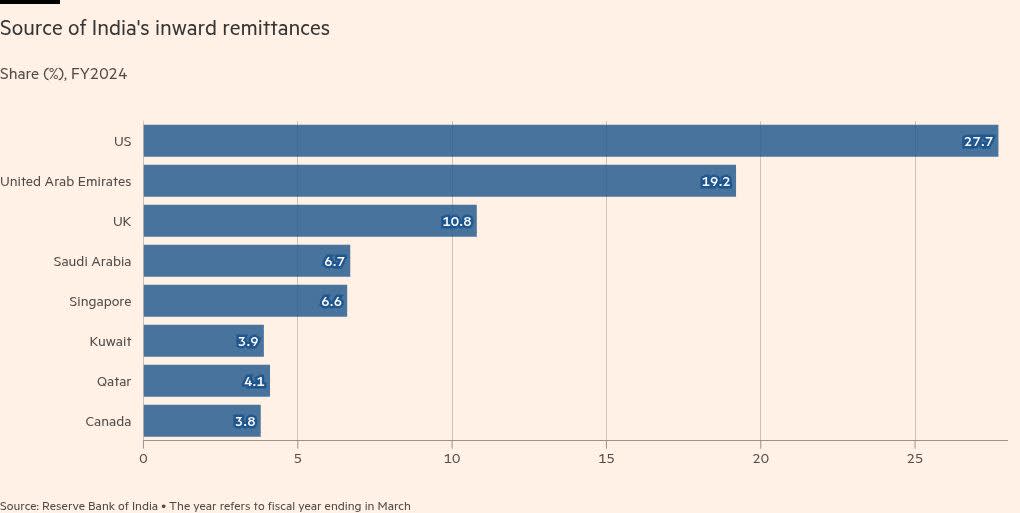

India is the top recipient of remittances in the world, and according to data from the Reserve Bank of India, the US constitutes almost 28 per cent of these inward transfers. Some $32bn came from the US in 2023-24, with one study suggesting that Indians in America send 20 per cent of their earnings home on average. Inward remittance to India has more than doubled since 2010, with the number crossing $100bn in 2021. But the more significant trend is where the transfers are coming from, with a move away from Gulf states to western countries. This suggests a socio-economic shift, since many Indians in countries such as the US or UK are usually engaged in higher-paying jobs often in tech or finance, as opposed to blue-collar work in the Middle East.

If the US bill is passed, there will be a significant increase in remittances as Indians rush to send home money before the new tax kicks in next year. After that though, inward remittances from the US will probably slow rapidly, as the tax eats into net remittance and more people seek informal channels in order to avoid this loss. At a macro level, the impact of the tax — while visible — will not be significant for India’s economy. But the same cannot be said for Indians in America.

For them, the tax is one more in a growing list of challenges. This is especially true for those who have recently started work after graduating from an American university. These young Indians have to grapple with fewer job opportunities, continued visa uncertainty, a rise in living costs and now higher costs of repayment of their educational loans taken in India. This tax adds to the souring of the American dream for many Indians.

As New Delhi negotiates a wider trade deal with Washington, India’s crypto industry is lobbying for tax cuts.

How will US trade policies impact India’s energy transition and security goals? Hear from industry leaders at an FT webinar this Thursday, 3pm IST. Register for free.

Do you think Indians will choose Canada and UK over the US now? Hit reply or email me at indiabrief@ft.com

Recommended stories

SoftBank’s Masayoshi Son has floated the idea of a joint US-Japan sovereign wealth fund.

The Indian Premier League helps JioHotstar catch up with Netflix.

Here are the stealth strategies banks and private equity firms are using to snag the best graduating talent.

“Rich and naive”: why Singaporeans are easy victims for scammers.

A new exhibition at the British Museum traces how religious imagery took hold in India and beyond.

HTSI reviews Shakti Prana, a blissful new lodge in the shadow of the Himalayas.

Not hacking IT

Tata Consultancy Services is investigating whether it was responsible for a massive cyber attack on Marks and Spencer last month that resulted in the theft of the UK company’s consumer data. M&S was forced to shut down its online clothing business for almost a month, and lost £750mn in market capitalisation. The retailer is also likely to take a £300mn hit to its operating profit for the year.

India’s TCS, which has declined to comment on the internal probe, has been providing IT services to M&S for more than 10 years. M&S chief Stuart Machin did not name the vendor, but said that cyber criminals gained access to the systems through “social engineering tactics” at a third-party supplier after they failed to breach the retailer’s security protocols. Such tactics refer to criminals gaining access by claiming to be employees, tricking IT staff into changing passwords and resetting authentication processes. M&S has declined to comment on the TCS reports.

In March, TCS’s competitor Infosys paid $17.5mn to settle lawsuits in the US over a cyber incident that occurred in 2023. If it turns out that TCS was indeed a gateway for the recent cyber attack on M&S, it will not only be an embarrassment for the IT company, but will add to the many woes plaguing the industry in India. With the uncertainties around Trump’s tariffs, companies are more cautious about spending decisions, including those on IT infrastructure. After showing some promise in January and February, the hiring outlook for Indian technology companies has also taken a turn for the worse.

The industry is counting on technological shifts to eventually drive new business. This implies that the next few quarters will continue to be slow, as client companies spend time feeling out AI and other related options. Analysts expect the industry to grow 4.5 per cent for the current fiscal year and 6 per cent for the next. These are tepid numbers for a sector that used to easily clock growth figures above 8 per cent and was once a stock market darling. To retain clients, India’s IT sector must re-establish its credentials as a provider of cutting-edge technology. Any vulnerability to cyber fraud will further weaken its case at this crucial juncture.

Go figure

Several Indian states have reported an uptick in reported Covid-19 cases in the past fortnight. All four southern states, as well as Delhi and Maharashtra, have active cases.

1,009

Current active cases

257

Active cases last week

My mantra

“I hang around the pantry during lunch, moving from table to table. The mantra used to be leadership by walking the corridors, I have modified it to leadership by sharing lunch. One of our big problems now is that we are a large organisation, and the only news that reaches me is what people think I want to hear. This is the best way of knowing what your people are actually saying and what the market buzz is.”

Shashi Sinha, head, IPG Mediabrands

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

Trump has delayed imposing 50 per cent tariffs on the EU until July 9. Do you think he will further postpone his “liberation day” tariffs? Tell us what you think here.

Buzzer round

On Friday, we asked: Testifying during a court hearing, what did top Apple executive Eddy Cue say would probably become obsolete in 10 years’ time?

The answer is . . . iPhones. “You may not need an iPhone 10 years from now, as crazy as it sounds,” Cue said.

Ram Teja was first with the correct answer, followed by Yaman Singhania, Aniruddha Dutta and Prasanna Venkatesh. Congratulations!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.