Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Much of the global attention around industrial self-sufficiency has focused on the US and China. Yet Japan, too, has been working to reduce its reliance on foreign suppliers in strategic sectors, and particularly when it comes to China. A part of that effort has been to catch up in the electric vehicle battery market. That push is now faltering.

Japan had a head start: Panasonic was one of the world’s first EV battery makers. Yet despite the country’s early mover advantage its position has weakened in recent years because of intensifying competition from Chinese rivals, limited local production capacity and a relatively late shift by its carmakers to pure battery EVs. These structural disadvantages have made battery making a national priority.

As recently as 2021, closing the gap seemed within reach. The government launched subsidies for more than 30 battery-related projects and set a target of producing 150 gigawatt hours of batteries annually by 2030, enough to power more than 2mn EVs per year.

The goal had been to build a local ecosystem covering cell production, material supply and component manufacturing. Japan’s carmakers were expected to play a central role. Nissan, for example, had planned a factory to produce low-cost lithium iron phosphate batteries for electric minicars starting in fiscal 2028. The project had secured local government backing and public funding as of this January.

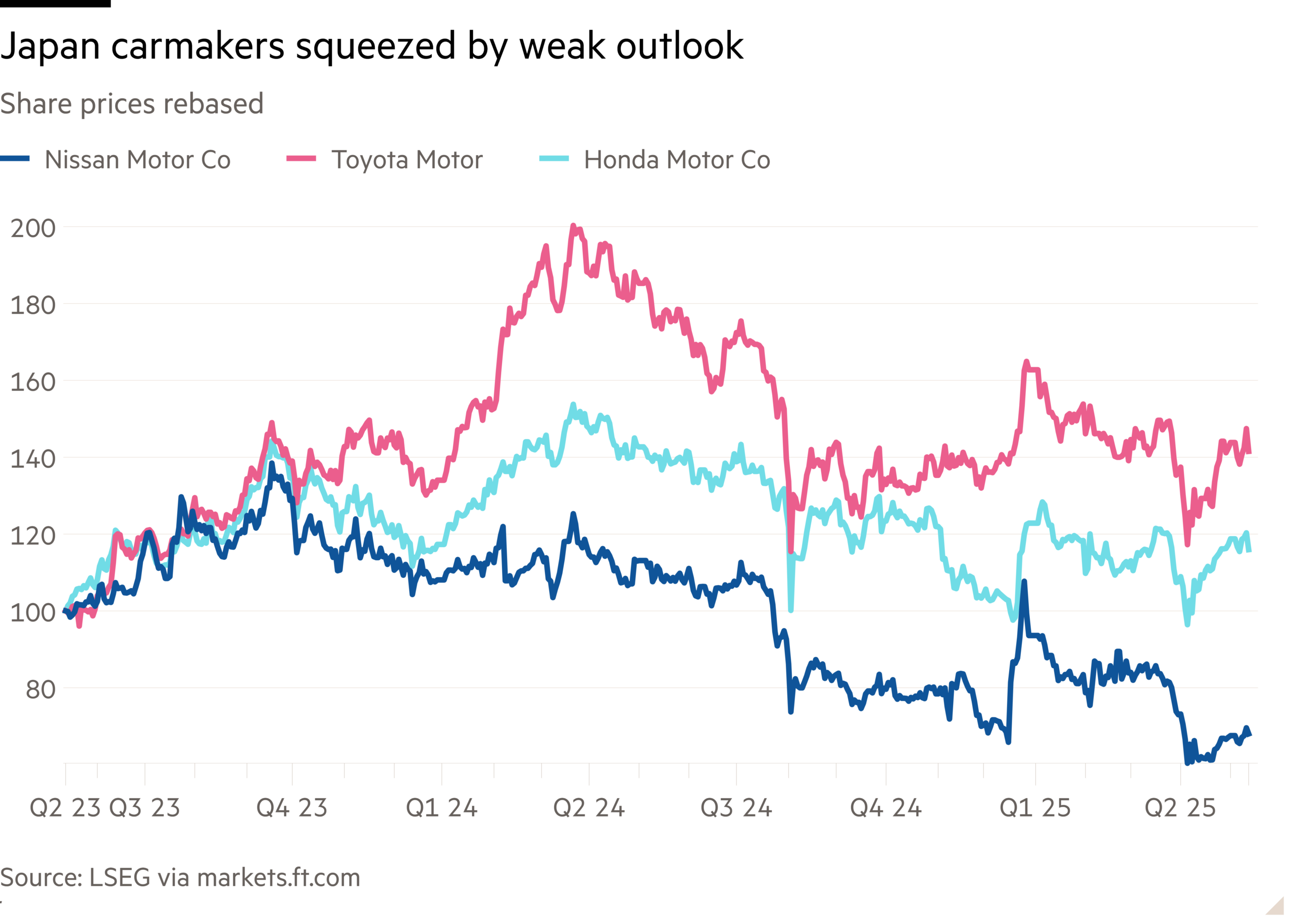

Yet, what the plan failed to anticipate was the sudden financial deterioration across the local auto sector. Nissan posted a net loss of ¥670bn ($4.5bn) for the fiscal year ended in March, one of the largest in its history. Peer Honda’s operating profit fell more than three quarters in the latest quarter, missing expectations by a wide margin. Meanwhile, Toyota, long considered the most resilient, has forecast a 21 per cent drop in profits for the current financial year to next.

This collective downturn has made it difficult for Japanese automakers to shoulder the steep upfront investment required to build localised plants. Nissan’s abrupt cancellation of its planned battery factory, along with Toyota’s earlier delay of a similar project, are major setbacks for this strategy.

These financial strains underscore a deeper structural problem. Panasonic’s share of the global EV battery market has fallen to less than 5 per cent in 2024, down from its dominant position in the early 2010s. Chinese rival CATL, about to list its shares in Hong Kong, holds nearly 40 per cent of the market.

As Japan’s carmakers retreat and Chinese battery makers expand into the country, the window to secure a national battery supply chain is rapidly closing.