Nishant Sharma migrated to Glasgow from Punjab in India almost two decades ago, starting as a dishwasher before founding his own spirits company, Rutland Square, named after the location of India’s consulate in Edinburgh.

This week’s announcement of UK trade deal with India has cleared the path for major export expansion back to his ancestral home in the tea plantations of Assam, where his great-grandfather learned to distil spirits and blend whiskies with a Scottish colonial officer.

For three years, Sharma has been infusing gin with Assam tea to build a cross-border narrative into the spirits he is now selling to Indian consumers through duty-free retail channels.

India’s hitherto high tariffs have acted as a barrier to craft operations such as Rutland Square, which now hopes to exploit expanding demand for prestige Scotch whisky and gin among India’s growing middle classes.

“This new trade deal gives us a gateway into India,” said Sharma, who is targeting £2mn in sales by the end of this year, 60 per cent of which come from overseas. “It will generate revenue for the country and huge employment.” he said.

The trade deal halves tariffs on Scotch imported to India from 150 per cent to 75 per cent, with a reduction to 40 per cent after 10 years. However, the two sides did not include Indian state tariffs in the announcement, which can amount to a further 150 per cent levy on top of federal charges.

The loosening of trade barriers nonetheless has the potential to boost exports to India by £1bn over the next five years, according to the Scotch Whisky Association, a trade body.

India is the world’s largest market for Scotch exports in volume, with 192mn bottles exported in 2024, or 13.7 per cent of all exports. Yet it is only the fifth largest in value, at £248mn — a quarter of the value of exports to the US.

The deal comes at an opportune time for an industry facing a cyclical downturn as consumers have traded down to cheaper brands while input costs have soared, leaving stacked warehouses and cash-strapped distillers seeking to limit production.

The world’s largest Scotch producer, Diageo, welcomed the deal announcement. India made up 6 per cent of the FTSE 100 group’s net sales in 2024, or an annual $1.3bn, according to analysts at Bernstein.

“Today’s agreement is a huge achievement,” said Diageo’s chief executive Debra Crew, adding that India was “the world’s largest and most exciting whisky market”.

“It will be transformational for Scotch and Scotland, while powering jobs and investment in both India and the UK,” she said.

Diageo’s higher-end brands such as Johnnie Walker, which are bottled in Scotland, make up about 24 per cent of the group’s sales in India. Scotch imported in bulk and bottled in India makes up a further 6 per cent, according to Bernstein. The remainder of its sales consist of local whisky brands, which are unaffected by the tariffs.

Analysts at Goldman Sachs estimated that the tariff reduction would boost earnings per share for Diageo and Pernod Ricard by low single digits. “This is welcome news considering the current weakness in spirits globally, but we remain cautious on the sector due to lacklustre demand in the USA,” they said.

A partial UK-US trade deal, also announced this week, has kept 10 per cent tariffs on most UK goods entering the US, with only car and steel exports to America winning cuts.

“The welcome progress for other sectors is a clear sign that the intensive efforts by the UK government is bearing fruit. We continue to support this measured and pragmatic approach in the weeks ahead so that Scotch whisky can return to the zero-for-zero tariff agreement with our friends and partners in the US whiskey industry as soon as possible,” the Scotch Whisky Association said.

As far as the UK’s deal with India goes, Jason Holway, senior consultant at data provider IWSR, estimates that the easing of tariffs will lead to a 10 per cent price drop for Indian consumers of UK whisky.

“This is not to be sniffed at but is not a game-changer either. It is important to stress that any savings will not be universal and may not be passed on to the consumer, at least not in the short-term,” he said.

Holway added that brand owners were already invoicing at lower prices to compensate for the high duties. “India’s state governments will be reluctant to allow price reductions as it will cut into their tax revenue,” he said.

Drinks analysts at Jefferies said the deal would help absorb excess Scotch inventories.

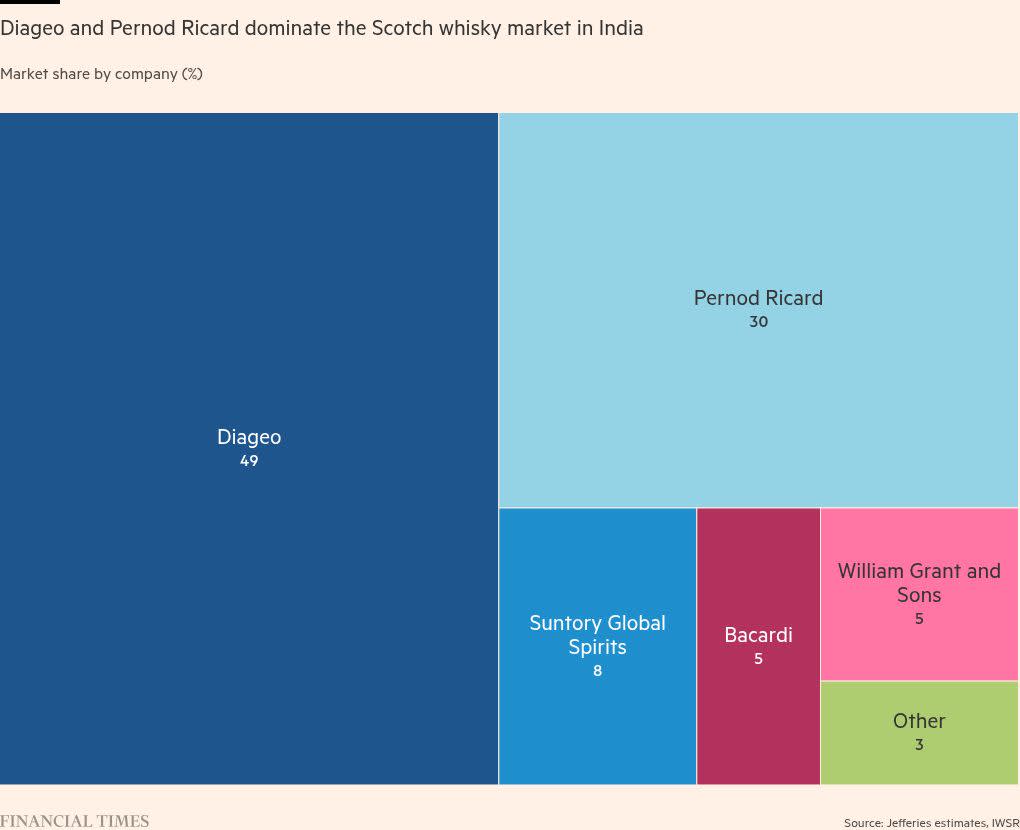

Currently, only the largest players, such as Diageo and Pernod — with 49 and 30 per cent share of the Scotch market, respectively — were able to afford the high cost of entry into India, said Jefferies analyst Ed Mundy. With levies lowered, more small and medium sized brands will be able to start exporting.

“This will help to absorb excess inventories in the market and partly assuage concerns of a whisky loch, which risks putting downward pressure on Scotch pricing,” Mundy said.

Exporters to India, the world’s biggest customer for bulk Scotch, were now more likely to push pricier bottled Scotch “which could deliver long-term upsides, rather than focus on low margin, short-term gains”, said IWSR’s Holway.

Huw Wright of Edinburgh’s Holyrood distillery had already been planning to launch its whisky brands in India. “Now, we have lower landing costs, we can be competitive and spend on brand building within the market,” he said.

The Isle of Raasay distillery, off Skye, already has an importing set up in India and will “enter the market in a more meaningful way”, said William Dobbie, managing director. Within five years, India could break into the company’s top five markets by volume — currently the UK, France, US, China and Germany.

Smaller distilleries would have to build distribution channels and expand marketing spend, as well as think about protection of intellectual property rights, said Brian Moore of law firm Dentons.

“There are plenty of things to do, but these are champagne problems,” he said. “This is an opportunity the industry has been asking for, for a long time.”

Data visualisation by Janina Conboye in London