Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

Britain has been in dealmaking mood this week. On Thursday, it announced an agreement that reduces prospective duties on its auto, steel and aluminium exports to the US, making it the first nation to win a reprieve from Donald Trump since he outlined plans for global tariffs last month. Two days earlier, the UK agreed a trade deal with India which had been in the works for three years. The two accords hardly represent the most optimal deals from Britain’s standpoint, and they will have little impact on its economic growth path. Still, there are positives to take from both, and they are a base for the government to build upon.

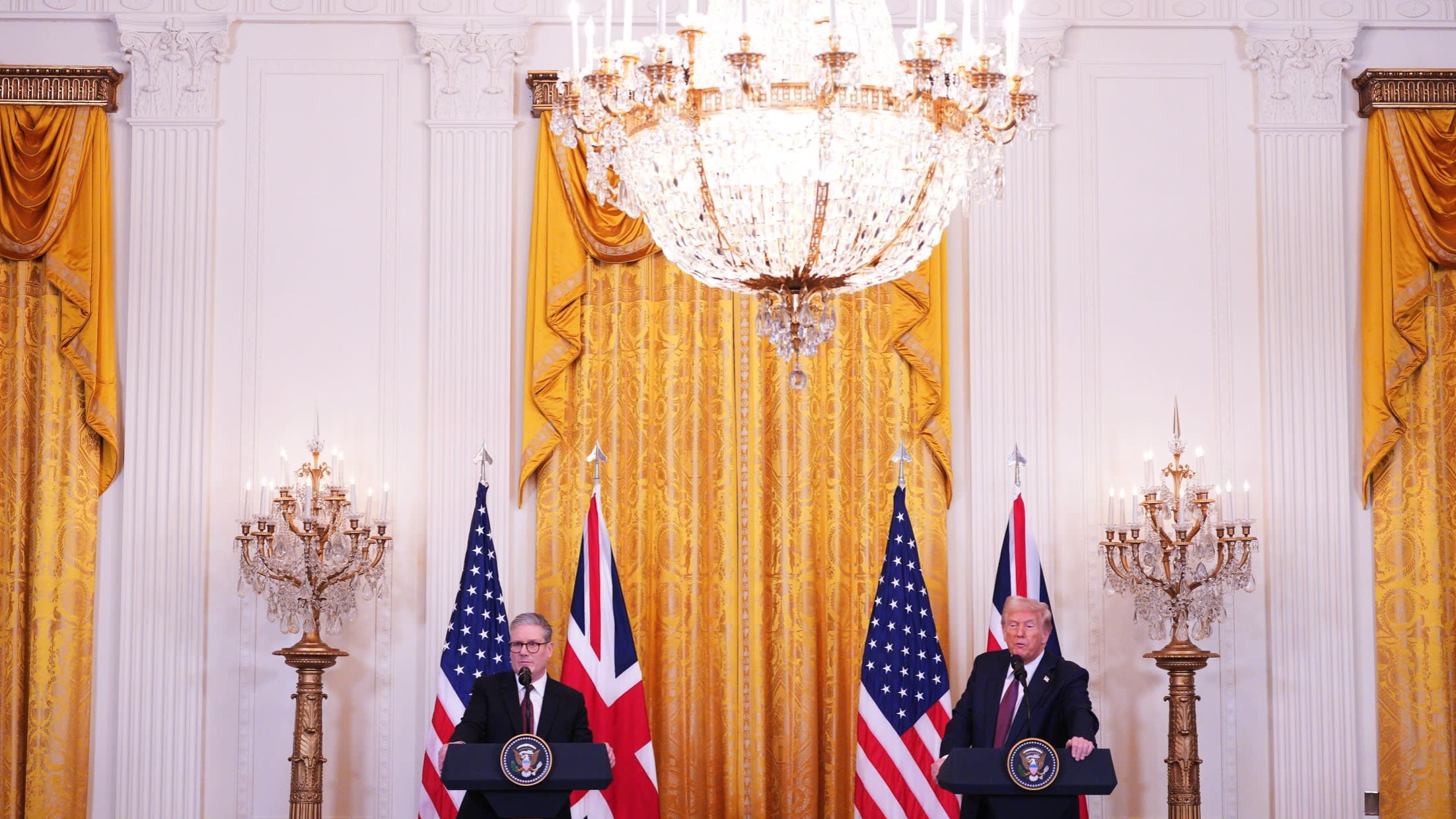

When uncertainty abounds, quick policy decisions take on greater significance. The US deal sets its tariffs at 10 per cent on most British auto sales, and removes steel and aluminium entirely, compared with the threatened 25 per cent. This provides at least near-term respite for both industries, their supply chains and workers. “Significant preferential treatment” for UK pharmaceuticals from any future US duties is another plus. The optics of Prime Minister Sir Keir Starmer being the first world leader to agree a deal with the US president shouldn’t be overlooked either. For investors it signals that the UK could be relatively sheltered from Trump’s protectionist agenda.

The agreement with India, meanwhile, aligns the UK more closely with one of the world’s fastest-growing major economies. It cuts duties on more than 90 per cent of British goods exports to the country, with particular upsides for the food and drink sector. With tariff barriers rising across the world, it is a small but symbolic win for free trade more broadly. And alongside the US deal, it reiterates Britain’s determination to remain open to global business.

Yet the deals must be put into perspective. The agreement with America is merely a less bad outcome for the UK, relative to the US tariffs it faced before Trump’s inauguration. It still faces a blanket 10 per cent duty on other goods. The US president announced plans for a 100 per cent tariff on foreign films last weekend, which would hit Britain’s booming film industry hard, but there was no mention of this in Thursday’s announcement.

The pact with India is also only expected to boost the UK’s long-run GDP by 0.1 per cent a year — by 2040. The deal largely focuses on goods, with limited detail on how it might raise access to India for Britain’s stronger services sector. A Westminster squabble over a three-year allowance for Indian employers and employees to avoid paying UK national insurance contributions also risks undermining any political gains for Starmer from the deal.

Both agreements need to be developed further. Starmer should build on his ties with Trump not only to insulate Britain from the president’s love of import levies, but also to find avenues where mutual tariff and non-tariff barriers can come down further. With India, the UK should use momentum from the deal to make it easier for its professional services industry to do business there, including by pressing for mutual recognition of qualifications.

Nonetheless, the greatest potential for trade-related economic gains for Britain is closer to home, through improving ties with the EU, still its largest trading partner. The government’s refusal to grant the US significant concessions on food and animal welfare standards may have diluted its agreement with Trump, but it does raise the chance of a more fruitful UK-EU trade deal on foodstuffs.

Starmer’s quick-footed pragmatism in getting trade deals done is refreshing for a government that still needs to prove it can deliver for the country. But when it comes to actually raising the UK’s economic growth, the agreements, so far, are little more than a sideshow.