Stay informed with free updates

Simply sign up to the Foreign exchange myFT Digest — delivered directly to your inbox.

Given everything going in the world — Mike Waltz leaving the chat; papal elections; GTA being delayed until 2026; etc — you’d be forgiven for not paying much attention to Asian FX.

But here’s a humdinger of a chart showing the Taiwanese dollar’s exchange rate against the US dollar:

We’ve reversed the Y axis to show how the Taiwanese dollar has soared against the US dollar in recent days. Bloomberg informs us that this is the biggest rise in almost four decades. Here’s what the Borg says:

The Taiwan dollar surged the most in nearly four decades as a combo of upbeat growth data, bets on easing trade tensions and strong US tech earnings turbocharged currency gains.

It closed about 3% higher against the greenback at 31.06 on Friday, marking the currency’s largest one-day advance since 1988. The island’s benchmark stock index also climbed 2.7% to outperform the region’s equity gauges.

The Taiwan dollar, which rarely makes headlines, was at the center stage of currency market on Friday as sentiment toward the island’s assets dramatically improved after China said it’s assessing possible trade talks with the US. Data showing the island’s economy expanding at a faster-than-expected pace and hopes that US tech giants will import more semiconductors from the region also helped to fan optimism.

Unfortunately, it is a little too late to call all of our favourite TWD dealers, but Alphaville is pretty confident that these reasons are extremely tenuous. The idea that a flurry of bets that the trade war will ease suddenly sent the Taiwanese dollar to the moon is, frankly, a bit fantastical.

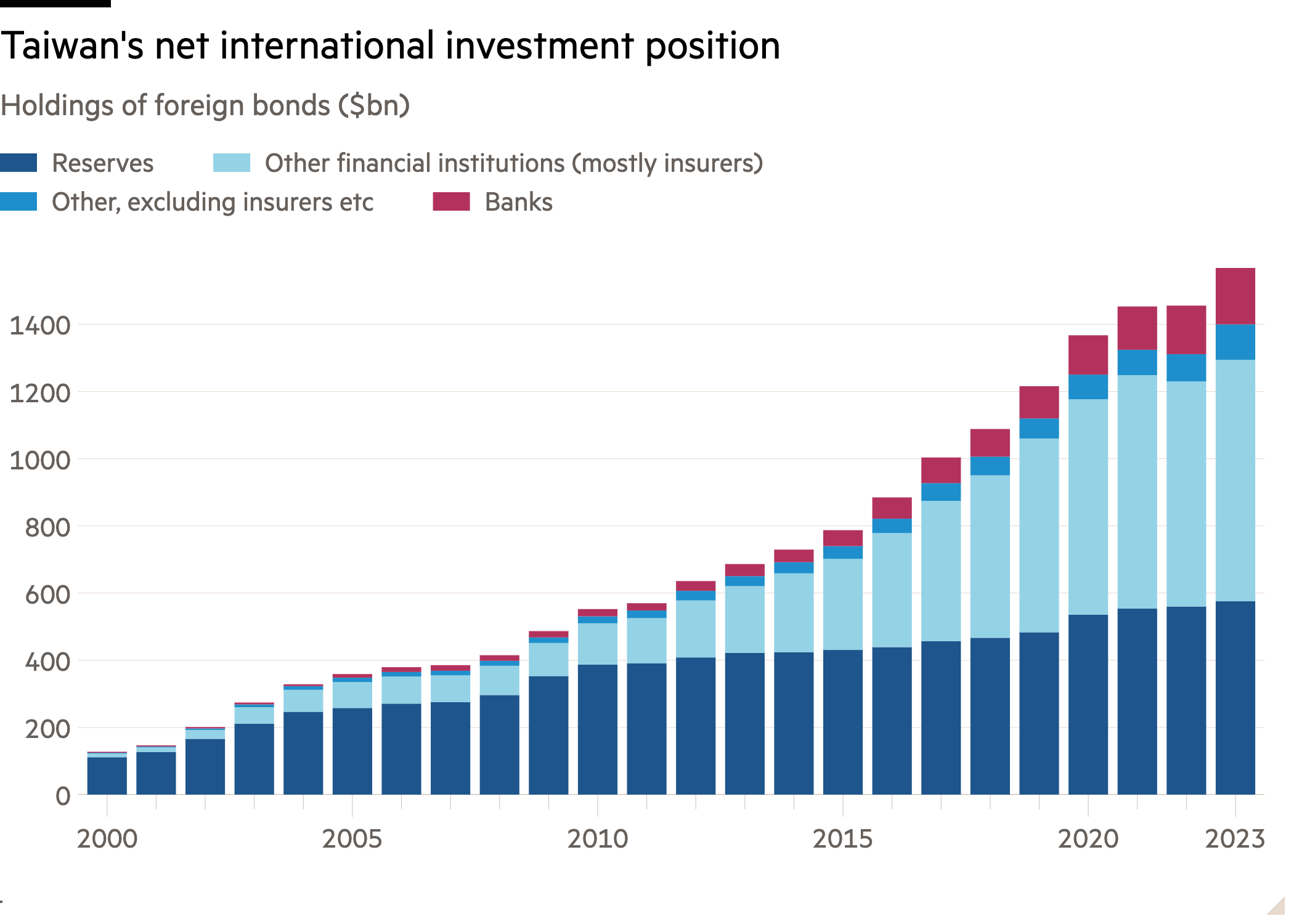

We’ll put out some feelers over the weekend, but to us this looks far more likely to be linked to an issue we highlighted at the start of the year: Taiwan has become a financial superpower thanks to its life insurance companies amassing a $1.7tn pile of overseas assets, most of which are US bonds.

However, as Brad Setser and Joshua Younger wrote at the time, “what might seem like both a reflection and source of financial and economic strength can just as easily be a glaring weakness”.

Taiwanese life insurers have apparently not been super-diligent about hedging their swelling foreign currency exposures, opening up a huge mismatch between their Taiwanese dollar liabilities and their US dollar assets.

When the US dollar’s 2025 decline suddenly began to accelerate and broaden earlier this month, it probably triggered cold sweats in certain corners of Taipei. As Setser and Younger wrote for Alphaville in January (our emphasis below):

Variants of this story have played out across Asia. The difference is simply one of scale. Taiwan’s open position is simply much larger and more precarious than that of, say, Japan’s. And for complicated reasons (related to Taiwan’s closed financial account) it cannot really be ameliorated unless the life insurers are allowed to borrow a ton from the central bank.

That means any big increase in the value of Taiwan’s dollar — an increase that is implied by the huge size of Taiwan’s trade surplus and the fact that it is still weaker against the dollar than it was 30 years ago — could obliterate the finances of Taiwan’s huge insurance industry.

To put it plainly, Taiwan’s life insurance industry has bet its solvency (with the support of its regulators) on the assumption that Taiwan’s central bank will be able to avoid a meaningful appreciation of the Taiwan dollar.

Our bet is therefore that the Taiwanese dollar’s sudden surge is caused by Taiwanese life insurance companies belatedly scrambling to hedge their dollar exposures. It will be interesting to see how next week goes.

Unfortunately, this easily something that could cause trouble outside of the country as well. As Younger and Setser pointed out in a follow-up piece, what happens in Taiwan doesn’t always stay in Taiwan.