Good morning. The US has urged India and Pakistan to “de-escalate tensions” after the terror attack in Pahalgam. The past few days have seen both countries take serious measures, including expelling diplomats. India also suspended its participation in a cross-border water treaty, which my colleagues Andres Schipani and Humza Jilani analyse in this in-depth read.

In today’s newsletter we look at Urban Company’s plans to go public this year. But first, the US calls out India’s poor record in protecting intellectual property rights.

Losing patience with Indian patents

India’s record of protecting intellectual property (IP) rights is once again in the US’s crosshairs. The country was one of eight placed by the US trade representative on America’s priority watch list this week, calling out India as one of the world’s most challenging major economies for the protection and enforcement of these rights.

New Delhi’s laxity in safeguarding IP rights has long been a bugbear for Washington. India was already on the same list in 2021, a year after the two countries had signed a memorandum of understanding to co-operate on IP examination and protection. But the issue has become particularly damaging now, with the two countries in the middle of high-stakes negotiations for a bilateral trade agreement.

While there is a laundry list of complaints that the US has in this regard, two significant points stand out. One is that Indian regulations make it difficult for patents registered outside the country to be protected here, due to a narrow eligibility criteria. This is pertinent to a possible trade deal because India maintains high customs duties on IP-intensive products, especially those in the technology, renewable energy and healthcare sectors. Added to this are the obscure processes and bureaucratic delays involved in registering a new IP or patent here. There are three channels of enforcement in India: police, courts and customs, each with their own areas of authority and paperwork requirements.

The other major issue is on pharmaceutical patents. US pharma companies have long had concerns about unfair commercial use and unauthorised disclosure of testing data. This is a problem made even more significant by the scale of generic drugs manufacturing in India, as well as the large domestic market for such treatments. US manufacturers who outsource to India grapple with the lack of a central enforcement agency, their unfamiliarity with how India investigates cases of IP infringement and the poor co-ordination between state and federal agencies.

Although India has maintained that its IP protection framework meets its obligations to the World Trade Organization, it needs to do more if it wants to be a key player in global trade. We do have a tendency to shrug away some of the concerns raised and extol “jugaad”, our ability to work around restrictions, as a virtue. But as our economy matures, and in light of the opportunities presented by the current disruption in the global trade order, it is imperative that we clean house. We should raise our standards both in protecting IP rights and making compliance and dispute resolutions easier.

The UK and India are in the final stages of trade talks.

India, eyeing critical minerals, has deepened ties with Latin America.

How should central banks navigate the new world order? Pose questions to Chris Giles and other FT experts about monetary policy, and have them answered in a live Q&A next Wednesday

Recommended stories

UBS, Barclays and SocGen have reaped a trading windfall from market turmoil.

Ukraine and the US have finally signed a deal giving Washington access to the country’s minerals and natural resources.

Microsoft says it will take the US government to court, if necessary, to protect its European business.

Shouty leadership is in vogue, but it is bad for business.

Where to eat in Flushing, New York, America’s largest Chinatown.

Here’s why teens should not be on social media.

Urban goes public

Urban Company, which provides at-home services, is looking to go public this year. The company has filed its draft red herring prospectus with regulators for a Rs19bn ($225mn) initial public offering, with more details of the debut to be announced later. Early investors in the company, Accel India, Tiger Global and VY Capital, will make bumper payouts, as will the founders Abhiraj Singh Bhal, Varun Khaitan and Raghav Chandra.

As a brand well-known in Indian cities for offering everything from plumbers to at-home spa treatments, Urban’s will certainly be the headline-hogging IPO of the year. But it is also a company that has often been in the news for the wrong reasons, including stand-offs between gig workers and its management. Earlier this year, in Pune, air-conditioning technicians went on strike demanding better wages and contractual terms. Last year, in Bengaluru and the national capital region, beauticians accused the company of “slavery like” work conditions. Founder Bhal had responded by saying the complaints were from a small fraction of workers who were instigated by local politicians and union leaders.

In its IPO prospectus, the company does mention its reliance on a large number of gig workers as a risk, highlighting potential labour regulation, quality control issues and the high churn of such workers as factors that will affect future profitability. The company will have to put in place effective mechanisms to retain workers by paying them higher commissions, or risk incurring greater costs in hiring and training new people.

Although it operates in a different category, Urban Company’s business model is similar to that of Zomato (now Eternal), and Swiggy, both of which have had a rocky ride in the markets. After languishing in the Rs60 range for months after its listing, Eternal is now trading at Rs230, up 18 per cent in the past year. Swiggy is down 25 per cent from its listing price in November 2024. Will Urban change this trend? I am not holding my breath.

Do you plan to invest in Urban Company’s IPO? Hit reply or write to us at indiabrief@ft.com

Go figure

The US economy contracted in the first quarter, as companies rushed to import more at the start of Trump’s trade war. These are the highlights.

0.3%

GDP contraction

41%

Import growth

1.8%

Consumption growth

Read, hear, watch

My colleague Martin Wolf had an excellent opinion piece on why the US will lose to China in its ongoing trade war. As an add-on to that, I highly recommend this episode of Ezra Klein’s podcast, where he speaks with fellow New York Times columnist Thomas Friedman, who has been covering China for a very long time. Friedman’s descriptions of the country’s technological and manufacturing prowess left me with my jaw hanging.

On a lighter note, I came across this cleverly-named coffee shop near my neighbourhood in Gurgaon last week. I love funny (punny?) business names. Burger Singh was my reigning favourite, until I encountered Desibucks. Have you come across a store that made you LOL? Send them to me at indiabrief@ft.com. Photos optional.

Buzzer round

Who are the “fish hippies”? Hint — they are not easy-going fisherfolk.

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

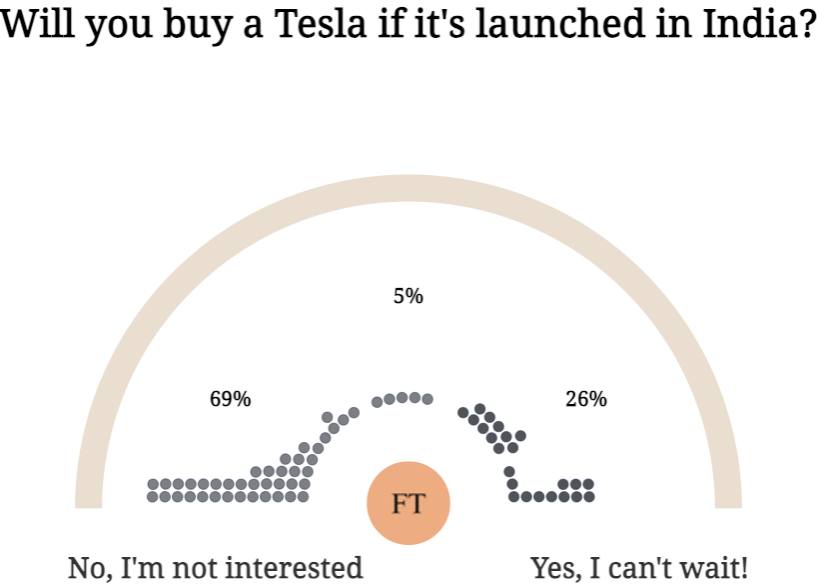

On Tuesday, we asked: Will you buy a Tesla if it launches in India?

Here are the results. Nearly 70 per cent of you are not interested. Elon Musk, who’s already facing rumours of being replaced as chief executive, will be heartbroken.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.