Good morning. Veena will be back next week (phew!) but for now I’m still filling in at the controls of India Business Briefing. We have a piece out today about tax raids on foreign companies in India: they do a lot of harm. On a more positive note, I think there’s potential for the “India Stack” to go global, and that’s a big deal. Onwards to the weekend.

How to strike oil and lose money

Before I became a journalist, I worked in the early 2000s as an analyst for a small fund management company in London. One of the stocks we owned at that time was a mid-cap oil explorer called Cairn Energy and so this morning’s piece on how the Indian tax authorities are going after multinationals such as Volkswagen, written by my colleagues Chris Kay, Krishn Kaushik and Andres Schipani, resonated a lot. (Veena wrote about the case in this newsletter a few weeks ago.)

Cairn’s story is pretty well-known: in January 2004, one of its exploration wells discovered the Mangala oilfield in Rajasthan, which today contributes more than 20 per cent of India’s crude oil production. A great deal subsequently happened, but for London investors the worst of it was in 2012, when India retrospectively changed its tax laws and imposed a huge bill on Cairn. Exploring for oil and gas is a risky business at the best of times, but if you lose even when you win — because the authorities come after you for retrospective taxes — it’s hard to overstate how damaging that is for investment.

The line that struck me most in today’s piece was this comment by Pramit Pal Chaudhuri of Eurasia Group: “There’s always a tendency for such cases to increase when the government is pushing really hard for tax revenue, which is definitely the case right now. They tend to set targets for their income tax officials . . . the guys who raise that get a promotion.”

That’s similar to what’s going on in China, where local governments are hitting all sorts of companies and rich individuals with retrospective taxes as they try to balance the books. But it’s terrible tax policy. If you’re running a business, then you set revenue targets to motivate staff and make things happen, but officials who wield the awesome powers of the state should always have orders to raise the correct amount of tax under the rules, and never an arbitrary amount of tax. If you need more revenue, raise the tax rates.

I fear the story we published today will, at the margin, discourage foreign investment in India. That’s a pity. I hope Narendra Modi’s government will consider a proper reform of corporate tax collection; if and when it does, I look forward to a more encouraging piece in the FT.

Recommended stories

India has the human talent to succeed in AI but its tech companies don’t compete via R&D, writes Krishn Kaushik.

The diamond industry has “ground to a halt” because of tariffs, with Indian polishers heavily affected.

Wall St heavyweight Jamie Dimon speaks to the FT about tariffs.

The US tells Europe to choose between the US and China on tech.

Europe, meanwhile, is telling staff bound for the US to use burner phones.

Government by API and the ‘India Stack’

Rich economies face some serious structural problems right now. There’s a depressing lack of growth; profit pools are getting sucked up by a few giant US tech companies; and as populations age, the generous welfare states that Europe fought so hard to create are becoming increasingly hard to afford. (Donald Trump’s tariffs will make things worse, but I regard them more as a misguided attempt at a cure rather than an underlying cause.)

I think India has part of the answer. I’ve been hugely impressed by the “India Stack”: the set of open APIs — application programming interfaces — for payments and identity that have transformed a lot of processes in India. My colleagues John Reed and Ben Parkin wrote about them at length a couple of years ago.

In the UK and elsewhere, similar APIs could offer a route to greater efficiency, and thus to economic growth. They could also tackle some of the monopoly problems that plague digital platform markets: in 2017, I proposed a public API matching passengers with drivers as a way to avoid platform monopolies in the ridesharing market.

Bringing the India Stack to other countries could offer opportunities for its creator as well. There’s a big moment in economic development when a country shifts from implementing the best practices evolved elsewhere, to providing the example for others to copy. The vision and innovation shown by these APIs makes me optimistic that moment is near for India.

What more should I understand about the India Stack? Is it as clever as it looks? Hit reply or write to us at indiabrief@ft.com.

Go figure

Hindustan Aeronautics trades on a punchy valuation but an “era of rearmament” in Europe has sent Rheinmetall’s stock through the roof.

Price-to-earnings multiples for defence contractors

37x

Hindustan Aeronautics

86x

Rheinmetall

21x

Lockheed Martin

Read, hear, watch

Life’s too short to read bad books so I normally stick to stuff where the critical reputation has settled down. I’m currently reading Lanark by Alasdair Gray: set in the real city of Glasgow and the fictional city of Unthank, it’s told out of order, starting with part three and then going to part one. That kind of modernism is often unenjoyable or even unreadable, but Lanark is unusually well done, and the illustrations, drawn by the author himself, further mark it out as something beyond the ordinary.

Meanwhile, I’ve been gripped by Adolescence on Netflix. It’s not light viewing and the context is very British, but there’s some wonderful acting and if, like me, you have teenage children then you’ll find it hits close to home.

Buzzer round

What do astronomers recently claim to have found on a water-covered planet 124 light years from Earth?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

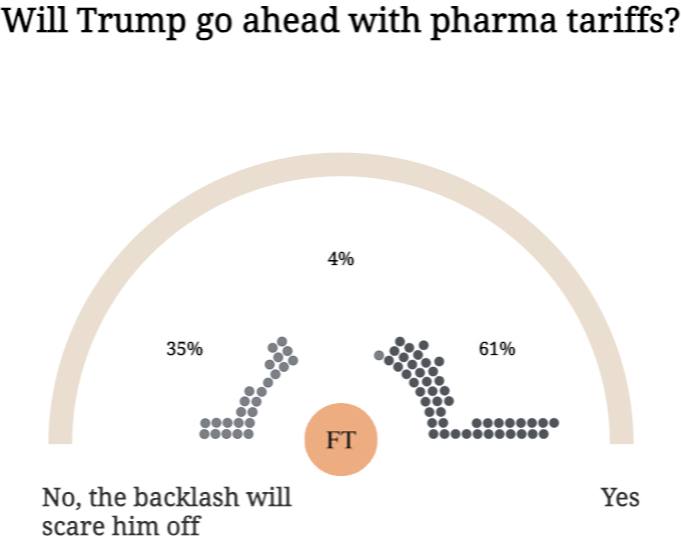

On Tuesday, we asked: Do you think Donald Trump will go ahead with tariffs on pharmaceuticals?

Here’s how you responded. Drugmakers will no doubt be bracing themselves after this week’s launch of a US national security probe into the sector.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.