A note published in the EU’s official journal said China’s rules favoured local suppliers in its procurement markets.

It pointed to a “buy China” policy, the Made in China 2025 strategy that directs hospitals to procure an increasing level of domestically-made medical devices, and regulations that stipulate that local authorities must procure domestic products.

It bemoaned the “more stringent rules for the procurement of imported products compared to the procurement of domestic ones”, and accused the government of “imposing conditions in its centralised procurement of medical devices leading to abnormally low bids that cannot be sustained by profit-oriented companies”.

The commission said its preliminary research found “serious and recurrent impairment of access of EU economic operators, goods and services to the public procurement market for medical devices” in China.

China’s medical technology market was estimated to be worth US$144.5 billion in 2022, according to a study by the Mercator Institute for China Studies, a Berlin think tank that has been sanctioned by Beijing.

But European businesses have complained that they are discriminated against when it comes to competing for public tenders in the industry.

The investigation is to be concluded within nine months, with the Chinese government invited to “submit its views and provide relevant information with respect to the alleged measures and practices”, the note said.

Should the commission confirm its preliminary findings, companies from China could have their applications for tenders in the single market downgraded. They could also face being excluded from tenders in the EU.

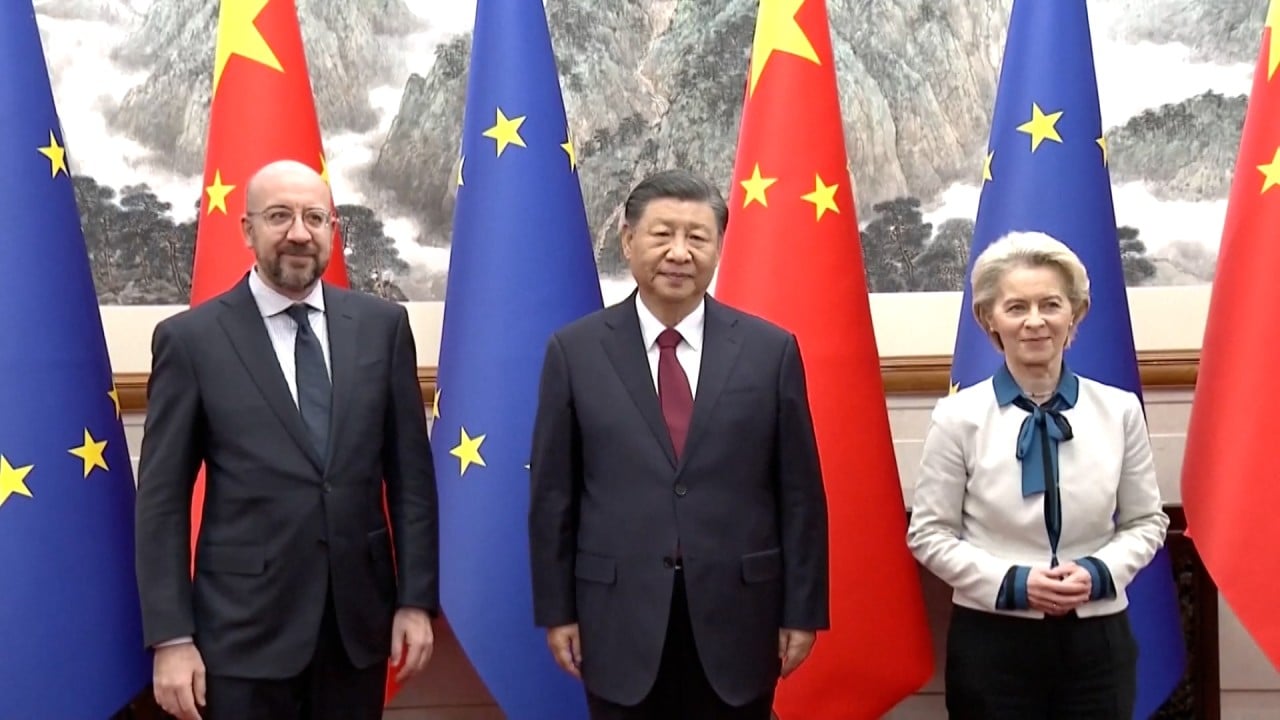

The inaugural IPI probe is the latest in a long line of investigations opened by Brussels under various instruments since the turn of the year, at an increasingly rapid pace – drawing criticism from Beijing and even surprise from some European member states.

A high-profile anti-subsidies probe into China’s electric vehicle sector last October set the tone, drawing a stern rebuke from the Chinese authorities but also consternation from Berlin and some other capitals that are exposed to the carmaking sector there.

The preliminary results of the case, including potential import duties to be imposed on Chinese-made cars, are expected in July.

This year, the tool of choice has been the foreign subsidies regulation (FSR), designed to uncover “market-distorting” state handouts on the books of overseas firms operating in the EU.

Four investigations have been launched against Chinese firms under this tool. Targeted businesses have voiced concerns about the speed and breadth of the FSR, having been forced to hand over their books to European authorities at short notice.

On Tuesday, businesses were shocked by unannounced “dawn raids” by the commission on the offices of a Chinese surveillance equipment maker in the Netherlands and Poland, first reported by the Post, in search of evidence of subsidies.

“Without prior notice, enforcement agencies authorised by the European Commission conducted raids at the company’s offices in both countries in the morning,” read a statement from the China Chamber of Commerce to the European Union.

“They seized the company’s IT equipment and employees’ mobile phones, scrutinised office documents, and demanded access to pertinent data.”