China should spend more on public services for its nearly 300 million migrant workers, rather than on lavish infrastructure projects, a former central bank adviser has argued, as the country struggles to pivot towards a consumption-driven growth model.

“Millions of rural migrant workers in the city are still faced with unsolved challenges in housing, [children’s] education, social insurance, if you give them their own apartments, they will spend more on interior decorating and buying household appliances,” Liu said at the event organised by the China Europe International Business School in Beijing on Tuesday.

From a utilitarian perspective, this approach is more cost-effective

Many municipalities have rolled out supportive measures to boost economic growth at the beginning of the year, mostly large-scale projects worth hundreds of billions or even trillions of yuan.

“Even if 10 per cent of the money was taken out to finance the basic public services for these rural migrant workers, the money will pay off much better in terms of expanding demand, and the effect will be much bigger than building a few subway lines,” Liu added.

“From a utilitarian perspective, this approach is more cost-effective.”

And as China’s real estate sector remains depressed, the government could also purchase the great number of flats that remain unsold and make them available as preferential housing for rural migrant workers, he said.

Proposed reform would give China’s migrants urban home – and benefits to match

Proposed reform would give China’s migrants urban home – and benefits to match

The ultra-long term special bonds should be used to improve public services for rural migrant workers, Liu added.

China had about 298 million migrant workers at the end of 2023, with their average monthly income rising by 3.6 per cent to 4,780 yuan (US$664) last year, according to official statistics.

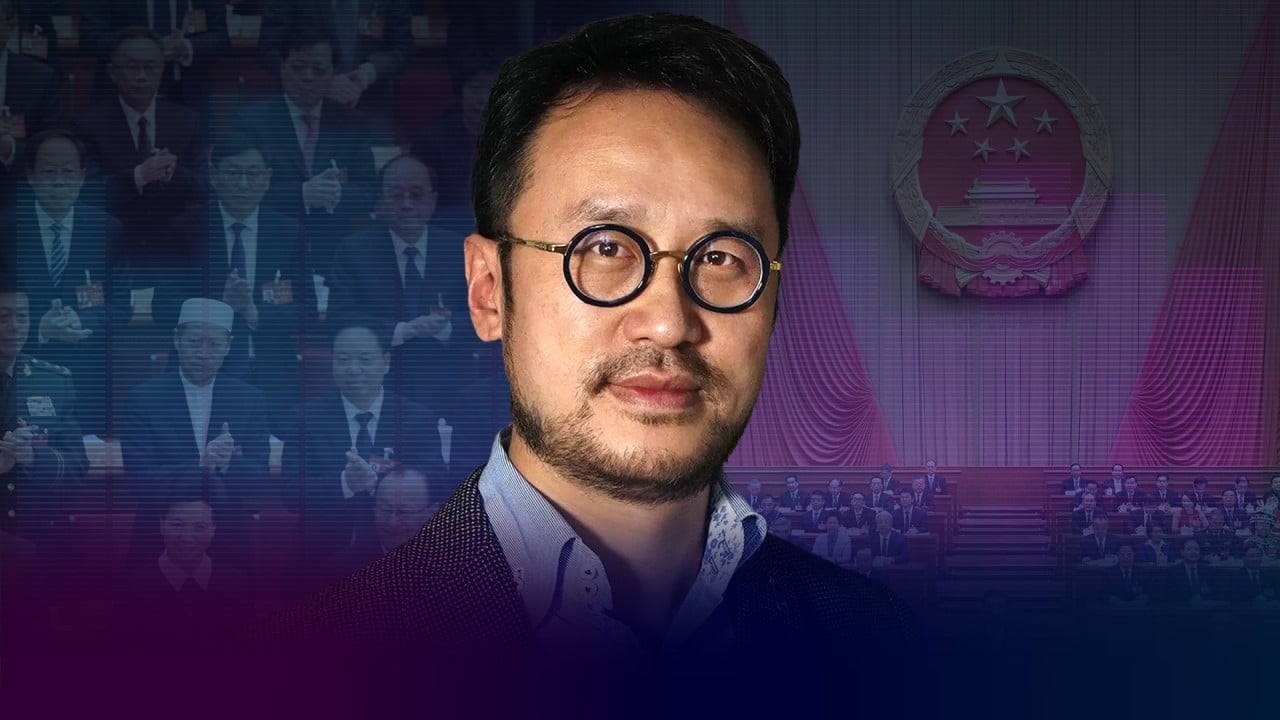

Liu, one of China’s leading voices for structural reforms, made the comments on the day he and Cai Fang, a prominent labour economist, were replaced as policy advisers to the People’s Bank of China by two financial experts. Liu had been a member of the monetary policy committee since 2018.

Analysts have called for a shift from its old pattern of reliance on investment to make up for the lack of consumption, and instead count on the spending power of the world’s largest middle-income group to drive economic growth.

Last year, consumption accounted for 82 per cent of China’s GDP growth.