Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. We start with an exclusive story today — Iran used two of the UK’s biggest banks to covertly move money around the world as part of a vast sanctions-evasion scheme backed by Tehran’s intelligence services.

Lloyds and Santander UK provided accounts to British front companies secretly owned by a sanctioned Iranian petrochemicals company based near Buckingham Palace, according to documents seen by the Financial Times.

The state-controlled Petrochemical Commercial Company was part of a network that the US accuses of raising hundreds of millions of dollars for the Iranian Revolutionary Guards Quds Force and of working with Russian intelligence agencies to raise money for Iranian proxy militias.

Both PCC and its British subsidiary PCC UK have been under US sanctions since November 2018.

Documents, emails and accounting records show that during this time PCC’s UK division has continued to operate out of an office in Grosvenor Gardens in Belgravia by using a complex web of front entities in Britain and other countries, including China.

Revelations about the Iranian sanctions-evasion operation in the heart of London come after the Royal Air Force recently joined US air strikes against Iranian-backed Houthi rebels in Yemen.

The FT’s Miles Johnson, Stephen Morris and Lucy Fisher show how the scheme works.

US-Iran tensions: The US has warned it will keep targeting Iranian-aligned militants after it carried out two of its biggest waves of strikes since the Israel-Hamas war triggered hostilities across the Middle East.

Here’s what I’m keeping tabs on today:

Economic data: Indonesia releases fourth-quarter GDP figures, while S&P Global/HCOB services purchasing managers’ index figures are due for Canada, China, EU, France, Germany, Italy, Japan, UK and the US.

Reports: OECD Interim Economic Outlook Report is published.

Japanese companies: Itochu, Kikkoman, Mitsubishi UFJ Financial Group and Sumitomo are among those reporting results.

Five more top stories

1. Officials in the Bank of Japan have grown increasingly confident that the economy is robust enough to attempt an imminent exit from negative interest rates. The central bank has become more bullish on its inflation outlook because of rising momentum for wage increases and growth in service sector prices — and a subtle but important change appeared in the BoJ’s latest quarterly economic outlook report.

2. The head of Emirates Airline has warned Boeing was in the “last chance saloon” as he prepared to send his own engineers to oversee the plane maker’s production lines after witnessing a long decline in its manufacturing performance. Sir Tim Clark told the FT he had seen a “progressive decline” in Boeing’s standards, which he put down to long-running management and governance mis-steps.

3. A multibillion-dollar patent fight has broken out over a technology that could transform the future of chipmaking, pitting the State University of New York against a company that is set to be owned by a Japanese government-backed fund. Here’s what’s at stake in the legal battle between Japan’s JSR and the US university.

4. Danish drugmaker Novo Nordisk has been “surprised” by the readiness of European consumers to pay for weight-loss drugs from their own pockets. Chief executive Lars Fruergaard Jørgensen told the FT: “We wondered, was that only a US phenomenon? We tested it out in Denmark and Norway, we saw more or less the same.” Here’s how the company plans to meet runaway demand for weight-loss drugs.

5. A unit of Jardine Matheson is resuming gold exploration in Indonesia despite concerns from scientists and environmental groups that any expansion of mining operations could threaten the habitat of the world’s most endangered great ape. The Martabe gold mine project in Sumatra is located in the only habitat for the Tapanuli orangutan, of which fewer than 800 remain in the wild

The Big Read

Markets were stunned by Friday’s US labour data showing that the country’s economy added 353,000 jobs in January — almost double what was expected. A March cut to interest rates was instantly ruled out on Wall Street as a result of the blowout employment data. The US jobs numbers demonstrate why central bankers around the world — who had begun laying the ground for interest rate cuts — are reluctant to declare victory over inflation.

We’re also reading . . .

Peak MBA: If demand for top MBAs has peaked, it might not be a tragedy at all, writes Pilita Clark.

What the world gets wrong about ‘civilisation’: Politicians everywhere are making appeals to ancient history — but their thinking is based on a myth.

China’s EV cull: The next round of consolidation in China’s EV industry will not deliver European carmakers a reprieve, writes geopolitics analyst Yanmei Xie.

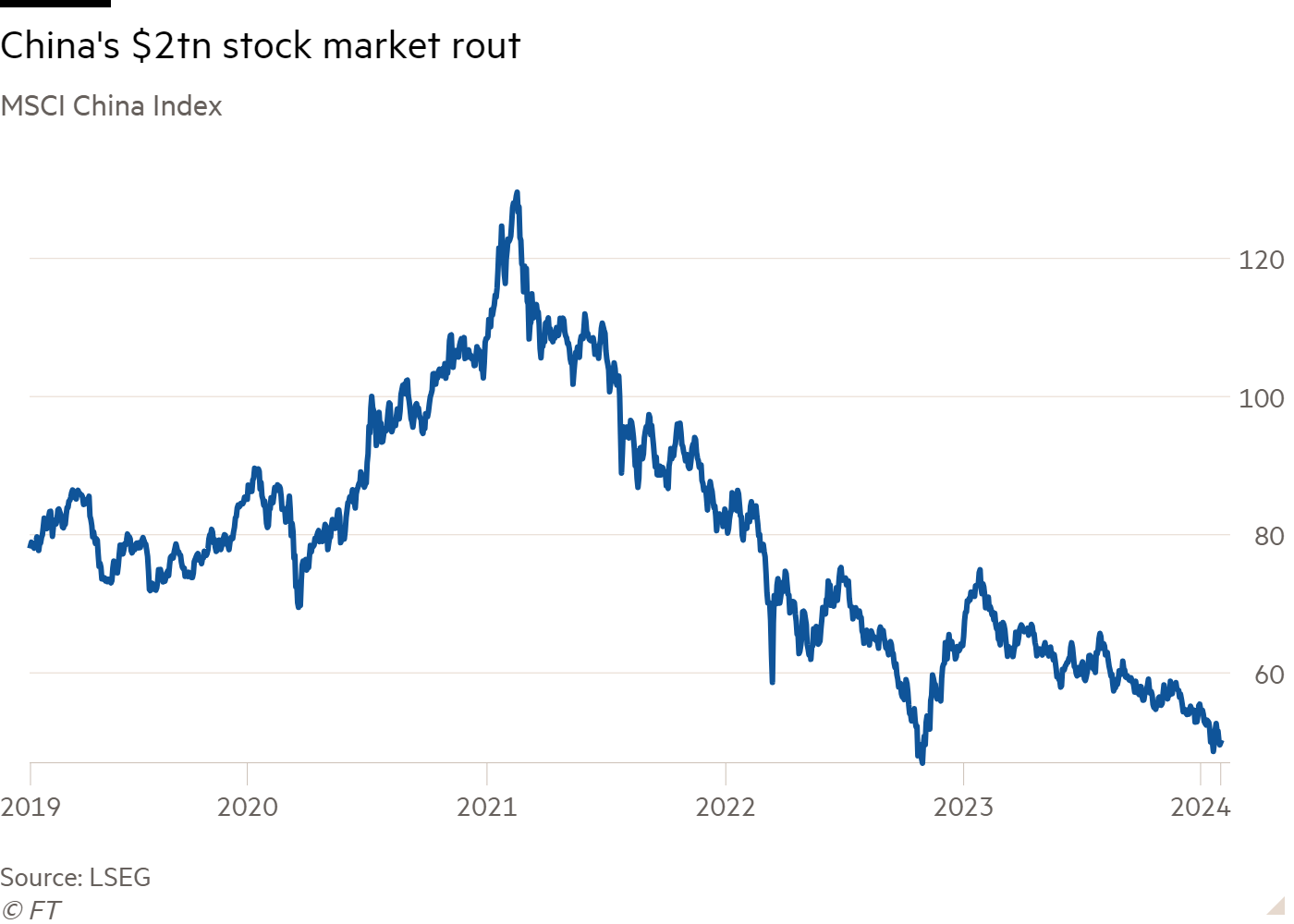

Chart of the day

Chinese authorities’ promise of “forceful” measures last week was their most vocal attempt yet to halt a stock market sell-off that has wiped out almost $2tn in value. For many investors at a Goldman Sachs conference in Hong Kong, that vow was too little, too late.

Take a break from the news

American composer Steve Reich has been influencing the course of modern music for nearly 60 years. He sat down for Lunch with the FT and discussed forging “minimalism” in 1960s downtown New York — and why Stravinsky has been a life-long obsession.