With Beijing vowing to build a new real estate development model on the bedrock of “three major projects” – including more affordable housing – some analysts are calling for all real estate restrictions to be lifted for buyers and sellers.

And they say central leadership might consider bailing out certain property developers in the midst of a liquidity crisis.

China’s housing minister, Ni Hong, said on Sunday that while the country’s real estate market is in a period of transformation that is fraught with difficulties, the foundation exists for sustainable development.

“The old development model that pursued speed and quantity no longer suits the new requirements of high-quality development, and a new development model is urgently needed,” he said in an interview with party mouthpiece People’s Daily.

“Building a new model of real estate development is a fundamental strategy to solve current problems and promote the stable and healthy development of the real estate market,” Ni added.

Are China’s houses for speculating? Beijing lets real estate off leash

Are China’s houses for speculating? Beijing lets real estate off leash

Indeed, a slew of relaxing measures, including reducing down payments and scrapping the requirement of “no mortgage records” for identifying “first-home buyers”, have been implemented since the meeting. But despite rounds of stimulus, the property market has remained lacklustre, with transaction volumes in major cities subdued.

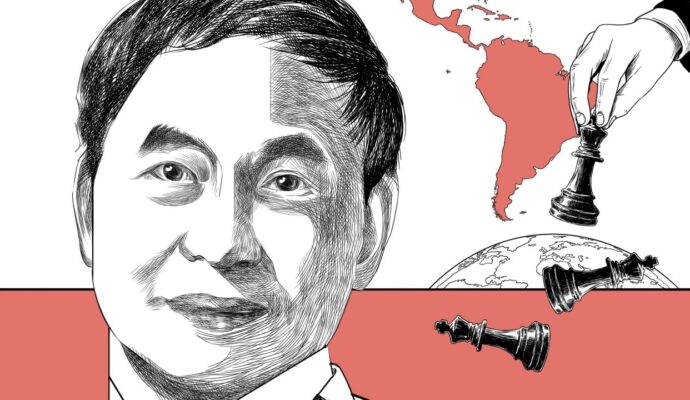

The Chinese economic power players making decisions that will impact the world

The Chinese economic power players making decisions that will impact the world

In terms of new affordable housing, Ni said the plan will focus on meeting the rising demands of urban migrants and young people.

And in urban villages – overcrowded village-style neighbourhoods surrounded by skyscrapers in major cities – he said efforts will revolve around eliminating potential safety hazards and improving the living conditions of residents.

Tao Ran, a professor with the School of Humanities and Social Science at the Chinese University of Hong Kong (Shenzhen), said that while expanding the housing supply in cities with population inflows is a step in the right direction, such projects will face implementation hurdles and are not a panacea for China’s property sector.

“For example, a local government may lack the motivation to promote affordable housing projects, as this would mean slashing their land-sale revenue,” Tao said.

All restrictions on property-related purchases, prices and loans, as well as financing constraints on developers, should be lifted

And the key problem currently facing the Chinese property market, Tao said, is the general lack of confidence that is deterring people from buying new homes.

“The real estate market needs to be rescued as soon as possible,” Tao said. “All restrictions on property-related purchases, prices and loans, as well as financing constraints on developers, should be lifted.”

And for private real estate developers that have been following all laws but are currently facing a liquidity crisis, Tao said the government should consider providing liquidity support, as their problems may further trigger a crisis in the banking system.

Larry Hu, chief China economist at Macquarie, said that while Beijing vowed at the central financial work conference to “meet the reasonable financing needs from developers”, in reality that is much easier said than done, as banks are reluctant to lend to developers because of the credit risks involved.

“Ideally, the central government should step in, but policymakers will take real actions only if things get bad enough for them,” Hu said in a note last week. “In any case, the property sector will not be out of the woods until the issue of credit risk is resolved.”