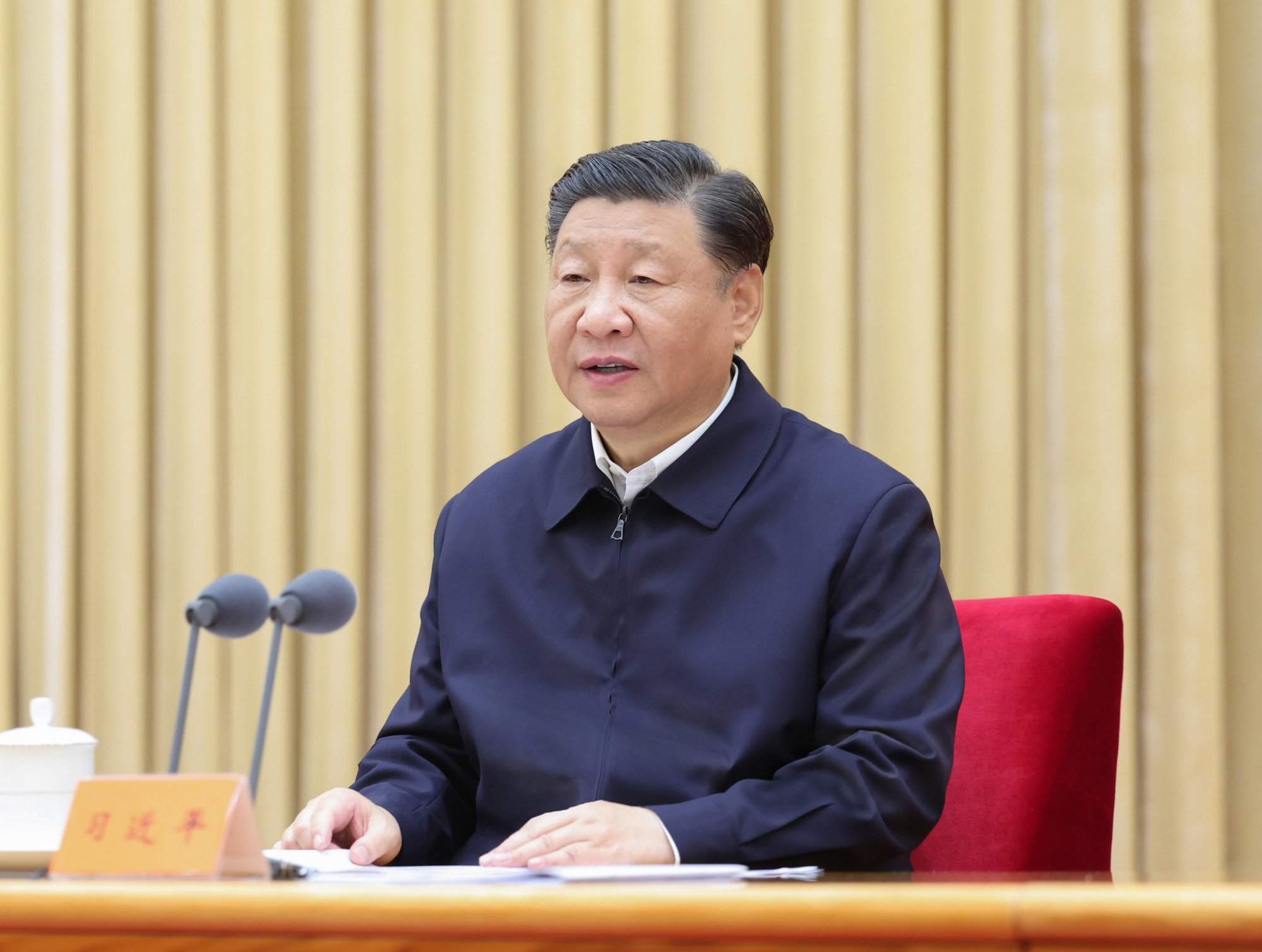

Echoing his speech, the spy agency’s post said China must be “soberly aware” of the many risks and challenges to its financial security. It also accused “some countries” of using the global financial market to undermine China, in a veiled swipe at the United States.

“Some countries regard the financial market as a tool for geopolitical games, playing with their monetary hegemony repeatedly, and wielding the big stick of financial sanctions at others,” the ministry said.

“There are also some people with ulterior motives who try to stir up trouble and profit from the chaos. There are not only short sellers, but also people who spread bearish sentiment and help to steal China’s financial assets, trying to shake the international community’s investor confidence in China and triggering domestic financial turmoil in our country,” it said.

“This has brought new challenges to maintaining financial security under the new situation.”

Spy games: why the US-China cold war is heating up in public

Spy games: why the US-China cold war is heating up in public

The post said China’s state security agencies should “proactively participate in the construction of national security systems in the economic, financial and other fields”. It said they would closely monitor and effectively prevent national security risks in the financial sector, as well as crack down on wrongdoing in the sector.

Concerns have been mounting over financial stability and future growth momentum in the world’s second-largest economy as it struggles with a prolonged downturn in the property market, capital outflows and sluggish exports.

With the US keeping interest rates high, foreign investors are pulling capital from China’s stock exchanges as equity prices slump, while the yuan’s exchange rate against the US dollar has fallen to a 16-year low.

Some US$75 billion of capital exited the country in September, the largest net outflow since 2016, Goldman Sachs said in a report earlier this month. That came after a US$42 billion flight in August as the capital and current accounts recorded deficits.

Xie Maosong, a senior researcher with the National Strategy Institute at Tsinghua University, said it appeared that Beijing suspected some of the capital flight and short selling could be politically motivated, with foreign collaboration. That was based on its conclusions after investigating the 2015 stock market crash, he said.

“If you check the anti-corruption agency’s verdict on many financial corruption cases – for instance Lai Xiaomin – there are very frequent mentions of ‘intertwined political and economic problems’, which actually means their corruption is not only for financial gain but it also had political motives,” Xie said.

Xie noted that the Ministry of State Security would only get involved in cases found to involve foreign collusion, as its main role is to counter foreign intelligence and subversion activities.

“For the financial corruption cases without any foreign collaboration, they will continue to follow the usual investigation process – detention by the party’s disciplinary commission for investigation, expulsion from the party, and handed over to the prosecutors, then face trial,” Xie said.

“For the cases where the Ministry of State Security is involved, the investigation is likely going to be secretive – the public might not even know about it.”