Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

To some investors and analysts, the Bank of Japan’s ‘yield curve control’ has been like a Sword of Damocles hanging over the global bond market. When it finally fell it would cause a bloody mess.

For example, here’s a list of the stories that famously even-keeled ZeroHedge has run on the subject recently:

Instead, the BoJ has through a series of teeny-tiny steps managed to let the 10-year Japanese government bond yield climb from the 0-0.1 per cent range it spent most of 2016-22 in to almost 1 per cent, without really causing any carnage.

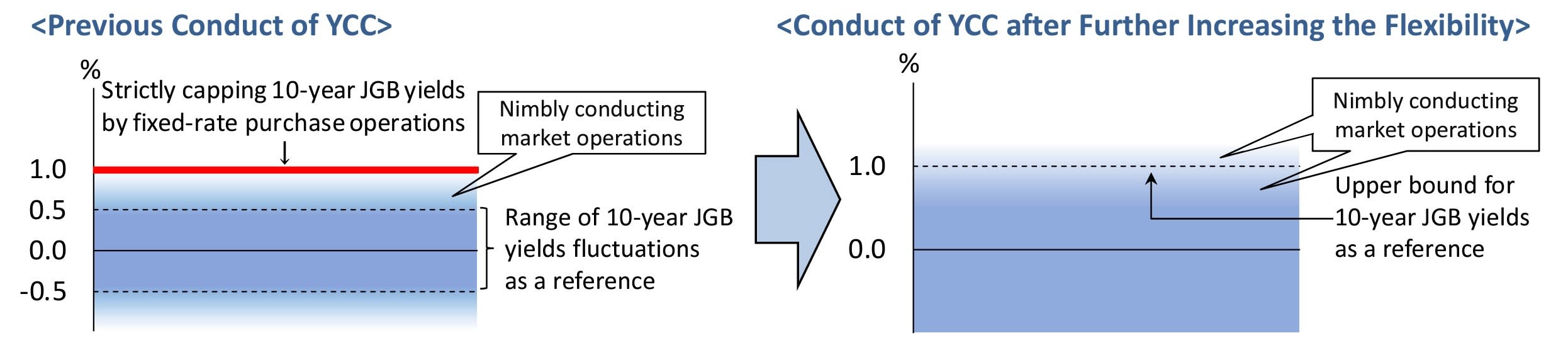

The latest move came earlier today, when the BoJ redefined its 1 per cent upper bound for 10-year JGB yields as “a reference” rather than a hard target — and therefore scrapping daily offers of unlimited purchases of bonds at 1 per cent.

Here’s how the central bank put it in today’s release:

The BoJ still stressed its flexibility and willingness to buy bonds above that level, but in practice this is the end of YCC. It has kicked the bucket, shuffled off its mortal coil, run down the choir and joined the choir invisible, etc.

And going by the sellside and market reaction, it has happened remarkably smoothly. Here’s Oxford Economics:

The BoJ’s decision was a surprise to us because we believed that the BoJ would and could defend the 1% 10-year JGB yield ceiling from speculators until global yields start to level off towards the year-end or early next year. We thought the BoJ would adjust the ceiling only when upside inflation risk materialised — and our economic projection is that such a chance is slim in the near term.

Although the 1% upper bound was maintained, the BoJ decided to allow yields to exceed it temporarily because they were concerned about the side-effects of rigidly defending the ceiling. Although global yields will likely start to level off in coming months, there is also nonnegligible risk that they will remain elevated higher than projected.

Most importantly, that could further encourage the weakening of the yen. Although the impact of a weak yen on the economy is mixed, persistent inflation caused by the pass-through of rising import cost has caused frustration among households. The approval rate of the Kishida administration has declined to a historic low. While the effectiveness of currency intervention is limited, the tweak of YCC policy is expected to mitigate the yen weakening pressures. Concern for the functioning of bond markets has also risen as investors have become uncertain about where yields would settle. Allowing more market-led yield formation would improve market functioning and enhance the issuance of corporate bonds.

Without an alternative yardstick to the nominal 1% ceiling, the BoJ will likely try to adjust the pace of yield rise through its JGB purchase operations on a more discretional basis. The BoJ will determine the offer rate of the fixed-rate JGB purchase operations each time considering market rates and other factors. The more flexible operation of the YCC framework could also invite challenges. In the short run, speculators could try higher yields to check the BoJ’s new implicit defence line and, as a result, volatility in JGB yields will likely rise. In the longer run, if yields stay above the upper bound and continue to be determined by discretional market operations, the YCC framework could become a matter of formality.

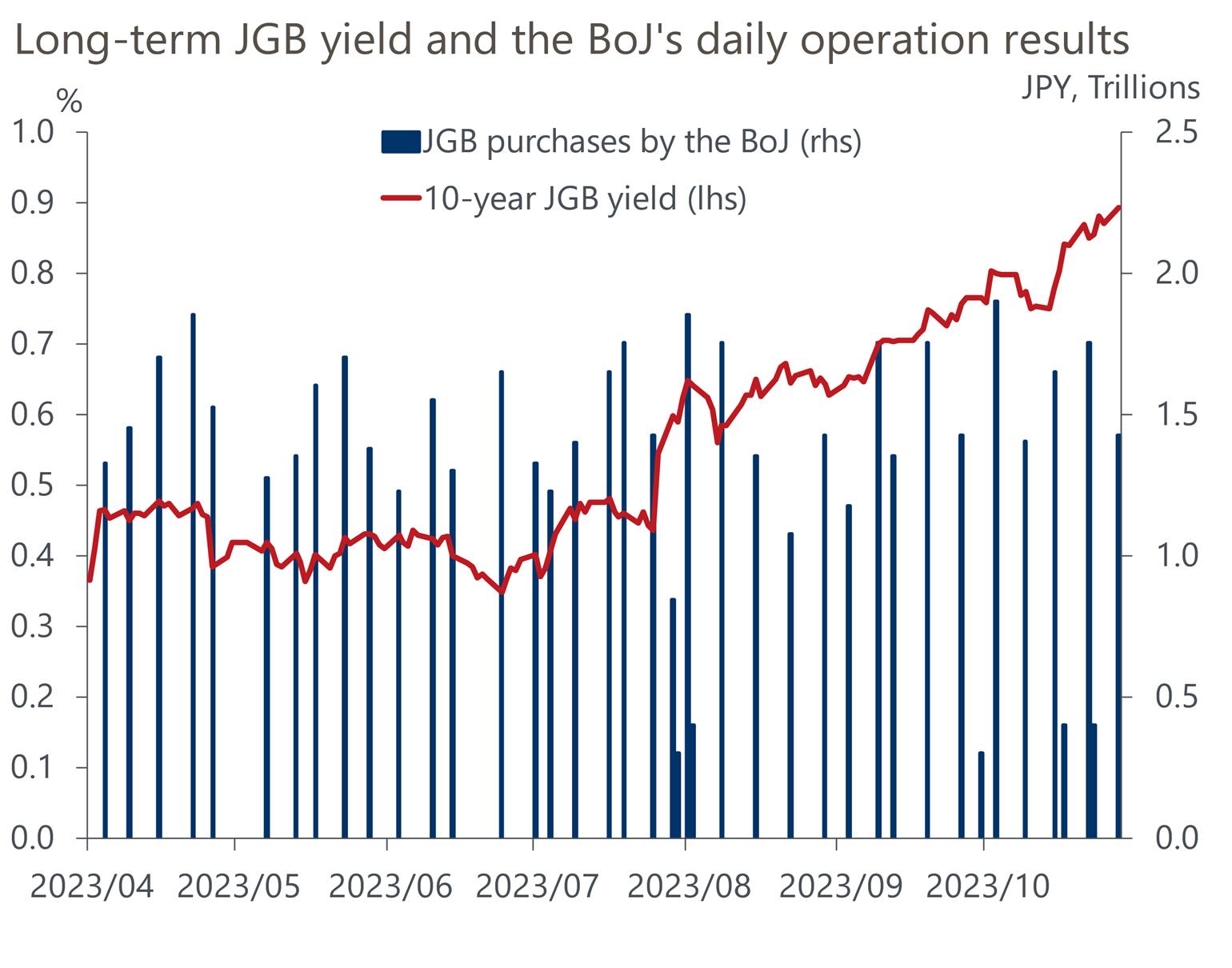

One of the points of the policy was that by dictating a credible yield target it would actually require fewer bond purchases to keep monetary policy easy. But as this Oxford Economics chart shows, it hasn’t really worked — the BoJ has had to keep buying oodles of JGBs.

At pixel time the 10-year JGB yield remains below 1 per cent, but at some point traders are likely to test the BoJ’s dedication to its new “reference”. We’ll then find out if it’s still willing to make massive purchases even without a hard ceiling. If it isn’t then the ructions could be violent.

But for now, it should be acknowledged that the BoJ has managed to engineer a cautious, gradual but unmistakable euthanasia of YCC without too much fuss. Even Alphaville had some doubts that this could be pulled off.