On Tuesday, the US Commerce Department further tightened its existing export restrictions for advanced computing semiconductors, chipmaking tools and other cutting-edge items that would support AI applications and end-uses in advanced weapon systems.

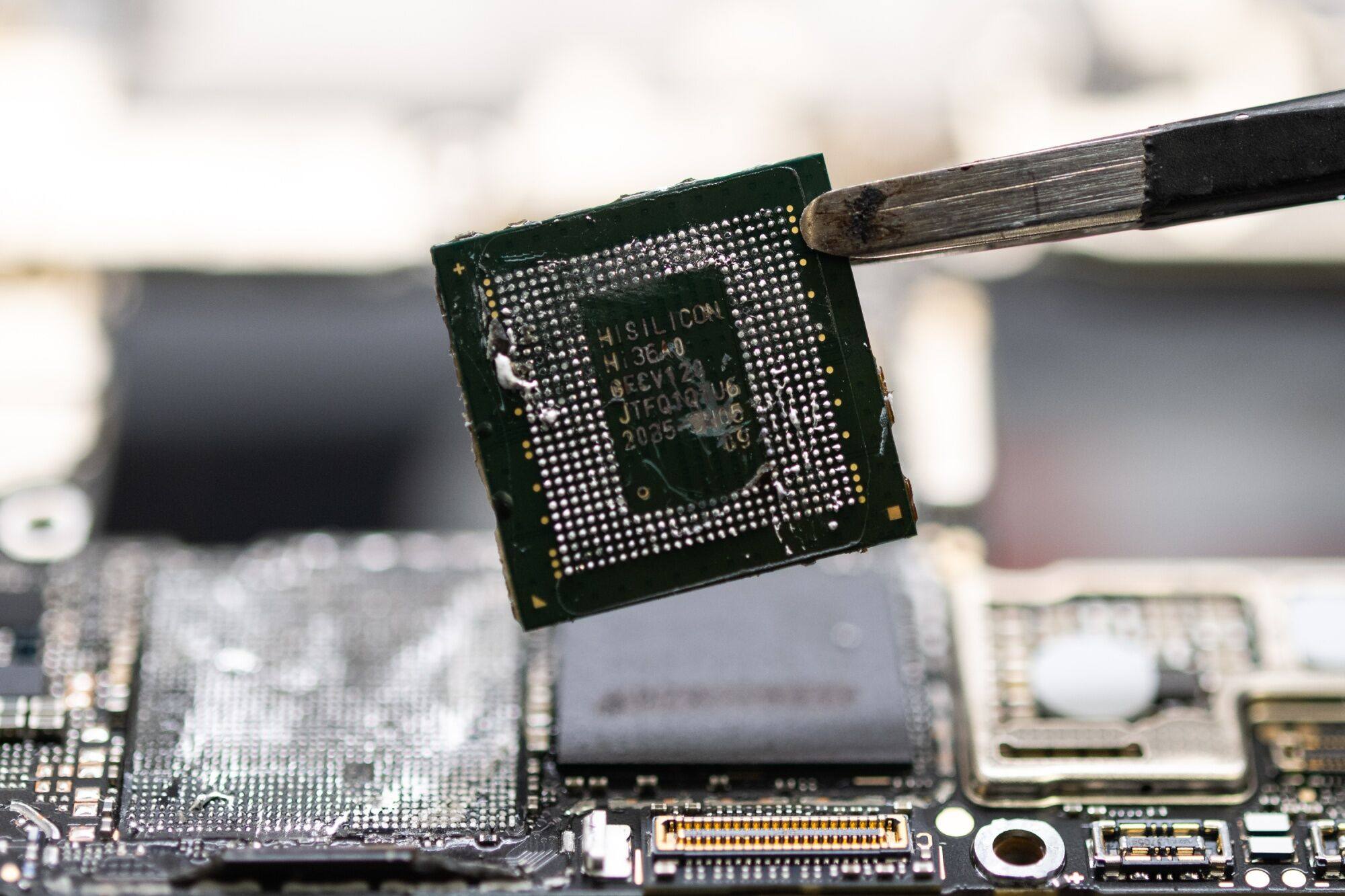

The new measures came just weeks after Huawei Technologies developed its own advanced seven-nanometer chip Kirin 9000s. Huawei has not disclosed how the chip was built, but industry sources say it was based on chips made by Nvidia, based in Santa Clara, California.

Such consideration appeared to have prompted Washington to further tighten the types of chips that US suppliers could export. The department also placed two Chinese graphic processing unit (GPU) chip start-ups – Moore Thread and Biren – on its “entities list” of companies US suppliers cannot do business with.

Both companies, which were founded by former Nvidia employees, specialise in GPU chips that can process big data for machine learning and have modern warfare applications.

Timothy Heath, a senior international defence researcher at the US-based think tank Rand Corporation, said that while China appears to have had “surprising success” in developing chips capable for military uses, it remains unclear how its domestic advanced semiconductor production is being handled.

“Reports suggest China is repurposing older manufacturing equipment, which means that production of the chips could be costly and relatively small scale,” he said, referring to Huawei’s Kirin chips.

Huawei’s release of Kirin 9000 chips fuelled Washington’s concern over China’s ambition to narrow the chip technological gap with the US in next-generation weapon development, said Andrei Chang of the military magazine Kanwa Asian Defence.

Kim Dae Jong, a business professor at Sejong University in Seoul, agreed, adding that Washington’s export controls stemmed from fears that China may use technologies similar to the Kirin chip in advanced weapons that would give the PLA a military advantage.

“These latest semiconductors and artificial intelligence semiconductors are essential elements in China’s missile and nuclear weapons used for invading Taiwan,” said Kim, referring to Beijing’s long-stated goal of reunification with the island, by force if necessary.

Lennart Heim, a research fellow at the Centre for the Governance of AI of Oxford University, said the revised chip export controls could be characterised as “patching certain loopholes”, shifting the focus from both computational performance and interconnect bandwidth to solely computational performance. That would affect anything in the military that is “computing intensive”, such as training or deployment of frontier models.

“The focus of these controls is their application within the field of AI, acknowledging the technology’s dual-use potential for both civilian and military purposes,” Heim said. “The primary goal for the US is to safeguard its competitive edge.”

US further restricts China from AI chips to hinder military development

US further restricts China from AI chips to hinder military development

However, Chang said that the new measures would not affect the PLA’s equipment modernisation for the next two or three years. He added that Beijing had already stocked a huge number of advanced chips and chipmaking tools imported from the US, Japan and other countries since President Xi Jinping introduced the “Made-in-China 2025 Plan” in 2015.

A national strategy which aims to close the gap with Western tech powers and lessening China’s dependency on imported technology, the programme was also one trigger of the US-China trade war that began in 2018.

Zhou said the PLA had gradually developed alternatives to cope with the US’s trade-war tech sanctions. He said that the army had even abandoned its previous Windows system and replaced it with the home-grown NeoKylin.

But since all China-made chips have been produced by manufacturing tools from the US, Japan, South Korea and Taiwan, Chang said the PLA would not escape the new rules’ long-term impact.

“Washington is very likely to ban the flow of high-end chip-making tools and raw materials into China in future regular reviews,” Chang said.

US ban on tailor-made Nvidia and Intel chips hits Beijing’s AI ambitions

US ban on tailor-made Nvidia and Intel chips hits Beijing’s AI ambitions

“Military chips are high consumable components that need to be replaced intensively, and it will take quite a long time for China to develop its own chip supply chain. Any malfunction could result in significant impact to weapon development.”

Song Zhongping, a defence analyst and former PLA instructor, said that more regulations and bans would only force Beijing to pump more resources into developing its own high-end chip technology, which would benefit both its military modernisation and space programme.

Experts outside China also anticipate that Beijing will pull out all stops to narrow its chip gap, given the PLA’s ultimate goal to become a modern fighting force on par with the US by 2035.

“These chips are essentially used to train and run large AI models … assist decision-making, planning and logistics. They can also be used in the most advanced weaponry, such as hypersonic missiles,” said Federico Mantellassi, a project officer at the Geneva Centre for Security Policy.

“More advanced chips will mean more accurate and capable autonomous weapons,” he noted.