It was the first survey of members since China began to relax domestic Covid-19 restrictions in December, followed by a major loosening of travel restrictions in March.

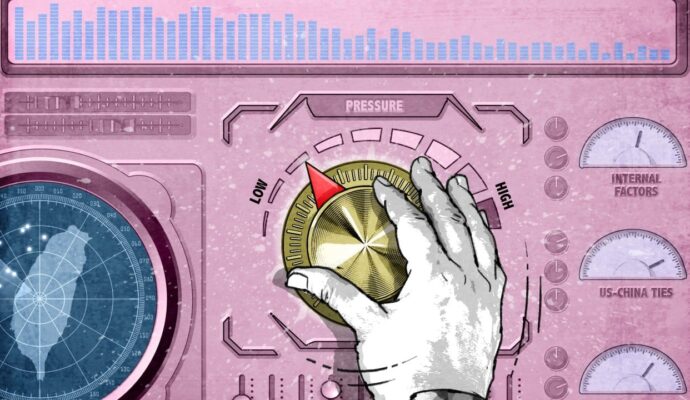

US firms in China have worst outlook on record, AmCham Shanghai survey reveals

US firms in China have worst outlook on record, AmCham Shanghai survey reveals

But respondents said they had seen few tangible changes in the Chinese business environment, with only 19 per cent saying it had improved in the previous 12 months.

China’s post-Covid rebound has fallen short of expectations. Its economy expanded by 6.3 per cent in the second quarter of 2023, accelerating from 4.5 per cent in the first three months of the year, but below the forecast growth of 7.3 per cent.

Compared with five years ago, confidence among US firms regarding their five-year outlook dropped from 75 per cent to just under 50 per cent this year.

The number of those with a “pessimistic” or “somewhat pessimistic” outlook reached an all-time high of 28 per cent, up 7 percentage points from last year’s survey.

More than half of companies surveyed attributed their outlook to geopolitical concerns and China’s regulatory and policy environment.

China’s data policies, which ranked fourth in the survey last year, were now the second biggest challenge, their highest-ever placement on the list.

In recent years, Beijing has made regulating data and protecting personal information higher priorities, and many of the implementing details were imprecise and costly, the report said.

China’s economic headwinds could hit region, US treasury deputy says

China’s economic headwinds could hit region, US treasury deputy says

But companies were “beginning to experience more tangible impacts from China’s data policies”, he added.

Similar to previous years, the impact of China’s industrial policy on the competitive landscape was a major concern. Competition with Chinese firms rose to fourth place compared with last year’s seventh.

As Beijing pursues strategies to promote domestic champions, 90 per cent of respondents believed they would lose market share within five years – a 31 percentage-point increase in those who indicated the same in last year’s survey.

Meanwhile, as the two countries increasingly impose export and investment barriers against each other, concerns over “export controls, sanctions and investment restrictions” increased as well, rising from sixth to third place in the list of concerns compared with last year.

Still, very few firms planned to fully exit the Chinese market.

Only 23 per cent of respondents had relocated or planned to relocate certain operations outside China, though this number was up from 16 per cent last year.

Meanwhile, more than 80 per cent of respondents reported being in China to access and serve the Chinese market as opposed to manufacturing in China and selling into other markets.

Almost a fifth of companies designated China as the top-priority market globally, while another third reported it as a top-three priority, though an all-time high percentage of respondents – 9 per cent – said China was not a priority market.

The USCBC also pointed to some positive signals coming from Beijing, including the State Council’s “24 measures” published in August.

The measures call for granting national treatment to foreign enterprises in government procurement and standard-setting initiatives, in addition to expediting security reviews necessary for cross-border data transfers.

US business optimism in China tumbles to an all-time low, survey shows

US business optimism in China tumbles to an all-time low, survey shows

And 80 per cent of surveyed firms were able to stay profitable, though this figure marked a 9 percentage-point decline from the previous year and the lowest percentage of profitable respondents tallied in 10 years.

As with last year’s respondents, most were in “wait-and-see mode”, opting to delay resource commitments over the next 12 months.

Like last year, a quarter of respondents reported planning to accelerate their investments in the Chinese market over the next year, but that was half the proportion of five years ago.

The number of companies planning to curtail certain commitments more than quadrupled since the 2018 survey, rising from 4 to a record 18 per cent.

“China’s large and growing middle class I think clearly still represents an important opportunity for companies over the long term,” Sullivan said.

“And companies also recognise in order to be competitive globally, it’s essential to be in the China market, where they’re close to suppliers and customers.”