A former adviser to China’s central bank has said the country has “too many” US Treasury bills, even as its holdings have been trimmed to a 14-year low.

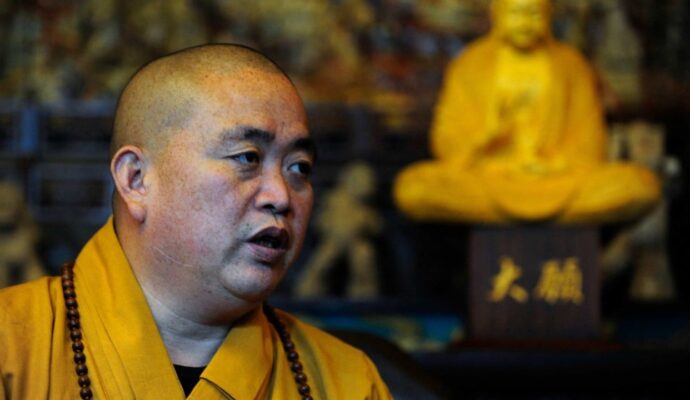

The comments from Yu Yongding, an outspoken economist at the Chinese Academy of Social Sciences, came as a growing number of academics and advisers openly express worries about the safety of China’s overseas assets.

Instead of accumulating US dollars through its massive export machine and investing them back via low-return US Treasuries, Yu said emphasis must be shifted to imports as the country now turns to domestic circulations – consumer spending, construction and home-grown technologies – for future growth.

High-level officials defend China’s economic prospects at conference

High-level officials defend China’s economic prospects at conference

This will also “smoothen” the country’s trade with the United States, he said during a panel discussion at Friday’s Bund Summit in Shanghai.

Dumping US Treasuries is one of the arrows speculated to be in Beijing’s quiver in the event financial sanctions from Washington demand retaliatory action. Denial of access to international payment messaging system Swift and the US dollar, meanwhile, are some of the weapons believed to be in the US arsenal.

Advertisement

China has joined many central banks in offloading US government debt since the US Federal Reserve embarked on steep interest-rate hikes to tame inflation in March 2022.

It reduced its holdings by US$13.6 billion in July to US$821.8 billion, making it the second-largest foreign holder after Japan.

Yu previously urged policymakers to make the safety of China’s overseas assets an imperative informing all overseas investment decision-making, adding geopolitics had complicated China’s holding of US Treasuries and the security of its US dollar-dominated assets.

State Administration of Foreign Exchange data show that in 2022, China’s current account surplus surged 32 per cent to US$417.5 billion. The net size of China’s assets overseas stood at US$2.53 trillion at the end of last year, but the country has been suffering net losses on its overseas investment.

Advertisement

The test of the yuan persists as the Fed remains hawkish – at least one more US rate hike is expected later this year despite rates staying unchanged this week – compared with Beijing’s rate cuts enacted to aid its faltering economy.

Advertisement

Wang Yimin, a vice-president of the China Centre for International Economic Exchanges, who now sits on the People’s Bank of China’s monetary policy committee, said China had upheld policy autonomy and withstood pressure from the US as it hiked rates by 525 basis points.

Yu also pleaded for a “more proactive, expansionary fiscal policy approach”, including monetary measures, to avert a “balance-sheet recession”.

He said China’s inflation had long been suppressed, leaving ample space for more proactive fiscal policies. The country, he added, was far from slipping into a recession in which consumption and investment are bogged down by high debt.

Advertisement

Nevertheless, Yu highlighted the need for proper policy options and the necessary room to tackle problems as local governments and developers run up huge debts.

He pointed to an essential difference between the US and developing countries: while capital repatriation has greased the wheels of the US financial market and made conditions less harsh, emerging economies will have to grapple with the spillover from the rate hikes – which could carry grim knock-on effects for their own fiscal health.

Advertisement