Country Garden Holdings extended the voting period by its bondholders to 10am on September 1, giving them extra time to deliberate on the property developer’s plan to postpone its payments and avert a default on a private onshore bond.

The developer extended the vote at 9:30pm last night, 30 minutes before bondholders were due to cast their final electronic ballots, according to a report by Caixin. Country Garden did not immediately respond to requests for comment.

Country Garden, China’s largest developer by sales not long ago, last week proposed extending the payment of the interest and principal on a 3.9 billion yuan (US$535 million) note in seven phases over three years.

But some bondholders did not accept this and requested full repayment, forcing Country Garden to delay the vote to 10pm Hong Kong time on Thursday from last Friday and seek the 40-day extension instead.

The initial plan put forward by Country Garden proposed that creditors wait until September 2026 to receive 44 per cent of their investment principal.

Holders of 10.5 per cent of the bonds had proposed declaring the developer in default, rejecting Country Garden’s appeal for postponement, according to people familiar with the matter.

Advertisement

The results of the vote came after the company posted a record loss of US$6.7 billion for the first half of the year on Wednesday and warned of a potential default. Its cash balance shrank by 21 per cent to 101.12 billion yuan from 123.48 billion yuan a year ago.

The developer has been trying to service its debt and avoid a default for nearly a month. For instance, on Wednesday it announced an equity financing project to raise about HK$270 million to offset payments it owes to another company.

Country Garden said on Wednesday it will “actively resolve its phased liquidity pressure by adopting various debt management measures”, including negotiating with bondholders to extend the maturity dates for notes due by the end of June next year.

It will also consider adopting debt management measures to cope with its remaining overseas debt with principals due in the next 10 months, according to a Country Garden filing with the Hong Kong stock exchange on Wednesday.

Advertisement

The 3.9 billion yuan note is the largest of the company’s debt maturing this year. But Country Garden also needs to repay two US bond coupons it missed earlier in August.

If the onshore 40-day grace period proposal is accepted, it could give Country Garden some breathing room, said Edward Chan, an analyst with ratings agency S&P. “But Country Garden also needs to take care of its US dollar coupon payments within the grace period too,” Chan said.

Advertisement

“If it fails to do so, it could trigger a cross default. This would create further stress for it.”

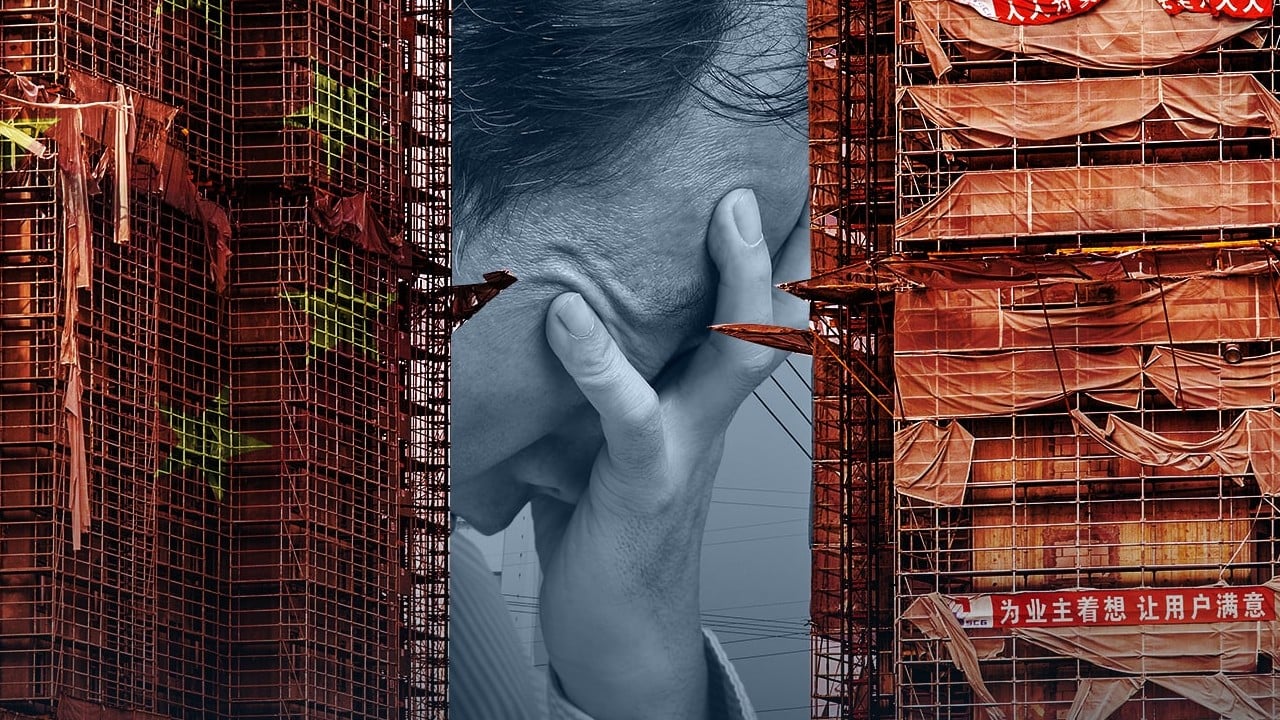

A default at Country Garden could trigger a larger crisis than China Evergrande Group’s, as it owns four times as many projects.

“Developers’ credit stress is likely to spill over to the property sector,” Moody’s analysts led by Kelly Chen said in a report on Thursday, citing Country Garden’s liquidity crisis as a case in point. “Specifically, it is likely to further weaken market sentiment and delay the recovery of China’s property sector.

Advertisement

The rating agency downgraded Country Garden to Ca from Caa1, citing tight liquidity and heightened risk of default, as well as the weak prospects of the bondholders being repaid in full as reasons.

Moody’s said it expects the offshore bondholders’ recovery prospects to be low if the company defaults, given its high debt leverage and “large amount of financing at the operating subsidiary level”.

“While the company could service its debt through asset disposals or other fundraising plans, such fundraising activities carry high uncertainties,” the rating agency said.

Advertisement

“Country Garden’s financial stress could raise homebuyers’ concerns over the financial health and project completion capabilities of other developers, particularly privately owned developers and smaller companies,” a report from Moody’s said, adding that bond issuances by privately-owned developers have stayed muted in both onshore and offshore markets over the past month.

Such credit events could also heighten “investor concerns about privately owned developers’ financial strength and further undermine their already restrained funding access.”

Separately, Sino-Ocean, a state-backed Chinese builder, successfully gathered enough votes from bondholders on Wednesday to extend the repayment of its yuan note.

Country Garden has hired China International Capital Corporation as a financial adviser for a potential restructuring in the future, according to reports by Chinese media outlets Caixin and Yicai.

Shares of Country Garden rose 1.1 per cent to close at 89 HK cents on Thursday. It has declined 67 per cent this year.

Advertisement