Employment across the manufacturing sector fell for the fifth straight month in July, although the pace of job shedding eased from June. Lower payroll numbers were attributed to reduced sales and cost-cutting by factory owners.

After five months of improvement, supplier performance worsened slightly. Firms said a lack of stock at some vendors had impacted lead times as they adopted leaner inventory policies in response to softer demand.

Competitive market conditions and price negotiations with clients led to a further reduction in Chinese factory gate prices at the start of the third quarter.

Manufacturers, overall remained optimistic regarding the 12-month outlook for output, but the degree of positive sentiment was below the long-run series average.

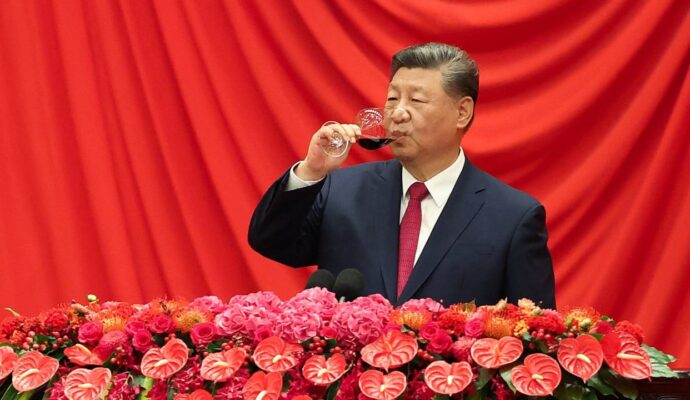

Top policymakers at a recent Politburo meeting pledged to step up support for the economy and strengthen countercyclical adjustments in the second half of this year.

But Wang Zhe, senior economist at Caixin Insight Group, said the current monetary settings would have only a limited effect on boosting supply, adding that “an expansionary fiscal policy that targets demand should be prioritised”.

The country’s top economic planner released measures on boosting consumption and private investment last month, with many measures aimed at improving the supply of goods.

While markets and investors are expecting more stimulus to spur demand, the housing minister recently called for more property easing measures.

Some of the biggest cities, including Beijing and Shenzhen, said over the weekend that they would implement measures to better meet the needs of homebuyers.