These chip-making equipment makers are supplying some of the biggest Chinese foundries as well as domestic semiconductor testing and packaging companies.

NAND Flash is a type of non-volatile storage technology that retains data even without power, which has made it ideal for many electronics devices such as smartphones, tablets, laptop computers and solid-state drives.

Those developments underscore the resolve of China’s sanctions-hit semiconductor industry to continue growing and innovating, despite their struggles with US trade restrictions.

In October last year, US firms Lam Research Corp and KLA Corp scrambled to comply with a new round of trade restrictions issued by Washington, which prompted them to cease supplying equipment and services to various Chinese chip projects. That allowed local suppliers to plug the gap in the market.

The American suppliers suspended their business on the mainland after the US Department of Commerce released updated policies intended to halt shipments of advanced chips and semiconductor-manufacturing technology of potential use to China’s military build-up and bid to dominate key industries.

Although disruptive, US sanctions against China’s semiconductor industry have brought a rare opportunity for domestic suppliers to become more closely aligned with the requirements of local foundries and Beijing’s chip ambitions. China has a tacit goal of procuring up to 70 per cent in value terms from domestic suppliers, according to industry professionals.

Peter Wennink, chief executive at Dutch lithography systems maker ASML Holding, recently said it was “logical” for China to develop its semiconductor-manufacturing equipment sector in light of US trade sanctions that block mainland firms’ access to advanced gear from overseas.

“So it is absolutely essential that we keep market access to China,” Wennink said.

He indicated that one carmaker in mainland China, which is ASML’s third-biggest market behind Taiwan and South Korea, plans to make so many electric vehicles in the next three years that it would require products from “six or seven full-fledged logic semiconductor factories”.

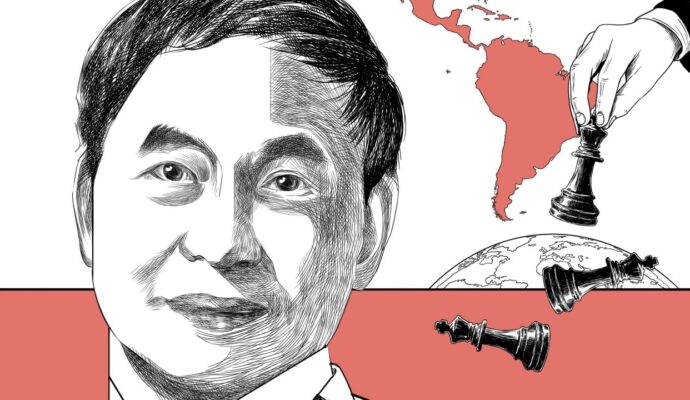

Peter Wennink, chief executive of Dutch lithography machine maker ASML Holding. Photo: Reuters

Yet even chip-making equipment vendors rely on foreign technologies, from materials and key components to specific semiconductors, to make their products, according to Kundojjala from TechInsights.

“It remains to be seen how they will overcome that dependency themselves,” he said.

More than 600 Chinese companies, including some of its national tech champions, have been put on the US trade blacklist, known as the Entity List, which restricts their access to US technology, equipment and services without Washington’s approval.

Certain major choke points are also holding back the progress of China’s chip manufacturing supply chain. For example, there are no viable domestic alternatives for the metrology tools supplied by US firm KLA, or the advanced lithography systems from ASML and Japanese vendors such as Nikon and Canon.