ZJLD said it will allocate 90 per cent of the offering to international investors, with the remainder reserved for Hong Kong traders, the statement said. Trading is expected to commerce on April 27. Goldman Sachs and China Securities International are the joint sponsors of the stock sale.

The proceeds will be used to fund construction of production facilities, build brands, expand sales channels, automate business operations and replenish working capitals, according to the statement.

The offering gives investors an option to ride on China’s consumption recovery play in the post-pandemic era. A government report due on Tuesday may say that retail sales growth accelerated to 7.5 per cent in March from 3.5 per cent in the first two months this year.

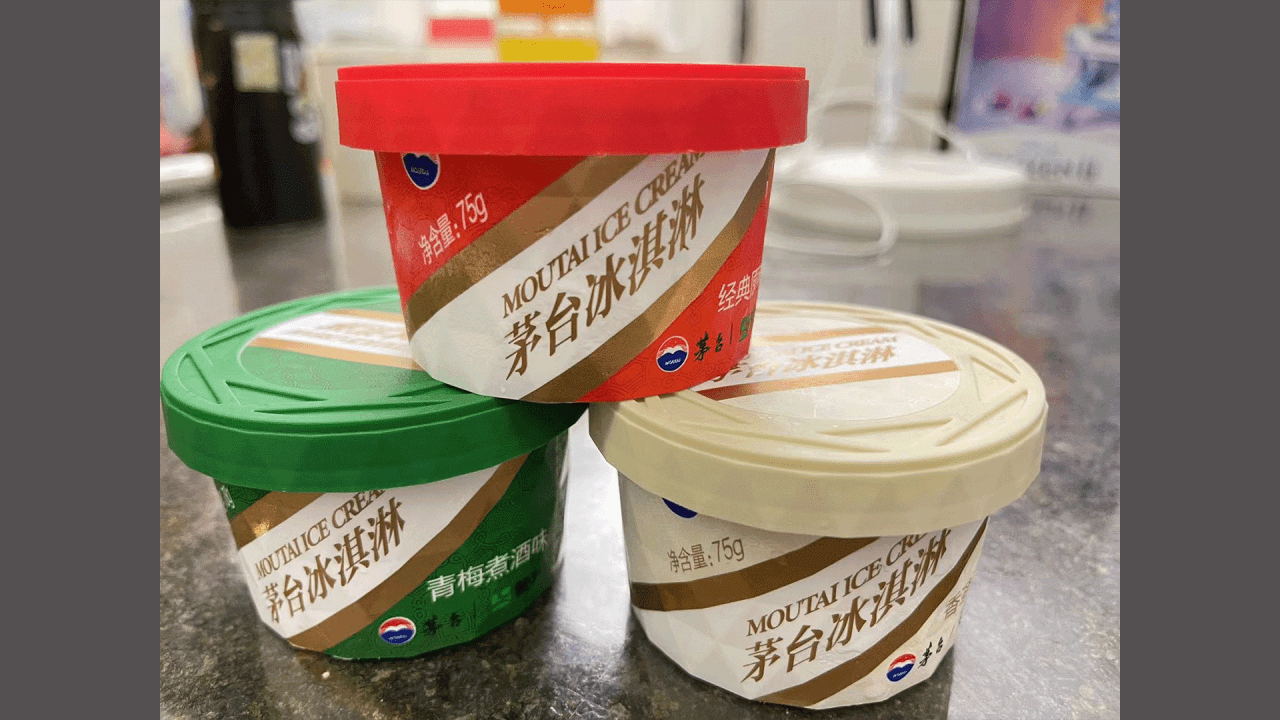

Baijiu, which is distilled from rice or other types of grain, accounted for about 70 per cent of the alcohol consumption in China in 2021, according to Frost & Sullivan. The industry value will probably balloon to about 770 billion yuan (US$112 billion) in 2026, representing an annualised growth rate of 5.5 per cent.

Kweichow Moutai, the most valuable company trading on China’s onshore markets, expected first-quarter profit to rise about 19 per cent from a year earlier to 20.5 billion yuan, according to a filing to the Shanghai exchange on Monday. That beat an estimate of 17 per cent by analysts tracked by Bloomberg. The Shanghai-listed stock regularly tops daily and monthly purchases among global fund managers through the exchange link programme.

ZJLD has six plants, with three in Southwest Guizhou province’s Zunyi town, where Kweichou Moutai is located. It sells its products under flagship brand Zhen Jiu and three other marques.

Wu Xiangdong, 54, who founded the company in 2003, now controls 81 per cent of the company through Zhenjiu Holding.

Net income dropped 8.8 per cent from a year ago to 712.2 million yuan in 2022, while revenue rose 17 per cent to 4.2 billion yuan, the statement said.