“March and April will be a critical time for orders for the entire year. I think generally it will be a hard year. Many people are expecting a decline in exports.”

The coming couple of months – normally the peak season for foreign buyers to place orders – are not only important for Zhang, but the entire Chinese economy.

China will announce its gross domestic product (GDP) growth target, roll out major economic policies and address key concerns at the “two sessions” starting on Saturday in Beijing.

After the Chinese government abruptly pivoted from hardline coronavirus rules at the end of last year, all eyes are on how it will restore confidence and spur recovery amid global uncertainties.

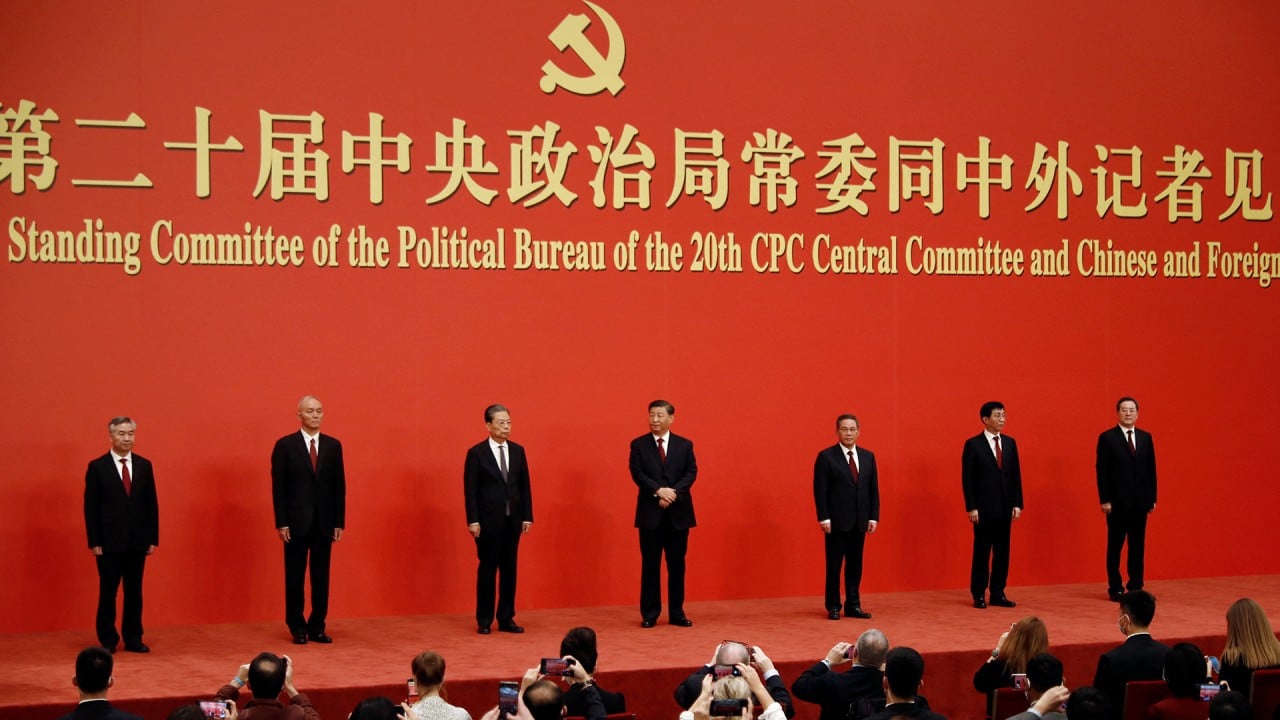

A new crop of officials will be named in China’s cabinet at the coming sessions of the National People’s Congress and the National Committee of the Chinese People’s Political Consultative Conference.

The top leadership team surrounding President Xi Jinping is widely expected to set the growth target at above 5 per cent this year, as consumers and investors re-engage in activities that were hampered by strict health control measures in 2022. China reported 3 per cent GDP growth last year, one of its slowest rates of growth in decades.

How steady and sustainable China’s recovery will be is unclear, as the country faces headwinds such as slowing overseas demand for its exports, rising geopolitical risk and trouble in the property sector, experts said.

China is still at the top of the boardroom agenda in terms of how to address it

“We expect the meeting to set the GDP growth target at ‘around 5 per cent’ with supportive macro policies, including slightly higher headline fiscal deficit at 3 per cent of GDP, a small increase in the new special [local government] bond quota to 3.7-3.8 trillion yuan (US$535-549 billion), and more property policy easing,” Ning Zhang, senior China economist at UBS, wrote in a note on Monday.

Global financial institutions including Morgan Stanley, Goldman Sachs and Standard Chartered, expect the Chinese economy to grow by more than 5.5 per cent in 2023.

But restoring business confidence in China, especially for multinationals, is a work in progress for authorities.

“China is still at the top of the boardroom agenda in terms of how to address it, and how to deal with [it]. That isn’t changing,” said Jonathan Woetzel, a Shanghai-based senior partner at global consulting firm McKinsey.

“What is changing is that there are other areas and regions at the top of the agenda now. Growth in areas outside China has picked up. And so now Asia, particularly South Asia, Southeast Asia, presents investment opportunities that it did not present before.”

Kent Liu, a manufacturing trader of clothes and digital fabric print machines in the southern province of Guangdong, hoped his business would see a major rebound this year after he increased investment and received support from the government.

“The demand in both domestic and foreign markets is not as weak as we feared last year,” he said.

Liu has set an ambitious goal of increasing annual export sales by 50 per cent or more this year. But he said the coming two months would be crucial.

Despite tariffs of 25 per cent on some of his products, growing competition from other countries and rising China-US tensions, Liu said the US market remains his largest source of orders and income.

To keep ahead of the competition, he has built warehouses overseas and established a team of 24-7 engineers and live broadcasters for various e-commerce platforms and social media. Liu’s staff has increased from more than 30 in 2021 to nearly 90 today.

Authorities have taken note of the difficulties facing small- and medium-sized exporters and responded with better targeted policies, he said.

“For example, the provincial and municipal governments have given us subsidies for export credit insurance, and the credit line given to us by the bank has also increased, while interest rates can be reduced to below 3 per cent,” he said.

“This is crucial to our cash flow and to help mitigate risks in foreign trade.”

Xu Mingqi, a professor of economics at the Shanghai Academy of Social Sciences, expected “adequate” policy support from the government to boost the economy as the worst of Covid-19 is over.

“Construction of infrastructure projects that were halted has restarted. The government is set to borrow more to drive recovery,” he said. “Consumer inflation is at a low level, which allows the central bank to keep monetary policy supportive.”

However, he said these efforts might be offset by weaker exports, a major reason why a rebound as strong as in 2021 is not expected.

“There are a lot of external environmental uncertainties, no foreseeable easing of geopolitical risks, and although Europe and the US are resilient, their growth potential is weak amid global slowdown,” he said.

China’s exports fell by 9.9 per cent in December compared with a year earlier, while overall in 2022, exports rose by 7 per cent. Trade figures for January and February will be released next month.

Fitch Ratings said tighter global monetary policy would weigh on demand for Chinese exports, adding it did not anticipate aggressive macro-policy easing from Beijing.

“Our base case is that support for the property market remains ‘defensive’ and intended to maintain homebuyers’ confidence in China’s presales model, rather than as a means to stimulate wider economic activity,” it said in a note last week.

Another obstacle preventing a stronger economic rebound is China’s chronically weak domestic demand, some observers said.

If weakening demand is to be reversed, private investment must be jump-started and Chinese consumers need to indulge in “revenge consumption”, wrote Xu Sitao, chief economist of Deloitte China, in an article published on the firm’s website earlier this month.

The biggest risk faced by consumers is uncertainty stemming from the property market, the primary engine of China’s economic growth in previous decades, he said.

“[This is] not because the sector presents a systemic risk – the Chinese government has the means to prevent such risk – but because consumers might hoard their savings if they do not see substantial upside to holding real estate as a financial asset,” he said.

Chinese consumers have been tightening their purse strings over the past year.

Households added 17.8 trillion yuan in bank deposits in 2022, nearly 8 trillion yuan above the previous three-year average, according to figures from China’s central bank.

Though bank deposits do not equal excess savings, to some extent they suggest Chinese families are trending that way. Financial services firm Nomura estimated excess savings reached 1.5 trillion yuan last year.

Lu Ting, chief China economist at Nomura, expected households to continue adding to savings in the coming years given significant balance sheet damage and their expectations of slower income growth.

“They may also be cautious in increasing housing investment on their balance sheets due to an ageing population, more realistic expectations of future home prices, and a less optimistic view of their future income potential,” he said in a recent report estimating households’ excess savings during the pandemic.

Despite marginal improvements recently in property sales in China’s mega cities, the market in lower-tier cities still faces weak sentiment.

Lily Wang, a senior sales manager at a real estate developer in Haining, a city of around 1 million people near Hangzhou, said this year would be bad after a rapid expansion starting in the mid-2010s.

“Between 2017 and 2019, the market was hot and we saw many buyers from Hangzhou and Shanghai, as prices were better and there were no home-purchase restrictions here,” she said.

“But it’s no longer the case as such constraints in major cities have gradually dropped in the past couple of years, while home prices remain high because developers bought land from the government at an overly expensive price years back.”

Small, low-end catering businesses like us do not have favourable policy support

All these mean a large portion of existing new homes will have trouble being sold, she said.

For Sun Guang, who runs a low-cost hotpot restaurant in southern China’s Guangzhou city, economic conditions are far from ideal.

“Our business has not yet recovered to the same period of last year,” he said, adding he hoped things would improve after March as more migrant labourers are expected to return to cities.

“Small, low-end catering businesses like us do not have favourable policy support, while we have a normal annual increase of 5 per cent in rent,” Sun said.