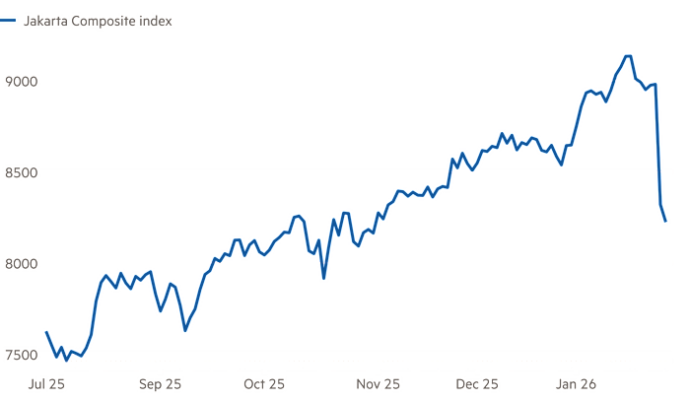

Chinese stocks whipsawed on Monday, in an apparent sign of investors’ unease over Xi Jinping’s tighter grip on the nation.

The CSI 300 Index of large Chinese companies’ share prices fell about 1.3 percent, then erased the losses before declining more than 1 percent by midafternoon. In Hong Kong, two indexes — the benchmark Hang Seng Index and one that tracks Chinese stocks traded in the city — had even wilder swings.

The volatility extended the recent turbulence for Chinese stocks, which were battered last week after Mr. Xi was confirmed for a third term as China’s leader. Under Mr. Xi, China has shifted its approach to how it manages the economy, exerting more state control after years of allowing markets a freer hand.

One of his signature policies, a zero-tolerance approach to the pandemic that involves harsh lockdowns, has led to uncertainty about doing business in China. On Monday, those concerns were compounded as government data showed that factory and services activity had declined last month in the country.

Some investors had hoped that at this month’s Communist Party congress, Mr. Xi would signal an easing of the “zero-Covid” policy. Instead, he doubled down on it. As the party extended his leadership for another term, the authorities ordered a new wave of lockdowns, most notably in the city of Zhengzhou, home to the largest iPhone manufacturing plant in the world.

On Monday, the CSI Index closed down 0.9 percent, extending last week’s decline of 5.4 percent. The Hang Seng China Enterprises Index, which tracks mainland companies traded in Hong Kong, ended the day 1.8 percent lower, while the Hang Seng Index fell 1.2 percent. They had each lost more than 8 percent last week.