AMERICAN AND Chinese officials often talk of expanding the array of weapons they have to confront one another. China studies its opponent’s moves and responds in kind. America is learning from its adversary, too. On June 12th the White House said that America and members of the G7 would launch a scheme to help finance infrastructure, such as roads and bridges, in poor countries. The plan, dubbed Build Back Better World (B3W), is an explicit counter to China’s Belt and Road Initiative (BRI), a programme that began to take shape in 2013 with many of the same goals.

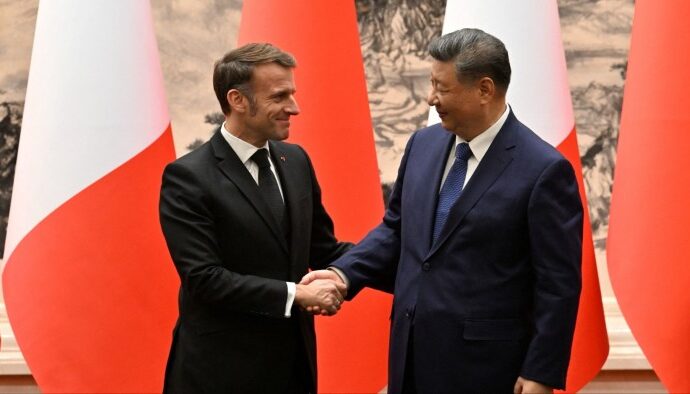

Competition with China has dominated Joe Biden’s agenda since he took over as America’s president in January. His administration has promised to use “all available tools” to push back against what it describes as China’s unfair trade practices. The B3W plan takes aim at a global initiative closely associated with his Chinese counterpart, Xi Jinping. Although BRI does not have a central planning body, more than 100 countries that are in need of infrastructure have signed up to it. The initiative has been criticised for burdening poor countries with unsustainable debts. But it has helped to strengthen bonds between China and the developing world.

B3W would offer financing for cleaner projects, in contrast to some of those backed by China, which include coal-fired power plants that contribute to global warming. America’s vague plan notes that projects will be developed in a sustainable and transparent manner—a dig at the opacity common in BRI contracts. It will also mobilise private capital where China has mainly used state-owned firms.

The idea appears half-baked. It is not clear whether Mr Biden or other G7 leaders will be able to extract substantial additional funding from their governments. The White House says it will work with Congress to “augment our development finance toolkit”. Yet Mr Biden is still struggling to get Republican votes for spending on domestic infrastructure. It is not even evident that the plan involves much more than the rebranding of projects that are already being considered. These include numerous green infrastructure schemes in poor countries that were promised as part of the Paris climate agreement of 2015. Easing this backlog will be costly.

Increasingly, China and America are replicating each other’s munitions. Days earlier, on June 10th, China’s legislature passed a law that allows the government to take action against individuals and companies for complying with other countries’ sanctions against China. America and the European Union have hit China with various punitive measures because of its mistreatment of ethnic Uyghurs in the western region of Xinjiang and its demolition of freedoms in Hong Kong. Donald Trump barred investment in several firms with links to the Chinese armed forces. His successor, Mr Biden, has doubled down on those rules by strengthening the legal foundations of the sanctions.

China’s new law says the government can seize the assets and block the transactions of firms complying with American or EU measures against China. Unlike the European Commission’s statute on foreign sanctions, which prohibits compliance with them, the Chinese law does not explicitly make such activity illegal. Instead it is intended as a deterrent that provides the authorities with a legal means to impose countermeasures, say state media.

The competing regimes put multinational firms in a bind. Fund managers have been attending webinars on how to navigate increasingly complex American and Chinese sanctions, says Kher Sheng Lee of the Alternative Investment Management Association, an industry body. Companies have had little choice but to follow American sanctions. China’s new bill could make that choice more difficult.

Likewise, poor countries have had few alternatives to China’s BRI project, until now. If executed well, the B3W plan could provide healthy competition to that, says Wang Jiangyu of City University of Hong Kong. But those countries now face a dilemma, he says. They may be “forced to choose between B3W and BRI”. ■

This article appeared in the China section of the print edition under the headline “Try this for size”

The Economist